Competition in the Irish Private Health Insurance Market

Competition in the Irish Private Health Insurance Market

Competition in the Irish Private Health Insurance Market

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

E 17.<br />

E 18.<br />

A number of <strong>in</strong>terviewees identified risk equalisation as a deterrent to<br />

entry. Uncerta<strong>in</strong>ty concern<strong>in</strong>g <strong>the</strong> future regulation of Vhi <strong>Health</strong>care<br />

and <strong>the</strong> future of <strong>the</strong> Risk Equalisation Scheme were also cited as<br />

deterrents to entry. However, a number of features of <strong>the</strong> Risk<br />

Equalisation Scheme, <strong>in</strong>clud<strong>in</strong>g an <strong>in</strong>itial three year exemption from<br />

payments, are <strong>in</strong>tended as <strong>in</strong>centives for market entry. The absence<br />

of risk equalisation payments <strong>in</strong> a community rated market gives a<br />

regulatory advantage to <strong>in</strong>surers with lower risk profiles. The Risk<br />

Equalisation Scheme is designed to reduce but not elim<strong>in</strong>ate this<br />

regulatory advantage and <strong>in</strong>surers with lower risk profiles will<br />

cont<strong>in</strong>ue to have a significant advantage, even with risk equalisation<br />

payments.<br />

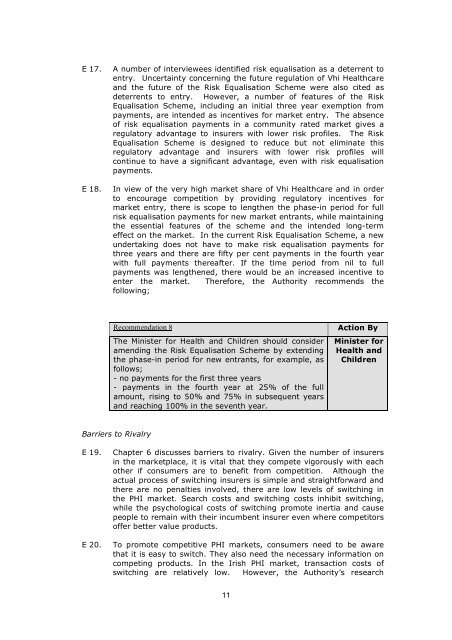

In view of <strong>the</strong> very high market share of Vhi <strong>Health</strong>care and <strong>in</strong> order<br />

to encourage competition by provid<strong>in</strong>g regulatory <strong>in</strong>centives for<br />

market entry, <strong>the</strong>re is scope to leng<strong>the</strong>n <strong>the</strong> phase-<strong>in</strong> period for full<br />

risk equalisation payments for new market entrants, while ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g<br />

<strong>the</strong> essential features of <strong>the</strong> scheme and <strong>the</strong> <strong>in</strong>tended long-term<br />

effect on <strong>the</strong> market. In <strong>the</strong> current Risk Equalisation Scheme, a new<br />

undertak<strong>in</strong>g does not have to make risk equalisation payments for<br />

three years and <strong>the</strong>re are fifty per cent payments <strong>in</strong> <strong>the</strong> fourth year<br />

with full payments <strong>the</strong>reafter. If <strong>the</strong> time period from nil to full<br />

payments was leng<strong>the</strong>ned, <strong>the</strong>re would be an <strong>in</strong>creased <strong>in</strong>centive to<br />

enter <strong>the</strong> market. Therefore, <strong>the</strong> Authority recommends <strong>the</strong><br />

follow<strong>in</strong>g;<br />

Recommendation 8<br />

The M<strong>in</strong>ister for <strong>Health</strong> and Children should consider<br />

amend<strong>in</strong>g <strong>the</strong> Risk Equalisation Scheme by extend<strong>in</strong>g<br />

<strong>the</strong> phase-<strong>in</strong> period for new entrants, for example, as<br />

follows;<br />

- no payments for <strong>the</strong> first three years<br />

- payments <strong>in</strong> <strong>the</strong> fourth year at 25% of <strong>the</strong> full<br />

amount, ris<strong>in</strong>g to 50% and 75% <strong>in</strong> subsequent years<br />

and reach<strong>in</strong>g 100% <strong>in</strong> <strong>the</strong> seventh year.<br />

Action By<br />

M<strong>in</strong>ister for<br />

<strong>Health</strong> and<br />

Children<br />

Barriers to Rivalry<br />

E 19.<br />

E 20.<br />

Chapter 6 discusses barriers to rivalry. Given <strong>the</strong> number of <strong>in</strong>surers<br />

<strong>in</strong> <strong>the</strong> marketplace, it is vital that <strong>the</strong>y compete vigorously with each<br />

o<strong>the</strong>r if consumers are to benefit from competition. Although <strong>the</strong><br />

actual process of switch<strong>in</strong>g <strong>in</strong>surers is simple and straightforward and<br />

<strong>the</strong>re are no penalties <strong>in</strong>volved, <strong>the</strong>re are low levels of switch<strong>in</strong>g <strong>in</strong><br />

<strong>the</strong> PHI market. Search costs and switch<strong>in</strong>g costs <strong>in</strong>hibit switch<strong>in</strong>g,<br />

while <strong>the</strong> psychological costs of switch<strong>in</strong>g promote <strong>in</strong>ertia and cause<br />

people to rema<strong>in</strong> with <strong>the</strong>ir <strong>in</strong>cumbent <strong>in</strong>surer even where competitors<br />

offer better value products.<br />

To promote competitive PHI markets, consumers need to be aware<br />

that it is easy to switch. They also need <strong>the</strong> necessary <strong>in</strong>formation on<br />

compet<strong>in</strong>g products. In <strong>the</strong> <strong>Irish</strong> PHI market, transaction costs of<br />

switch<strong>in</strong>g are relatively low. However, <strong>the</strong> Authority’s research<br />

11