Moving forward in Zimbabwe - Brooks World Poverty Institute - The ...

Moving forward in Zimbabwe - Brooks World Poverty Institute - The ...

Moving forward in Zimbabwe - Brooks World Poverty Institute - The ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Mov<strong>in</strong>g</strong> <strong>forward</strong> <strong>in</strong> <strong>Zimbabwe</strong><br />

Reduc<strong>in</strong>g poverty and promot<strong>in</strong>g growth<br />

ten per cent of the recipients of remittances <strong>in</strong> Lat<strong>in</strong> America have<br />

bank accounts (Smith, 2005), yet remittances are a grow<strong>in</strong>g global<br />

bus<strong>in</strong>ess, worth an estimated $433 billion <strong>in</strong> 2008, that m-bank<strong>in</strong>g<br />

is <strong>in</strong> a position to service (<strong>World</strong> Bank 2009).<br />

From a bus<strong>in</strong>ess po<strong>in</strong>t of view, figures from McK<strong>in</strong>sey and<br />

Company <strong>in</strong>dicate that mobile money has the potential to deliver up<br />

to US$5 billion <strong>in</strong> direct revenues for mobile operators, and US$2.5<br />

billion <strong>in</strong> <strong>in</strong>direct revenues per year by 2012 (GSMA, 2009). This<br />

is on the basis of the service be<strong>in</strong>g adopted by an additional 364<br />

million unbanked customers. <strong>The</strong> market size growth projection<br />

is put at 1.7 billion people <strong>in</strong> develop<strong>in</strong>g countries with mobile<br />

phones but no access to f<strong>in</strong>ancial services by 2012, up from the<br />

current one billion (CGAP, GSMA 2009).<br />

Africa is an <strong>in</strong>terest<strong>in</strong>g proposition for mobile bank<strong>in</strong>g, because<br />

of the comb<strong>in</strong>ed impact of rapidly <strong>in</strong>creas<strong>in</strong>g mobile penetration<br />

and very low access to f<strong>in</strong>ancial services, as well as the existence<br />

of large populations of people liv<strong>in</strong>g abroad and support<strong>in</strong>g their<br />

families and relatives back home through remittances. With mobile<br />

penetration expected to grow, so will access to f<strong>in</strong>ancial services<br />

that are mobile enabled. <strong>The</strong> weighted average percentage of<br />

population with access to f<strong>in</strong>ancial services is approximately 23<br />

per cent, which makes it comparatively lower than <strong>in</strong> other regions<br />

(GSMA, 2009). Mobile penetration levels and access to f<strong>in</strong>ancial<br />

services for selected countries are shown <strong>in</strong> Table 9.5.<br />

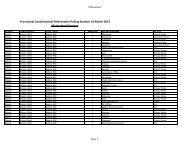

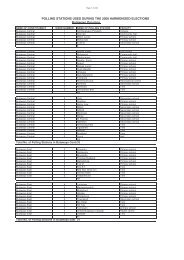

Table 9.5: Selected regional countries’ access to f<strong>in</strong>ancial<br />

services and mobile penetration, 2008 and 2012.<br />

Country<br />

Access to<br />

f<strong>in</strong>ancial<br />

services (%)<br />

Mobile penetration (%)<br />

2008 2012*<br />

Tanzania 5 33 61<br />

Kenya 10 49 101<br />

Liberia 11 29 49<br />

Mozambique 12 26 42<br />

Sierra Leone 13 26 55<br />

Zambia 15 31 63<br />

Sudan 15 29 73<br />

Nigeria 15 46 97<br />

* Projected.<br />

Sources: Wireless Intelligence (www.wireless<strong>in</strong>telligence.com),<br />

<strong>World</strong> Bank (2007).<br />

Globally remittances cont<strong>in</strong>ue to grow <strong>in</strong> size and significance<br />

to national economies. <strong>The</strong>y are the second largest f<strong>in</strong>ancial flow<br />

<strong>in</strong>to develop<strong>in</strong>g country economies after foreign direct <strong>in</strong>vestment<br />

(Scott et al, 2004). Remittances are popular <strong>in</strong> Africa, with estimates<br />

of over US$ 90 billion sent back home by migrant workers every<br />

year (Ericsson, 2007). Remittances through mobiles are up to ten<br />

times cheaper than other forms of remittances. This reason alone<br />

makes mobile bank<strong>in</strong>g an attractive alternative <strong>in</strong> Africa. Mobile<br />

bank<strong>in</strong>g was popularised <strong>in</strong> the Philipp<strong>in</strong>es (Porteous, 2006). In<br />

Africa, South Africa’s WIZZIT, started <strong>in</strong> December 2004, is an<br />

example of this (Ivatury and Pickens, 2006). M-Pesa – a mobile<br />

bank<strong>in</strong>g service <strong>in</strong>troduced by Kenya’s lead<strong>in</strong>g mobile operator,<br />

