Decentralization of Forest Administration in Indonesia, Implications ...

Decentralization of Forest Administration in Indonesia, Implications ...

Decentralization of Forest Administration in Indonesia, Implications ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Ida Aju Pradnja Resosudarmo, Christopher Barr, Ahmad Dermawan, and John McCarthy 61<br />

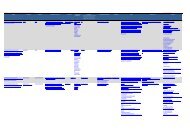

Table 4.1: Revenue Shar<strong>in</strong>g Among Central, Prov<strong>in</strong>cial, and District/Municipality<br />

Governments Prior to 1999 <strong>Decentralization</strong> and Fiscal Balanc<strong>in</strong>g Laws (by<br />

percentage)<br />

Revenue Source<br />

Central Prov<strong>in</strong>cial District or<br />

Government Government Municipality<br />

Oil 100 0 0<br />

LNG a 100 0 0<br />

M<strong>in</strong><strong>in</strong>g: Land-rent 20 16 64<br />

M<strong>in</strong><strong>in</strong>g: Royalty 20 16 64<br />

<strong>Forest</strong>ry: IHPH b 30 56 14<br />

<strong>Forest</strong>ry: PSDH c 55 30 15<br />

Fishery 100 0 0<br />

Land and Build<strong>in</strong>g Tax 19 16.2 64.8<br />

Land/Build<strong>in</strong>g Transfer Fee 20 16 64<br />

Personal Income Tax 100 0 0<br />

Sources: Ditjen PKPD (2004), Ford (2000), Prakosa (1996), Shah and Qureshi (1994), various<br />

government regulations<br />

Note:<br />

a<br />

LNG = Liquefied Natural Gas<br />

b<br />

IHPH = Iuran Hak Pengusahaan Hutan (HPH License Fee)<br />

c<br />

PSDH = Provisi Sumber Daya Hutan (<strong>Forest</strong> Resource Rent Provision)<br />

Dur<strong>in</strong>g the New Order period, regional governments had only limited<br />

opportunities for rais<strong>in</strong>g their own revenues. Through the 1980s and much <strong>of</strong> the<br />

1990s, for <strong>in</strong>stance, governments at both the prov<strong>in</strong>cial and district levels imposed<br />

numerous taxes and fees, although very few <strong>of</strong> these had much revenue potential<br />

(Devas 1989). 2 In 1997, the central government further restricted the capacity <strong>of</strong><br />

regional governments to generate their own revenues with the <strong>in</strong>troduction <strong>of</strong> Law<br />

18/1997 on Regional Taxes and Levies. Law 18/1997 stipulated that prov<strong>in</strong>cial and<br />

district governments could only impose taxes and levies that were <strong>in</strong>cluded on a<br />

specified list formulated by the M<strong>in</strong>istry <strong>of</strong> F<strong>in</strong>ance and that any changes to this list<br />

would only take effect if they were approved by the M<strong>in</strong>istry (World Bank 2003).<br />

For district governments, the list <strong>of</strong> authorized taxes covered six relatively m<strong>in</strong>or<br />

sources <strong>of</strong> revenue: C-grade m<strong>in</strong><strong>in</strong>g (for sand, gravel, etc.); surface and ground water;<br />

advertisements; hotels and restaurants; enterta<strong>in</strong>ment; and street light<strong>in</strong>g.<br />

Prov<strong>in</strong>cial and district governments were also permitted to obta<strong>in</strong> their own<br />

revenues through the operation <strong>of</strong> regional government enterprises (Badan Usaha<br />

Milik Daerah, BUMD). Many prov<strong>in</strong>cial and district government formed BUMD to<br />

manage commercial operations (such as hotels and enterta<strong>in</strong>ment facilities) and public<br />

utilities (such as water supply) (Devas 1989). However, most <strong>of</strong> these enterprises were<br />

notorious for be<strong>in</strong>g poorly managed and, <strong>in</strong> many cases, for generat<strong>in</strong>g economic<br />

losses rather than positive revenues.