Competition in the Irish Private Health Insurance Market

Competition in the Irish Private Health Insurance Market

Competition in the Irish Private Health Insurance Market

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

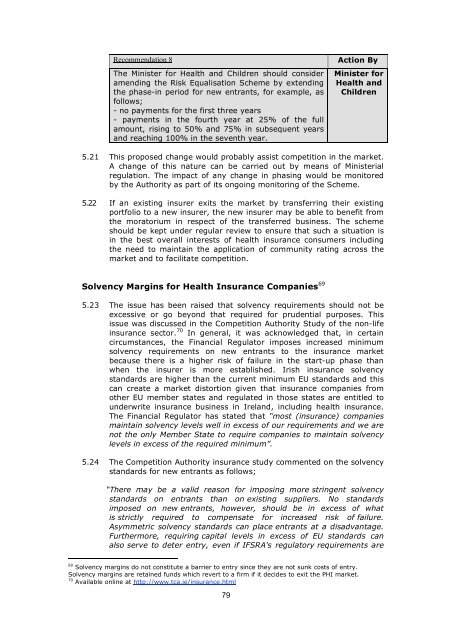

Recommendation 8<br />

The M<strong>in</strong>ister for <strong>Health</strong> and Children should consider<br />

amend<strong>in</strong>g <strong>the</strong> Risk Equalisation Scheme by extend<strong>in</strong>g<br />

<strong>the</strong> phase-<strong>in</strong> period for new entrants, for example, as<br />

follows;<br />

- no payments for <strong>the</strong> first three years<br />

- payments <strong>in</strong> <strong>the</strong> fourth year at 25% of <strong>the</strong> full<br />

amount, ris<strong>in</strong>g to 50% and 75% <strong>in</strong> subsequent years<br />

and reach<strong>in</strong>g 100% <strong>in</strong> <strong>the</strong> seventh year.<br />

Action By<br />

M<strong>in</strong>ister for<br />

<strong>Health</strong> and<br />

Children<br />

5.21 This proposed change would probably assist competition <strong>in</strong> <strong>the</strong> market.<br />

A change of this nature can be carried out by means of M<strong>in</strong>isterial<br />

regulation. The impact of any change <strong>in</strong> phas<strong>in</strong>g would be monitored<br />

by <strong>the</strong> Authority as part of its ongo<strong>in</strong>g monitor<strong>in</strong>g of <strong>the</strong> Scheme.<br />

5.22 If an exist<strong>in</strong>g <strong>in</strong>surer exits <strong>the</strong> market by transferr<strong>in</strong>g <strong>the</strong>ir exist<strong>in</strong>g<br />

portfolio to a new <strong>in</strong>surer, <strong>the</strong> new <strong>in</strong>surer may be able to benefit from<br />

<strong>the</strong> moratorium <strong>in</strong> respect of <strong>the</strong> transferred bus<strong>in</strong>ess. The scheme<br />

should be kept under regular review to ensure that such a situation is<br />

<strong>in</strong> <strong>the</strong> best overall <strong>in</strong>terests of health <strong>in</strong>surance consumers <strong>in</strong>clud<strong>in</strong>g<br />

<strong>the</strong> need to ma<strong>in</strong>ta<strong>in</strong> <strong>the</strong> application of community rat<strong>in</strong>g across <strong>the</strong><br />

market and to facilitate competition.<br />

Solvency Marg<strong>in</strong>s for <strong>Health</strong> <strong>Insurance</strong> Companies 69<br />

5.23 The issue has been raised that solvency requirements should not be<br />

excessive or go beyond that required for prudential purposes. This<br />

issue was discussed <strong>in</strong> <strong>the</strong> <strong>Competition</strong> Authority Study of <strong>the</strong> non-life<br />

<strong>in</strong>surance sector. 70 In general, it was acknowledged that, <strong>in</strong> certa<strong>in</strong><br />

circumstances, <strong>the</strong> F<strong>in</strong>ancial Regulator imposes <strong>in</strong>creased m<strong>in</strong>imum<br />

solvency requirements on new entrants to <strong>the</strong> <strong>in</strong>surance market<br />

because <strong>the</strong>re is a higher risk of failure <strong>in</strong> <strong>the</strong> start-up phase than<br />

when <strong>the</strong> <strong>in</strong>surer is more established. <strong>Irish</strong> <strong>in</strong>surance solvency<br />

standards are higher than <strong>the</strong> current m<strong>in</strong>imum EU standards and this<br />

can create a market distortion given that <strong>in</strong>surance companies from<br />

o<strong>the</strong>r EU member states and regulated <strong>in</strong> those states are entitled to<br />

underwrite <strong>in</strong>surance bus<strong>in</strong>ess <strong>in</strong> Ireland, <strong>in</strong>clud<strong>in</strong>g health <strong>in</strong>surance.<br />

The F<strong>in</strong>ancial Regulator has stated that “most (<strong>in</strong>surance) companies<br />

ma<strong>in</strong>ta<strong>in</strong> solvency levels well <strong>in</strong> excess of our requirements and we are<br />

not <strong>the</strong> only Member State to require companies to ma<strong>in</strong>ta<strong>in</strong> solvency<br />

levels <strong>in</strong> excess of <strong>the</strong> required m<strong>in</strong>imum”.<br />

5.24 The <strong>Competition</strong> Authority <strong>in</strong>surance study commented on <strong>the</strong> solvency<br />

standards for new entrants as follows;<br />

“There may be a valid reason for impos<strong>in</strong>g more str<strong>in</strong>gent solvency<br />

standards on entrants than on exist<strong>in</strong>g suppliers. No standards<br />

imposed on new entrants, however, should be <strong>in</strong> excess of what<br />

is strictly required to compensate for <strong>in</strong>creased risk of failure.<br />

Asymmetric solvency standards can place entrants at a disadvantage.<br />

Fur<strong>the</strong>rmore, requir<strong>in</strong>g capital levels <strong>in</strong> excess of EU standards can<br />

also serve to deter entry, even if IFSRA's regulatory requirements are<br />

69 Solvency marg<strong>in</strong>s do not constitute a barrier to entry s<strong>in</strong>ce <strong>the</strong>y are not sunk costs of entry.<br />

Solvency marg<strong>in</strong>s are reta<strong>in</strong>ed funds which revert to a firm if it decides to exit <strong>the</strong> PHI market.<br />

70 Available onl<strong>in</strong>e at http://www.tca.ie/<strong>in</strong>surance.html<br />

79