2007 Annual report (PDF 8.1 Mb) - University of Melbourne

2007 Annual report (PDF 8.1 Mb) - University of Melbourne

2007 Annual report (PDF 8.1 Mb) - University of Melbourne

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

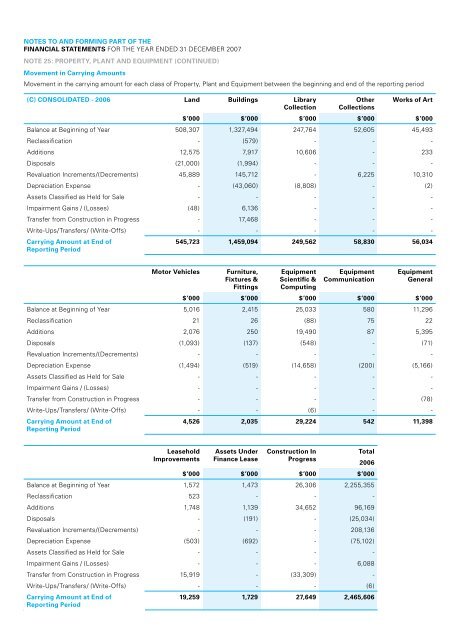

NOTES TO AND FORMING PART OF THE<br />

FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER <strong>2007</strong><br />

NOTE 25: PROPERTY, PLANT AND EQUIPMENT (CONTINUED)<br />

Movement in Carrying Amounts<br />

Movement in the carrying amount for each class <strong>of</strong> Property, Plant and Equipment between the beginning and end <strong>of</strong> the <strong>report</strong>ing period<br />

(C) CONSOLIDATED - 2006 Land Buildings Library<br />

Collection<br />

Other<br />

Collections<br />

Works <strong>of</strong> Art<br />

$’000 $’000 $’000 $’000 $’000<br />

Balance at Beginning <strong>of</strong> Year 508,307 1,327,494 247,764 52,605 45,493<br />

Reclassification - (579) - - -<br />

Additions 12,575 7,917 10,606 - 233<br />

Disposals (21,000) (1,994) - - -<br />

Revaluation Increments/(Decrements) 45,889 145,712 - 6,225 10,310<br />

Depreciation Expense - (43,060) (8,808) - (2)<br />

Assets Classified as Held for Sale - - - - -<br />

Impairment Gains / (Losses) (48) 6,136 - - -<br />

Transfer from Construction in Progress - 17,468 - - -<br />

Write-Ups/Transfers/ (Write-Offs) - - - - -<br />

Carrying Amount at End <strong>of</strong><br />

Reporting Period<br />

545,723 1,459,094 249,562 58,830 56,034<br />

Motor Vehicles<br />

Furniture,<br />

Fixtures &<br />

Fittings<br />

Equipment<br />

Scientific &<br />

Computing<br />

Equipment<br />

Communication<br />

Equipment<br />

General<br />

$’000 $’000 $’000 $’000 $’000<br />

Balance at Beginning <strong>of</strong> Year 5,016 2,415 25,033 580 11,296<br />

Reclassification 21 26 (88) 75 22<br />

Additions 2,076 250 19,490 87 5,395<br />

Disposals (1,093) (137) (548) - (71)<br />

Revaluation Increments/(Decrements) - - - - -<br />

Depreciation Expense (1,494) (519) (14,658) (200) (5,166)<br />

Assets Classified as Held for Sale - - - - -<br />

Impairment Gains / (Losses) - - - - -<br />

Transfer from Construction in Progress - - - - (78)<br />

Write-Ups/Transfers/ (Write-Offs) - - (6) - -<br />

Carrying Amount at End <strong>of</strong><br />

Reporting Period<br />

4,526 2,035 29,224 542 11,398<br />

Leasehold<br />

Improvements<br />

Assets Under<br />

Finance Lease<br />

Construction In<br />

Progress<br />

Total<br />

2006<br />

$’000 $’000 $’000 $’000<br />

Balance at Beginning <strong>of</strong> Year 1,572 1,473 26,306 2,255,355<br />

Reclassification 523 - - -<br />

Additions 1,748 1,139 34,652 96,169<br />

Disposals - (191) - (25,034)<br />

Revaluation Increments/(Decrements) - - - 208,136<br />

Depreciation Expense (503) (692) - (75,102)<br />

Assets Classified as Held for Sale - - - -<br />

Impairment Gains / (Losses) - - - 6,088<br />

Transfer from Construction in Progress 15,919 - (33,309) -<br />

Write-Ups/Transfers/ (Write-Offs) - - - (6)<br />

Carrying Amount at End <strong>of</strong><br />

Reporting Period<br />

19,259 1,729 27,649 2,465,606