Demonstrator Manual - Stampin' Up!

Demonstrator Manual - Stampin' Up!

Demonstrator Manual - Stampin' Up!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

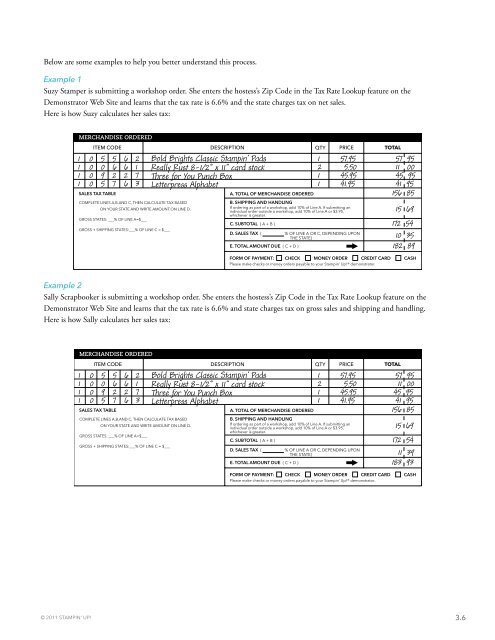

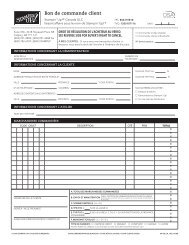

Below are some examples to help you better understand this process.<br />

Example 1<br />

Suzy Stamper is submitting a workshop order. She enters the hostess’s Zip Code in the Tax Rate Lookup feature on the<br />

<strong>Demonstrator</strong> Web Site and learns that the tax rate is 6.6% and the state charges tax on net sales.<br />

Here is how Suzy calculates her sales tax:<br />

MERCHANDISE ORDERED<br />

ITEM CODE<br />

1 0 5 5 6 2<br />

1 0 0 6 6 1<br />

1 0 9 2 2 7<br />

1 0 5 7 6 3<br />

SALES TAX TABLE<br />

COMPLETE LINES A,B,AND C, THEN CALCULATE TAX BASED<br />

ON YOUR STATE AND WRITE AMOUNT ON LINE D.<br />

GROSS STATES: ___% OF LINE A=$___<br />

GROSS + SHIPPING STATES:___% OF LINE C = $___<br />

DESCRIPTION<br />

Bold Brights Classic Stampin’ Pads<br />

Really Rust 8-1/2” x 11” card stock<br />

Three for You Punch Box<br />

Letterpress Alphabet<br />

QTY<br />

PRICE<br />

A. TOTAL OF MERCHANDISE ORDERED<br />

B. SHIPPING AND HANDLING<br />

If ordering as part of a workshop, add 10% of Line A. If submitting an<br />

individual order outside a workshop, add 10% of Line A or $3.95,<br />

whichever is greater.<br />

C. SUBTOTAL ( A + B )<br />

1<br />

2<br />

1<br />

1<br />

57.95<br />

5.50<br />

45.95<br />

41.95<br />

D. SALES TAX ( % OF LINE A OR C, DEPENDING UPON<br />

THE STATE)<br />

E. TOTAL AMOUNT DUE ( C + D )<br />

TOTAL<br />

57 95<br />

11 00<br />

45 95<br />

41 95<br />

156 85<br />

15 69<br />

172 54<br />

10 35<br />

182 89<br />

FORM OF PAYMENT: CHECK MONEY ORDER CREDIT CARD CASH<br />

Please make checks or money orders payable to your Stampin’ <strong>Up</strong>!® demonstrator.<br />

DEMONSTRATOR COPY (WHITE) • HOSTESS (YELLOW) • CUSTOMER COPY (PINK AND GOLD) 7/07<br />

Example 2<br />

Sally Scrapbooker is submitting a workshop order. She enters the hostess’s Zip Code in the Tax Rate Lookup feature on the<br />

<strong>Demonstrator</strong> Web Site and learns that the tax rate is 6.6% and state charges tax on gross sales and shipping and handling.<br />

Here is how Sally calculates her sales tax:<br />

MERCHANDISE ORDERED<br />

ITEM CODE<br />

1 0 5 5 6 2<br />

1 0 0 6 6 1<br />

1 0 9 2 2 7<br />

1 0 5 7 6 3<br />

SALES TAX TABLE<br />

COMPLETE LINES A,B,AND C, THEN CALCULATE TAX BASED<br />

ON YOUR STATE AND WRITE AMOUNT ON LINE D.<br />

GROSS STATES: ___% OF LINE A=$___<br />

GROSS + SHIPPING STATES:___% OF LINE C = $___<br />

DESCRIPTION<br />

Bold Brights Classic Stampin’ Pads<br />

Really Rust 8-1/2” x 11” card stock<br />

Three for You Punch Box<br />

Letterpress Alphabet<br />

A. TOTAL OF MERCHANDISE ORDERED<br />

C. SUBTOTAL ( A + B )<br />

E. TOTAL AMOUNT DUE ( C + D )<br />

QTY<br />

1<br />

2<br />

1<br />

1<br />

PRICE<br />

57.95<br />

5.50<br />

45.95<br />

41.95<br />

B. SHIPPING AND HANDLING<br />

If ordering as part of a workshop, add 10% of Line A. If submitting an<br />

individual order outside a workshop, add 10% of Line A or $3.95,<br />

whichever is greater.<br />

D. SALES TAX ( % OF LINE A OR C, DEPENDING UPON<br />

THE STATE)<br />

TOTAL<br />

57 95<br />

11 00<br />

45 95<br />

41 95<br />

156 85<br />

15 69<br />

172 54<br />

11 39<br />

183 93<br />

FORM OF PAYMENT: CHECK MONEY ORDER CREDIT CARD CASH<br />

Please make checks or money orders payable to your Stampin’ <strong>Up</strong>!® demonstrator.<br />

DEMONSTRATOR COPY (WHITE) • HOSTESS (YELLOW) • CUSTOMER COPY (PINK AND GOLD) 7/07<br />

© 2011 STAMPIN’ UP! 3.6