Safaricom, <strong>in</strong> March 2007 – is another example offer<strong>in</strong>g money<br />

transfers, airtime top-up and transfers, and payments for utilities<br />

such as electricity bills. It competes very favourably <strong>in</strong> the money<br />

transfer market. Other money transfer platforms have lost market<br />

share and now control only three per cent of total transfers, from<br />

close to a tenth of the total transfers two years ago. A major sell<strong>in</strong>g<br />

po<strong>in</strong>t for the mobile operators is their relatively low transaction<br />

costs. Official data on cash movement <strong>in</strong> the Kenyan economy<br />

shows that nowadays 47 per cent of all money transfers take place<br />

through the mobile phone (Bus<strong>in</strong>ess Daily, 14 Sept 2009). A survey<br />

<strong>in</strong> Kenya done by F<strong>in</strong>ancial Sector Deepen<strong>in</strong>g on behalf of the<br />

Central Bank of Kenya, found out that n<strong>in</strong>e out of ten users of<br />

mobile cash transfers say they are ma<strong>in</strong>ly attracted by convenience,<br />

almost <strong>in</strong>stantaneous speeds, safety and relatively lower transaction<br />

costs.<br />

Lessons for <strong>Zimbabwe</strong>’s recovery programme<br />

Based on this analysis, it is clear that recovery for the ICT sector will<br />

mean four key priorities. Firstly, there will be a need to implement a<br />

sound ICT policy that recognises the central role of ICTs <strong>in</strong> national<br />

development. This should be based on a robust and coherent<br />

framework that responds to the cross-sectoral nature of ICTs.<br />

This is one way to avoid contradictions and suboptimal resource<br />

utilisation. <strong>The</strong> establishment of a M<strong>in</strong>istry for ICT creates an<br />

<strong>in</strong>stitutional base, from which to direct a sound policy environment<br />

for the sector. We emphasise here that policy should be evidencebased.<br />

This necessarily means look<strong>in</strong>g at how the comparative<br />

experience can be adapted to suit the <strong>Zimbabwe</strong> sett<strong>in</strong>g. One<br />

advantage of the time warp created by the crisis <strong>in</strong> <strong>Zimbabwe</strong> is<br />

that we can avoid mistakes made by the trailblazers if we are careful<br />

enough <strong>in</strong> formulat<strong>in</strong>g a sound policy environment that embraces<br />

and promotes rather than h<strong>in</strong>ders ICT development.<br />

Secondly, promot<strong>in</strong>g competition and public-private<br />

partnerships will be key. A recent ICT survey <strong>in</strong> <strong>Zimbabwe</strong><br />

identified as priorities <strong>in</strong>frastructure development, f<strong>in</strong>ance<br />

mobilisation, and human resource development and capacity<br />

build<strong>in</strong>g. On <strong>in</strong>frastructure and f<strong>in</strong>ancial resource mobilisation,<br />

the critical issue is to open the market to competition and create<br />

a policy and regulatory environment that is <strong>in</strong>vestor friendly. <strong>The</strong><br />

growth of ICTs <strong>in</strong> African countries such as Nigeria is directly<br />

l<strong>in</strong>ked to creat<strong>in</strong>g a competitive environment, lower<strong>in</strong>g barriers to<br />

entry, and allow<strong>in</strong>g market forces to determ<strong>in</strong>e the pace of growth.<br />

Competition encourages <strong>in</strong>vestment and reduces access costs for<br />

consumers. <strong>The</strong> telecommunications market <strong>in</strong> <strong>Zimbabwe</strong> cannot<br />

be said to be competitive with only one dom<strong>in</strong>ant player.<br />

<strong>The</strong> third priority is capacity build<strong>in</strong>g. Countries that use the<br />

ICT <strong>in</strong>dustry as an export market have <strong>in</strong>vested <strong>in</strong> human capital<br />

development. Simply implement<strong>in</strong>g the right policies and regulatory<br />

environment will not produce the skills to run the sector, or attract<br />

back lost talent. In the long term, there is a need to create an e-<br />

culture that extends to primary education, and promotes ICT use<br />

at an early age. At tertiary level it is essential to establish centres<br />

of excellence <strong>in</strong> ICT. <strong>The</strong> state can lead this, but private sector<br />

<strong>in</strong>volvement is also needed.<br />

<strong>The</strong> last priority is sector regulation. A perception that regulation<br />

and regulators have been subjected to political <strong>in</strong>terference and<br />

serve the state rather than citizens dim<strong>in</strong>ishes confidence and the<br />

ability to fully embrace the opportunities that ICTs offer. It is <strong>in</strong><br />

the <strong>in</strong>terest of ICT sector growth, and the long-term <strong>in</strong>terest of<br />

the <strong>in</strong>clusive government, to promote regulatory environments<br />

109