Moving forward in Zimbabwe - Brooks World Poverty Institute - The ...

Moving forward in Zimbabwe - Brooks World Poverty Institute - The ...

Moving forward in Zimbabwe - Brooks World Poverty Institute - The ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Mov<strong>in</strong>g</strong> <strong>forward</strong> <strong>in</strong> <strong>Zimbabwe</strong><br />

Reduc<strong>in</strong>g poverty and promot<strong>in</strong>g growth<br />

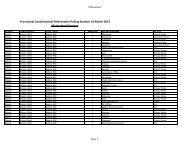

Figure 9.1: <strong>Zimbabwe</strong>’s subscriber growth, 2000-2008.<br />

Figure 9.2: Operators’ subscriber growth <strong>in</strong><br />

<strong>Zimbabwe</strong>, 2000-2008.<br />

Source: Supplied upon request from POTRAZ (2009)<br />

Source: Supplied upon request from POTRAZ (2009)<br />

When the data are disaggregated further (see Table 9.1 and<br />

Figure 9.2) they reveal a market dom<strong>in</strong>ated largely by one player,<br />

with the others hardly register<strong>in</strong>g any growth at all. By 2008 Econet<br />

Wireless had a 76 per cent market share of mobile subscribers and<br />

60 per cent of total telephone subscribers, <strong>in</strong>clud<strong>in</strong>g fixed.<br />

Accurate data on effective demand for telephony <strong>in</strong> <strong>Zimbabwe</strong><br />

are not easy to come by, but it is not <strong>in</strong>accurate to observe that all<br />

the operators suffered capacity constra<strong>in</strong>ts. Demand for telephony<br />

has far outstripped supply, turn<strong>in</strong>g the market <strong>in</strong>to a suppliers’<br />

market. Poor service quality, especially network congestion, has<br />

been a feature of telephony <strong>in</strong> <strong>Zimbabwe</strong>. Furthermore, the<br />

fact that demand for services far outstrips supply has generated<br />

a thriv<strong>in</strong>g black market for the few mobile phone l<strong>in</strong>es available,<br />

which by 2009 retailed at anyth<strong>in</strong>g between US$50 to US$100.<br />

This compares with other countries, such as Uganda and Kenya,<br />

where mobile l<strong>in</strong>es are ubiquitous and retail at less than a tenth of<br />

the rates found <strong>in</strong> <strong>Zimbabwe</strong>. Clearly the crisis created a service<br />

capacity gap that needs to be addressed.<br />

<strong>The</strong> situation was not helped by <strong>The</strong> Postal and<br />

Telecommunications Regulatory Authority of <strong>Zimbabwe</strong><br />

(POTRAZ), which tried to balance the legitimate demands by<br />

operators for a tariff structure that ensures their viability, with<br />

an equally legitimate obligation to ensure an affordable service<br />

for the consumer. Often, it failed to satisfy either of the parties.<br />

For example, pric<strong>in</strong>g regulations implemented <strong>in</strong> July 2007 forced<br />

operators to charge the equivalent of US$0.005 (half a US cent)<br />

per m<strong>in</strong>ute aga<strong>in</strong>st an <strong>in</strong>ternational average of US$0.15. Operators<br />

were not happy with this suboptimum tariff, yet at the same time,<br />

that tariff was beyond the reach of many ord<strong>in</strong>ary mobile users,<br />

whose <strong>in</strong>comes were no more than US$10 per month.<br />

Operator viability was further hurt by the non-availability of<br />

foreign currency, with the only source be<strong>in</strong>g the thriv<strong>in</strong>g parallel<br />

(black) market, which was, however, crim<strong>in</strong>alised. F<strong>in</strong>ancial results<br />

declared us<strong>in</strong>g the official exchange rate would show a deceptively<br />

rosy picture.<br />

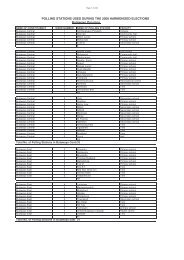

Table 9.1: <strong>Zimbabwe</strong>’s subscriber growth s<strong>in</strong>ce 2000.<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008<br />

ECONET 93,706 134,000 139,402 151,000 173,000 362,000 477,000 648,908 988,656<br />

NET ONE 89,949 91,800 114,000 117,000 130,000 197,000 215,488 331,000 418,065<br />

TELECEL 82,786 84,690 85,000 95,000 130,000 140,000 156,698 245,746 248,000<br />

TEL ONE 238,956 249,400 257,777 300,921 317,000 328,000 335,561 344,502 364,281<br />

Total 505,397 559,890 596,179 663,921 750,000 1,027,000 1,184,747 1,570,156 1,641,565<br />

Total mobile 266,441 310,490 338,402 363,000 433,000 699,000 849,186 1,225,564 1,296,565<br />

% growth (F) 1 4 3 17 5 3 2 3 6<br />

% growth (M) 65 17 9 7 19 61 31 44 35<br />

Source: Supplied upon request from POTRAZ (2009)<br />

104