Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

99<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>-<strong>2007</strong><br />

(b) During the year, pursuant to the retrospective amendment of proviso to section 80 IA of the Income Tax Act, 1961 the Company<br />

has reviewed it’s claim in respect of section 80 IA and has decided to provide for income tax of earlier years without considering<br />

the benefits available u/s. 80 IA. The amount of short provision including interest amounting to Rs. 52.56 Crores is being debited<br />

to the Profit & Loss Account as short provision of earlier years.<br />

(c) GALM:<br />

The tax rate applicable to the joint venture is 12%. For the purpose of determining the tax payable for the period, the accounting<br />

profit has been adjusted for tax purposes. Adjustments for tax purposes include items relating to both income and expenses.<br />

The adjustments are based on the current understanding of the existing tax laws, regulation and practices.<br />

16. Cochin Bridge Infrastructure Company Limited (CBICL) depreciates its BOT project assets being the Bridge over the concession<br />

period in its books. However, the depreciation as per the Income Tax Act does not fully cover the costs over the concession period.<br />

The difference in the charge of depreciation is a permanent difference and hence not recognized in calculation of the deferred tax<br />

liability/asset.<br />

17. In case of Cochin Bridge Infrastructure Company Limited (CBICL) the Annuity income pursuant to the orders of Government of Kerala<br />

dated 24 th January, 2005 and 1 st March, 2005, the revenue of the Company has become positive and due to this there is a virtual<br />

certainty supported by convincing evidence that there would be sufficient future taxable income to realize the Deferred Tax Assets.<br />

The entire amount of Deferred Tax Assets relates to the unabsorbed losses and depreciation as per Income tax Act, 1961.<br />

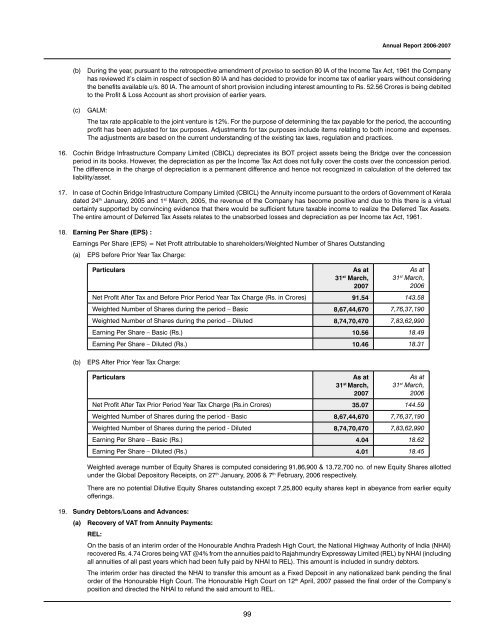

18. Earning Per Share (EPS) :<br />

Earnings Per Share (EPS) = Net Profit attributable to shareholders/Weighted Number of Shares Outstanding<br />

(a) EPS before Prior Year Tax Charge:<br />

Particulars As at<br />

31 st March,<br />

<strong>2007</strong><br />

As at<br />

31 st March,<br />

<strong>2006</strong><br />

Net Profit After Tax and Before Prior Period Year Tax Charge (Rs. in Crores) 91.54 143.58<br />

Weighted Number of Shares during the period – Basic 8,67,44,670 7,76,37,190<br />

Weighted Number of Shares during the period – Diluted 8,74,70,470 7,83,62,990<br />

Earning Per Share – Basic (Rs.) 10.56 18.49<br />

Earning Per Share – Diluted (Rs.) 10.46 18.31<br />

(b) EPS After Prior Year Tax Charge:<br />

Particulars As at<br />

31 st March,<br />

<strong>2007</strong><br />

As at<br />

31 st March,<br />

<strong>2006</strong><br />

Net Profit After Tax Prior Period Year Tax Charge (Rs.in Crores) 35.07 144.59<br />

Weighted Number of Shares during the period - Basic 8,67,44,670 7,76,37,190<br />

Weighted Number of Shares during the period - Diluted 8,74,70,470 7,83,62,990<br />

Earning Per Share – Basic (Rs.) 4.04 18.62<br />

Earning Per Share – Diluted (Rs.) 4.01 18.45<br />

Weighted average number of Equity Shares is computed considering 91,86,900 & 13,72,700 no. of new Equity Shares allotted<br />

under the Global Depository Receipts, on 27 th January, <strong>2006</strong> & 7 th February, <strong>2006</strong> respectively.<br />

There are no potential Dilutive Equity Shares outstanding except 7,25,800 equity shares kept in abeyance from earlier equity<br />

offerings.<br />

19. Sundry Debtors/Loans and Advances:<br />

(a) Recovery of VAT from Annuity Payments:<br />

REL:<br />

On the basis of an interim order of the Honourable Andhra Pradesh High Court, the National Highway Authority of <strong>India</strong> (NHAI)<br />

recovered Rs. 4.74 Crores being VAT @4% from the annuities paid to Rajahmundry Expressway Limited (REL) by NHAI (including<br />

all annuities of all past years which had been fully paid by NHAI to REL). This amount is included in sundry debtors.<br />

The interim order has directed the NHAI to transfer this amount as a Fixed Deposit in any nationalized bank pending the final<br />

order of the Honourable High Court. The Honourable High Court on 12th April, <strong>2007</strong> passed the final order of the Company’s<br />

position and directed the NHAI to refund the said amount to REL.