Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Annual Report 2006-2007 - Gammon India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GAMMON INDIA LIMITED<br />

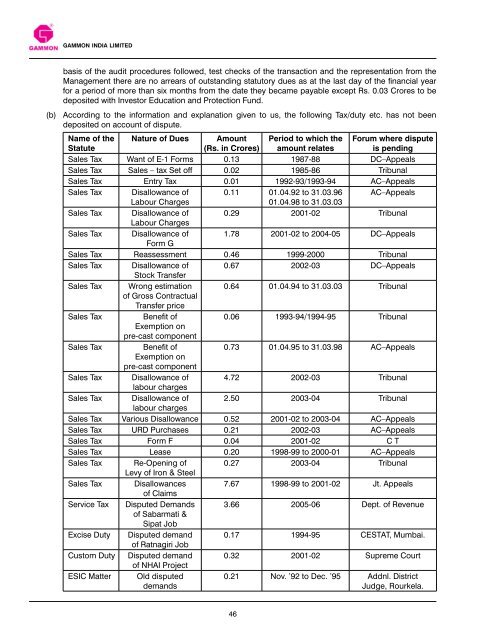

basis of the audit procedures followed, test checks of the transaction and the representation from the<br />

Management there are no arrears of outstanding statutory dues as at the last day of the financial year<br />

for a period of more than six months from the date they became payable except Rs. 0.03 Crores to be<br />

deposited with Investor Education and Protection Fund.<br />

(b) According to the information and explanation given to us, the following Tax/duty etc. has not been<br />

deposited on account of dispute.<br />

Name of the Nature of Dues Amount Period to which the forum where dispute<br />

Statute<br />

(Rs. in Crores) amount relates is pending<br />

Sales Tax Want of E-1 Forms 0.13 1987-88 DC–Appeals<br />

Sales Tax Sales – tax Set off 0.02 1985-86 Tribunal<br />

Sales Tax Entry Tax 0.01 1992-93/1993-94 AC–Appeals<br />

Sales Tax Disallowance of 0.11 01.04.92 to 31.03.96 AC–Appeals<br />

Labour Charges<br />

01.04.98 to 31.03.03<br />

Sales Tax Disallowance of<br />

Labour Charges<br />

0.29 2001-02 Tribunal<br />

Sales Tax Disallowance of<br />

Form G<br />

1.78 2001-02 to 2004-05 DC–Appeals<br />

Sales Tax Reassessment 0.46 1999-2000 Tribunal<br />

Sales Tax Disallowance of<br />

Stock Transfer<br />

0.67 2002-03 DC–Appeals<br />

Sales Tax Wrong estimation<br />

of Gross Contractual<br />

Transfer price<br />

0.64 01.04.94 to 31.03.03 Tribunal<br />

Sales Tax Benefit of<br />

Exemption on<br />

pre-cast component<br />

0.06 1993-94/1994-95 Tribunal<br />

Sales Tax Benefit of<br />

Exemption on<br />

pre-cast component<br />

0.73 01.04.95 to 31.03.98 AC–Appeals<br />

Sales Tax Disallowance of<br />

labour charges<br />

4.72 2002-03 Tribunal<br />

Sales Tax Disallowance of<br />

labour charges<br />

2.50 2003-04 Tribunal<br />

Sales Tax Various Disallowance 0.52 2001-02 to 2003-04 AC–Appeals<br />

Sales Tax URD Purchases 0.21 2002-03 AC–Appeals<br />

Sales Tax Form F 0.04 2001-02 C T<br />

Sales Tax Lease 0.20 1998-99 to 2000-01 AC–Appeals<br />

Sales Tax Re-Opening of<br />

Levy of Iron & Steel<br />

0.27 2003-04 Tribunal<br />

Sales Tax Disallowances<br />

of Claims<br />

7.67 1998-99 to 2001-02 Jt. Appeals<br />

Service Tax Disputed Demands<br />

of Sabarmati &<br />

Sipat Job<br />

3.66 2005-06 Dept. of Revenue<br />

Excise Duty Disputed demand<br />

of Ratnagiri Job<br />

0.17 1994-95 CESTAT, Mumbai.<br />

Custom Duty Disputed demand<br />

of NHAI Project<br />

0.32 2001-02 Supreme Court<br />

ESIC Matter Old disputed<br />

demands<br />

0.21 Nov. ’92 to Dec. ’95 Addnl. District<br />

Judge, Rourkela.<br />

46