July (pdf) - New York Power Authority

July (pdf) - New York Power Authority

July (pdf) - New York Power Authority

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

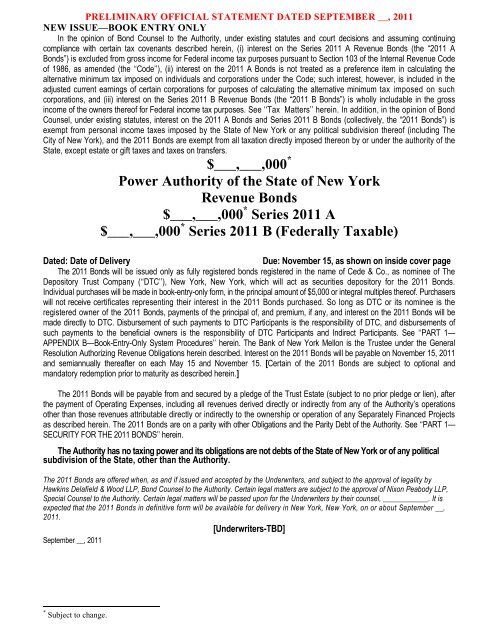

PRELIMINARY OFFICIAL STATEMENT DATED SEPTEMBER __, 2011<br />

NEW ISSUE—BOOK ENTRY ONLY<br />

In the opinion of Bond Counsel to the <strong>Authority</strong>, under existing statutes and court decisions and assuming continuing<br />

compliance with certain tax covenants described herein, (i) interest on the Series 2011 A Revenue Bonds (the “2011 A<br />

Bonds”) is excluded from gross income for Federal income tax purposes pursuant to Section 103 of the Internal Revenue Code<br />

of 1986, as amended (the ‘‘Code’’), (ii) interest on the 2011 A Bonds is not treated as a preference item in calculating the<br />

alternative minimum tax imposed on individuals and corporations under the Code; such interest, however, is included in the<br />

adjusted current earnings of certain corporations for purposes of calculating the alternative minimum tax imposed on such<br />

corporations, and (iii) interest on the Series 2011 B Revenue Bonds (the “2011 B Bonds”) is wholly includable in the gross<br />

income of the owners thereof for Federal income tax purposes. See ‘‘Tax Matters’’ herein. In addition, in the opinion of Bond<br />

Counsel, under existing statutes, interest on the 2011 A Bonds and Series 2011 B Bonds (collectively, the “2011 Bonds”) is<br />

exempt from personal income taxes imposed by the State of <strong>New</strong> <strong>York</strong> or any political subdivision thereof (including The<br />

City of <strong>New</strong> <strong>York</strong>), and the 2011 Bonds are exempt from all taxation directly imposed thereon by or under the authority of the<br />

State, except estate or gift taxes and taxes on transfers.<br />

$___,___,000 *<br />

<strong>Power</strong> <strong>Authority</strong> of the State of <strong>New</strong> <strong>York</strong><br />

Revenue Bonds<br />

$___,___,000 * Series 2011 A<br />

$___,___,000 * Series 2011 B (Federally Taxable)<br />

Dated: Date of Delivery<br />

Due: November 15, as shown on inside cover page<br />

The 2011 Bonds will be issued only as fully registered bonds registered in the name of Cede & Co., as nominee of The<br />

Depository Trust Company (‘‘DTC’’), <strong>New</strong> <strong>York</strong>, <strong>New</strong> <strong>York</strong>, which will act as securities depository for the 2011 Bonds.<br />

Individual purchases will be made in book-entry-only form, in the principal amount of $5,000 or integral multiples thereof. Purchasers<br />

will not receive certificates representing their interest in the 2011 Bonds purchased. So long as DTC or its nominee is the<br />

registered owner of the 2011 Bonds, payments of the principal of, and premium, if any, and interest on the 2011 Bonds will be<br />

made directly to DTC. Disbursement of such payments to DTC Participants is the responsibility of DTC, and disbursements of<br />

such payments to the beneficial owners is the responsibility of DTC Participants and Indirect Participants. See ‘‘PART 1—<br />

APPENDIX B—Book-Entry-Only System Procedures’’ herein. The Bank of <strong>New</strong> <strong>York</strong> Mellon is the Trustee under the General<br />

Resolution Authorizing Revenue Obligations herein described. Interest on the 2011 Bonds will be payable on November 15, 2011<br />

and semiannually thereafter on each May 15 and November 15. [Certain of the 2011 Bonds are subject to optional and<br />

mandatory redemption prior to maturity as described herein.]<br />

The 2011 Bonds will be payable from and secured by a pledge of the Trust Estate (subject to no prior pledge or lien), after<br />

the payment of Operating Expenses, including all revenues derived directly or indirectly from any of the <strong>Authority</strong>’s operations<br />

other than those revenues attributable directly or indirectly to the ownership or operation of any Separately Financed Projects<br />

as described herein. The 2011 Bonds are on a parity with other Obligations and the Parity Debt of the <strong>Authority</strong>. See ‘‘PART 1—<br />

SECURITY FOR THE 2011 BONDS’’ herein.<br />

The <strong>Authority</strong> has no taxing power and its obligations are not debts of the State of <strong>New</strong> <strong>York</strong> or of any political<br />

subdivision of the State, other than the <strong>Authority</strong>.<br />

The 2011 Bonds are offered when, as and if issued and accepted by the Underwriters, and subject to the approval of legality by<br />

Hawkins Delafield & Wood LLP, Bond Counsel to the <strong>Authority</strong>. Certain legal matters are subject to the approval of Nixon Peabody LLP,<br />

Special Counsel to the <strong>Authority</strong>. Certain legal matters will be passed upon for the Underwriters by their counsel, ____________. It is<br />

expected that the 2011 Bonds in definitive form will be available for delivery in <strong>New</strong> <strong>York</strong>, <strong>New</strong> <strong>York</strong>, on or about September __,<br />

2011.<br />

[Underwriters-TBD]<br />

September __, 2011<br />

* Subject to change.