City of Methuen Master Plan

City of Methuen Master Plan

City of Methuen Master Plan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Economic Development<br />

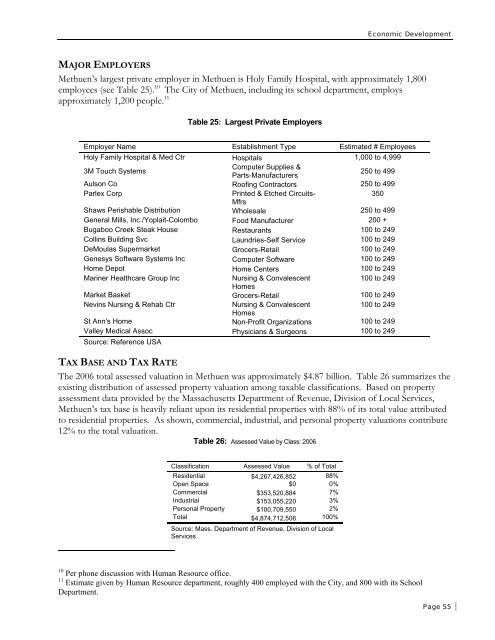

MAJOR EMPLOYERS<br />

<strong>Methuen</strong>’s largest private employer in <strong>Methuen</strong> is Holy Family Hospital, with approximately 1,800<br />

employees (see Table 25). 10 The <strong>City</strong> <strong>of</strong> <strong>Methuen</strong>, including its school department, employs<br />

approximately 1,200 people. 11<br />

Table 25: Largest Private Employers<br />

Employer Name Establishment Type Estimated # Employees<br />

Holy Family Hospital & Med Ctr Hospitals 1,000 to 4,999<br />

3M Touch Systems<br />

Computer Supplies &<br />

Parts-Manufacturers<br />

250 to 499<br />

Aulson Co Ro<strong>of</strong>ing Contractors 250 to 499<br />

Parlex Corp<br />

Printed & Etched Circuits-<br />

350<br />

Mfrs<br />

Shaws Perishable Distribution Wholesale 250 to 499<br />

General Mills, Inc./Yoplait-Colombo Food Manufacturer 200 +<br />

Bugaboo Creek Steak House Restaurants 100 to 249<br />

Collins Building Svc Laundries-Self Service 100 to 249<br />

DeMoulas Supermarket Grocers-Retail 100 to 249<br />

Genesys S<strong>of</strong>tware Systems Inc Computer S<strong>of</strong>tware 100 to 249<br />

Home Depot Home Centers 100 to 249<br />

Mariner Healthcare Group Inc<br />

Nursing & Convalescent<br />

100 to 249<br />

Homes<br />

Market Basket Grocers-Retail 100 to 249<br />

Nevins Nursing & Rehab Ctr<br />

Nursing & Convalescent<br />

100 to 249<br />

Homes<br />

St Ann's Home Non-Pr<strong>of</strong>it Organizations 100 to 249<br />

Valley Medical Assoc Physicians & Surgeons 100 to 249<br />

Source: Reference USA<br />

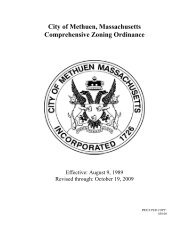

TAX BASE AND TAX RATE<br />

The 2006 total assessed valuation in <strong>Methuen</strong> was approximately $4.87 billion. Table 26 summarizes the<br />

existing distribution <strong>of</strong> assessed property valuation among taxable classifications. Based on property<br />

assessment data provided by the Massachusetts Department <strong>of</strong> Revenue, Division <strong>of</strong> Local Services,<br />

<strong>Methuen</strong>’s tax base is heavily reliant upon its residential properties with 88% <strong>of</strong> its total value attributed<br />

to residential properties. As shown, commercial, industrial, and personal property valuations contribute<br />

12% to the total valuation.<br />

Table 26: Assessed Value by Class: 2006<br />

Classification Assessed Value % <strong>of</strong> Total<br />

Residential $4,267,426,852 88%<br />

Open Space $0 0%<br />

Commercial $353,520,884 7%<br />

Industrial $153,055,220 3%<br />

Personal Property $100,709,550 2%<br />

Total $4,874,712,506 100%<br />

Source: Mass. Department <strong>of</strong> Revenue, Division <strong>of</strong> Local<br />

Services<br />

10 Per phone discussion with Human Resource <strong>of</strong>fice.<br />

11 Estimate given by Human Resource department, roughly 400 employed with the <strong>City</strong>, and 800 with its School<br />

Department.<br />

Page 55