Competition in the Irish Private Health Insurance Market

Competition in the Irish Private Health Insurance Market

Competition in the Irish Private Health Insurance Market

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

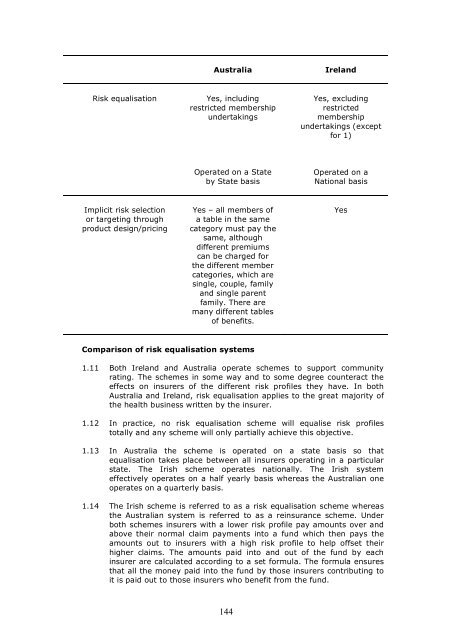

Australia<br />

Ireland<br />

Risk equalisation<br />

Yes, <strong>in</strong>clud<strong>in</strong>g<br />

restricted membership<br />

undertak<strong>in</strong>gs<br />

Yes, exclud<strong>in</strong>g<br />

restricted<br />

membership<br />

undertak<strong>in</strong>gs (except<br />

for 1)<br />

Operated on a State<br />

by State basis<br />

Operated on a<br />

National basis<br />

Implicit risk selection<br />

or target<strong>in</strong>g through<br />

product design/pric<strong>in</strong>g<br />

Yes – all members of<br />

a table <strong>in</strong> <strong>the</strong> same<br />

category must pay <strong>the</strong><br />

same, although<br />

different premiums<br />

can be charged for<br />

<strong>the</strong> different member<br />

categories, which are<br />

s<strong>in</strong>gle, couple, family<br />

and s<strong>in</strong>gle parent<br />

family. There are<br />

many different tables<br />

of benefits.<br />

Yes<br />

Comparison of risk equalisation systems<br />

1.11 Both Ireland and Australia operate schemes to support community<br />

rat<strong>in</strong>g. The schemes <strong>in</strong> some way and to some degree counteract <strong>the</strong><br />

effects on <strong>in</strong>surers of <strong>the</strong> different risk profiles <strong>the</strong>y have. In both<br />

Australia and Ireland, risk equalisation applies to <strong>the</strong> great majority of<br />

<strong>the</strong> health bus<strong>in</strong>ess written by <strong>the</strong> <strong>in</strong>surer.<br />

1.12 In practice, no risk equalisation scheme will equalise risk profiles<br />

totally and any scheme will only partially achieve this objective.<br />

1.13 In Australia <strong>the</strong> scheme is operated on a state basis so that<br />

equalisation takes place between all <strong>in</strong>surers operat<strong>in</strong>g <strong>in</strong> a particular<br />

state. The <strong>Irish</strong> scheme operates nationally. The <strong>Irish</strong> system<br />

effectively operates on a half yearly basis whereas <strong>the</strong> Australian one<br />

operates on a quarterly basis.<br />

1.14 The <strong>Irish</strong> scheme is referred to as a risk equalisation scheme whereas<br />

<strong>the</strong> Australian system is referred to as a re<strong>in</strong>surance scheme. Under<br />

both schemes <strong>in</strong>surers with a lower risk profile pay amounts over and<br />

above <strong>the</strong>ir normal claim payments <strong>in</strong>to a fund which <strong>the</strong>n pays <strong>the</strong><br />

amounts out to <strong>in</strong>surers with a high risk profile to help offset <strong>the</strong>ir<br />

higher claims. The amounts paid <strong>in</strong>to and out of <strong>the</strong> fund by each<br />

<strong>in</strong>surer are calculated accord<strong>in</strong>g to a set formula. The formula ensures<br />

that all <strong>the</strong> money paid <strong>in</strong>to <strong>the</strong> fund by those <strong>in</strong>surers contribut<strong>in</strong>g to<br />

it is paid out to those <strong>in</strong>surers who benefit from <strong>the</strong> fund.<br />

144