City of Methuen Master Plan

City of Methuen Master Plan

City of Methuen Master Plan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fiscal Analysis<br />

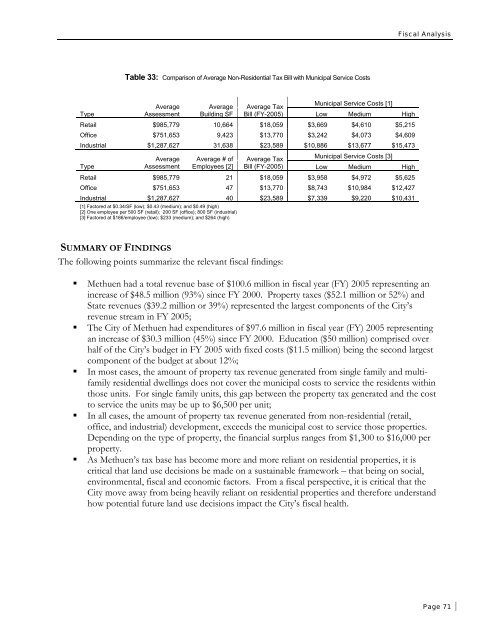

Table 33: Comparison <strong>of</strong> Average Non-Residential Tax Bill with Municipal Service Costs<br />

Average Average Average Tax<br />

Municipal Service Costs [1]<br />

Type<br />

Assessment Building SF Bill (FY-2005) Low Medium High<br />

Retail $985,779 10,664 $18,059 $3,669 $4,610 $5,215<br />

Office $751,653 9,423 $13,770 $3,242 $4,073 $4,609<br />

Industrial $1,287,627 31,638 $23,589 $10,886 $13,677 $15,473<br />

Average Average # <strong>of</strong> Average Tax<br />

Municipal Service Costs [3]<br />

Type<br />

Assessment Employees [2] Bill (FY-2005) Low Medium High<br />

Retail $985,779 21 $18,059 $3,958 $4,972 $5,625<br />

Office $751,653 47 $13,770 $8,743 $10,984 $12,427<br />

Industrial $1,287,627 40 $23,589 $7,339 $9,220 $10,431<br />

[1] Factored at $0.34/SF (low); $0.43 (medium); and $0.49 (high)<br />

[2] One employee per 500 SF (retail); 200 SF (<strong>of</strong>fice); 800 SF (industrial)<br />

[3] Factored at $186/employee (low); $233 (medium); and $264 (high)<br />

SUMMARY OF FINDINGS<br />

The following points summarize the relevant fiscal findings:<br />

• <strong>Methuen</strong> had a total revenue base <strong>of</strong> $100.6 million in fiscal year (FY) 2005 representing an<br />

increase <strong>of</strong> $48.5 million (93%) since FY 2000. Property taxes ($52.1 million or 52%) and<br />

State revenues ($39.2 million or 39%) represented the largest components <strong>of</strong> the <strong>City</strong>’s<br />

revenue stream in FY 2005;<br />

• The <strong>City</strong> <strong>of</strong> <strong>Methuen</strong> had expenditures <strong>of</strong> $97.6 million in fiscal year (FY) 2005 representing<br />

an increase <strong>of</strong> $30.3 million (45%) since FY 2000. Education ($50 million) comprised over<br />

half <strong>of</strong> the <strong>City</strong>’s budget in FY 2005 with fixed costs ($11.5 million) being the second largest<br />

component <strong>of</strong> the budget at about 12%;<br />

• In most cases, the amount <strong>of</strong> property tax revenue generated from single family and multifamily<br />

residential dwellings does not cover the municipal costs to service the residents within<br />

those units. For single family units, this gap between the property tax generated and the cost<br />

to service the units may be up to $6,500 per unit;<br />

• In all cases, the amount <strong>of</strong> property tax revenue generated from non-residential (retail,<br />

<strong>of</strong>fice, and industrial) development, exceeds the municipal cost to service those properties.<br />

Depending on the type <strong>of</strong> property, the financial surplus ranges from $1,300 to $16,000 per<br />

property.<br />

• As <strong>Methuen</strong>’s tax base has become more and more reliant on residential properties, it is<br />

critical that land use decisions be made on a sustainable framework – that being on social,<br />

environmental, fiscal and economic factors. From a fiscal perspective, it is critical that the<br />

<strong>City</strong> move away from being heavily reliant on residential properties and therefore understand<br />

how potential future land use decisions impact the <strong>City</strong>’s fiscal health.<br />

Page 71