Demonstrator Manual - Stampin' Up!

Demonstrator Manual - Stampin' Up!

Demonstrator Manual - Stampin' Up!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

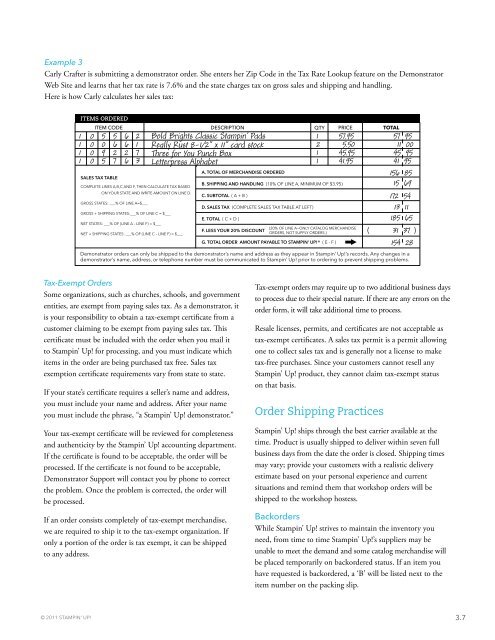

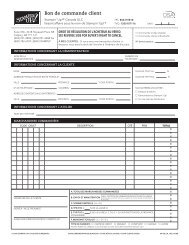

Example 3<br />

Carly Crafter is submitting a demonstrator order. She enters her Zip Code in the Tax Rate Lookup feature on the <strong>Demonstrator</strong><br />

Web Site and learns that her tax rate is 7.6% and the state charges tax on gross sales and shipping and handling.<br />

Here is how Carly calculates her sales tax:<br />

ITEMS ORDERED<br />

ITEM CODE<br />

1 0 5 5 6 2<br />

1 0 0 6 6 1<br />

1 0 9 2 2 7<br />

1<br />

0 5 7 6 3<br />

SALES TAX TABLE<br />

COMPLETE LINES A,B,C AND F, THEN CALCULATE TAX BASED<br />

ON YOUR STATE AND WRITE AMOUNT ON LINE D.<br />

GROSS STATES: ___% OF LINE A=$___<br />

GROSS + SHIPPING STATES:___% OF LINE C = $___<br />

NET STATES: ___% OF (LINE A – LINE F) = $___<br />

NET + SHIPPING STATES: ___% OF (LINE C – LINE F) = $___<br />

DESCRIPTION<br />

Bold Brights Classic Stampin’ Pads<br />

Really Rust 8-1/2” x 11” card stock<br />

Three for You Punch Box<br />

Letterpress Alphabet<br />

A. TOTAL OF MERCHANDISE ORDERED<br />

<strong>Demonstrator</strong> orders can only be shipped to the demonstrator’s name and address as they appear in Stampin’ <strong>Up</strong>!’s records. Any changes in a<br />

demonstrator’s name, address, or telephone number must be communicated to Stampin’ <strong>Up</strong>! prior to ordering to prevent shipping problems.<br />

QTY<br />

B. SHIPPING AND HANDLING (10% OF LINE A, MINIMUM OF $3.95)<br />

C. SUBTOTAL ( A + B )<br />

D. SALES TAX (COMPLETE SALES TAX TABLE AT LEFT)<br />

E. TOTAL ( C + D )<br />

F. LESS YOUR 20% DISCOUNT<br />

1<br />

2<br />

1<br />

1<br />

G. TOTAL ORDER AMOUNT PAYABLE TO STAMPIN’ UP!® ( E - F )<br />

PRICE<br />

57.95<br />

5.50<br />

45.95<br />

41.95<br />

(20% OF LINE A—ONLY CATALOG MERCHANDISE<br />

ORDERS, NOT SUPPLY ORDERS.)<br />

TOTAL<br />

57 95<br />

11 00<br />

45 95<br />

41 95<br />

156 85<br />

15 69<br />

172 54<br />

13 11<br />

185 65<br />

( 31 37 )<br />

154 28<br />

Tax-Exempt Orders<br />

Some organizations, such as churches, schools, and government<br />

entities, are exempt from paying sales tax. As a demonstrator, it<br />

is your responsibility to obtain a tax-exempt certificate from a<br />

customer claiming to be exempt from paying sales tax. This<br />

certificate must be included with the order when you mail it<br />

to Stampin’ <strong>Up</strong>! for processing, and you must indicate which<br />

items in the order are being purchased tax free. Sales tax<br />

exemption certificate requirements vary from state to state.<br />

If your state’s certificate requires a seller’s name and address,<br />

you must include your name and address. After your name<br />

you must include the phrase, “a Stampin’ <strong>Up</strong>! demonstrator.”<br />

Your tax-exempt certificate will be reviewed for completeness<br />

and authenticity by the Stampin’ <strong>Up</strong>! accounting department.<br />

If the certificate is found to be acceptable, the order will be<br />

processed. If the certificate is not found to be acceptable,<br />

<strong>Demonstrator</strong> Support will contact you by phone to correct<br />

the problem. Once the problem is corrected, the order will<br />

be processed.<br />

If an order consists completely of tax-exempt merchandise,<br />

we are required to ship it to the tax-exempt organization. If<br />

only a portion of the order is tax exempt, it can be shipped<br />

to any address.<br />

Tax-exempt orders may require up to two additional business days<br />

to process due to their special nature. If there are any errors on the<br />

order form, it will take additional time to process.<br />

Resale licenses, permits, and certificates are not acceptable as<br />

tax-exempt certificates. A sales tax permit is a permit allowing<br />

one to collect sales tax and is generally not a license to make<br />

tax-free purchases. Since your customers cannot resell any<br />

Stampin’ <strong>Up</strong>! product, they cannot claim tax-exempt status<br />

on that basis.<br />

Order Shipping Practices<br />

7/07<br />

Stampin’ <strong>Up</strong>! ships through the best carrier available at the<br />

time. Product is usually shipped to deliver within seven full<br />

business days from the date the order is closed. Shipping times<br />

may vary; provide your customers with a realistic delivery<br />

estimate based on your personal experience and current<br />

situations and remind them that workshop orders will be<br />

shipped to the workshop hostess.<br />

Backorders<br />

While Stampin’ <strong>Up</strong>! strives to maintain the inventory you<br />

need, from time to time Stampin’ <strong>Up</strong>!’s suppliers may be<br />

unable to meet the demand and some catalog merchandise will<br />

be placed temporarily on backordered status. If an item you<br />

have requested is backordered, a ‘B’ will be listed next to the<br />

item number on the packing slip.<br />

© 2011 STAMPIN’ UP! 3.7