Competition in the Irish Private Health Insurance Market

Competition in the Irish Private Health Insurance Market

Competition in the Irish Private Health Insurance Market

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

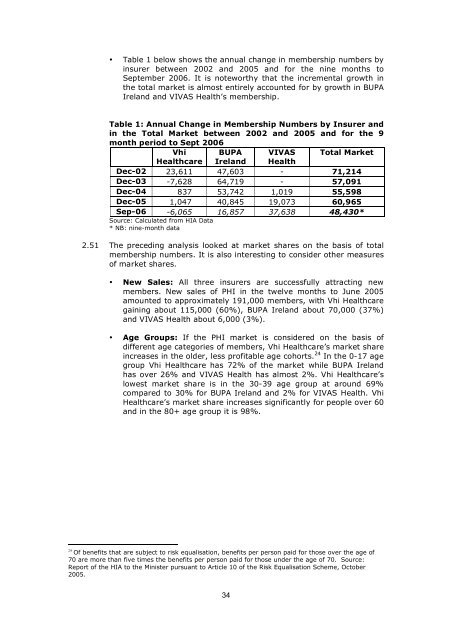

• Table 1 below shows <strong>the</strong> annual change <strong>in</strong> membership numbers by<br />

<strong>in</strong>surer between 2002 and 2005 and for <strong>the</strong> n<strong>in</strong>e months to<br />

September 2006. It is noteworthy that <strong>the</strong> <strong>in</strong>cremental growth <strong>in</strong><br />

<strong>the</strong> total market is almost entirely accounted for by growth <strong>in</strong> BUPA<br />

Ireland and VIVAS <strong>Health</strong>’s membership.<br />

Table 1: Annual Change <strong>in</strong> Membership Numbers by Insurer and<br />

<strong>in</strong> <strong>the</strong> Total <strong>Market</strong> between 2002 and 2005 and for <strong>the</strong> 9<br />

month period to Sept 2006<br />

Vhi BUPA VIVAS Total <strong>Market</strong><br />

<strong>Health</strong>care Ireland <strong>Health</strong><br />

Dec-02 23,611 47,603 - 71,214<br />

Dec-03 -7,628 64,719 - 57,091<br />

Dec-04 837 53,742 1,019 55,598<br />

Dec-05 1,047 40,845 19,073 60,965<br />

Sep-06 -6,065 16,857 37,638 48,430*<br />

Source: Calculated from HIA Data<br />

* NB: n<strong>in</strong>e-month data<br />

2.51 The preced<strong>in</strong>g analysis looked at market shares on <strong>the</strong> basis of total<br />

membership numbers. It is also <strong>in</strong>terest<strong>in</strong>g to consider o<strong>the</strong>r measures<br />

of market shares.<br />

• New Sales: All three <strong>in</strong>surers are successfully attract<strong>in</strong>g new<br />

members. New sales of PHI <strong>in</strong> <strong>the</strong> twelve months to June 2005<br />

amounted to approximately 191,000 members, with Vhi <strong>Health</strong>care<br />

ga<strong>in</strong><strong>in</strong>g about 115,000 (60%), BUPA Ireland about 70,000 (37%)<br />

and VIVAS <strong>Health</strong> about 6,000 (3%).<br />

• Age Groups: If <strong>the</strong> PHI market is considered on <strong>the</strong> basis of<br />

different age categories of members, Vhi <strong>Health</strong>care’s market share<br />

<strong>in</strong>creases <strong>in</strong> <strong>the</strong> older, less profitable age cohorts. 24 In <strong>the</strong> 0-17 age<br />

group Vhi <strong>Health</strong>care has 72% of <strong>the</strong> market while BUPA Ireland<br />

has over 26% and VIVAS <strong>Health</strong> has almost 2%. Vhi <strong>Health</strong>care’s<br />

lowest market share is <strong>in</strong> <strong>the</strong> 30-39 age group at around 69%<br />

compared to 30% for BUPA Ireland and 2% for VIVAS <strong>Health</strong>. Vhi<br />

<strong>Health</strong>care’s market share <strong>in</strong>creases significantly for people over 60<br />

and <strong>in</strong> <strong>the</strong> 80+ age group it is 98%.<br />

24 Of benefits that are subject to risk equalisation, benefits per person paid for those over <strong>the</strong> age of<br />

70 are more than five times <strong>the</strong> benefits per person paid for those under <strong>the</strong> age of 70. Source:<br />

Report of <strong>the</strong> HIA to <strong>the</strong> M<strong>in</strong>ister pursuant to Article 10 of <strong>the</strong> Risk Equalisation Scheme, October<br />

2005.<br />

34