Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

69<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>-<strong>2007</strong><br />

(b) The banking facilities including fund and other non-fund based borrowings utilized by the Joint Venture entity are in the name of<br />

the Company but have been accounted in the books of Joint Venture. The borrowings have been guaranteed by the Company<br />

and are secured by assignment of the Joint Venture contract receivable and Joint registration and insurance of all equipments.<br />

The total of such borrowings as at 31 st March, <strong>2007</strong> is RO 1,90,35,026 (Rs. 215.40 crores) [Previous Year RO 1,90,79,907<br />

(Rs. 221.77 crores)] which consists of Fund based RO 1,65,87,491 (Rs. 187.71 crores) [Previous Year RO 67,70,790 (Rs. 78.70<br />

crores)] and Non-fund based RO 24,47,535 (Rs. 27.69 crores) [Previous Year RO 1,23,09,117 (Rs. 143.07 crores)]. However,<br />

the term loan for equipments provided to the Joint Venture entity by the Company has been considered in these financial<br />

statements.<br />

(c) Transactions of Oman Branch and the accounting effect of the <strong>Gammon</strong> Al Matar Joint Venture profits are accounted on the<br />

basis of the accounts prepared specially for this purpose and which is duly audited by the Company’s auditor.<br />

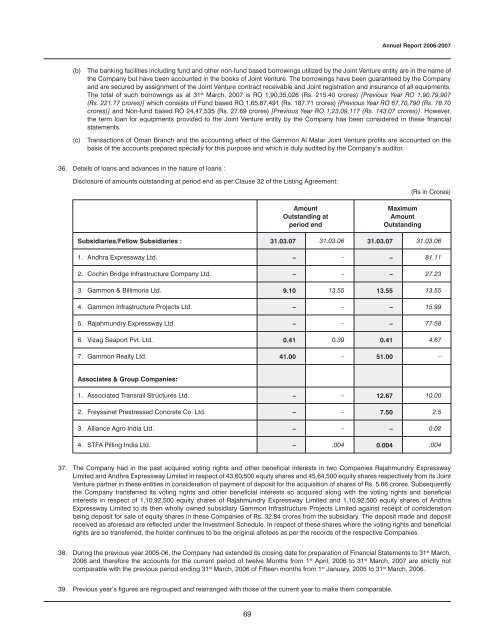

36. Details of loans and advances in the nature of loans :<br />

Disclosure of amounts outstanding at period end as per Clause 32 of the Listing Agreement:<br />

Amount<br />

Outstanding at<br />

period end<br />

Maximum<br />

Amount<br />

Outstanding<br />

(Rs in Crores)<br />

Subsidiaries/Fellow Subsidiaries : 31.03.07 31.03.06 31.03.07 31.03.06<br />

1. Andhra Expressway Ltd. – – – 81.11<br />

2. Cochin Bridge Infrastructure Company Ltd. – – – 27.23<br />

3. <strong>Gammon</strong> & Billimoria Ltd. 9.10 13.55 13.55 13.55<br />

4. <strong>Gammon</strong> Infrastructure Projects Ltd. – – – 15.99<br />

5. Rajahmundry Expressway Ltd. – – – 77.58<br />

6. Vizag Seaport Pvt. Ltd. 0.41 0.39 0.41 4.67<br />

7. <strong>Gammon</strong> Realty Ltd. 41.00 – 51.00 –<br />

Associates & Group Companies:<br />

1. Associated Transrail Structures Ltd. – – 12.67 10.00<br />

2. Freyssinet Prestressed Concrete Co. Ltd. – – 7.50 2.5<br />

3. Alliance Agro <strong>India</strong> Ltd. – – – 0.02<br />

4. STFA Pilling <strong>India</strong> Ltd. – .004 0.004 .004<br />

37. The Company had in the past acquired voting rights and other beneficial interests in two Companies Rajahmundry Expressway<br />

Limited and Andhra Expressway Limited in respect of 43,60,500 equity shares and 45,64,500 equity shares respectively from its Joint<br />

Venture partner in these entities in consideration of payment of deposit for the acquisition of shares of Rs. 5.66 crores. Subsequently<br />

the Company transferred its voting rights and other beneficial interests so acquired along with the voting rights and beneficial<br />

interests in respect of 1,10,92,500 equity shares of Rajahmundry Expressway Limited and 1,10,92,500 equity shares of Andhra<br />

Expressway Limited to its then wholly owned subsidiary <strong>Gammon</strong> Infrastructure Projects Limited against receipt of consideration<br />

being deposit for sale of equity shares in these Companies of Rs. 32.84 crores from the subsidiary. The deposit made and deposit<br />

received as aforesaid are reflected under the Investment Schedule. In respect of these shares where the voting rights and beneficial<br />

rights are so transferred, the holder continues to be the original allotees as per the records of the respective Companies.<br />

38. During the previous year 2005-06, the Company had extended its closing date for preparation of Financial Statements to 31 st March,<br />

<strong>2006</strong> and therefore the accounts for the current period of twelve Months from 1 st April, <strong>2006</strong> to 31 st March, <strong>2007</strong> are strictly not<br />

comparable with the previous period ending 31 st March, <strong>2006</strong> of Fifteen months from 1 st January, 2005 to 31 st March, <strong>2006</strong>.<br />

39. Previous year’s figures are regrouped and rearranged with those of the current year to make them comparable.