Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Far East. In Denmark, potassium nitrate<br />

production was expanded, and the plant<br />

extension is being continued through a<br />

new investment that is expected to be<br />

completed in the autumn of 2000.<br />

NPK projects in Southeast Asia progressed<br />

according to plans and the plant<br />

of a joint venture in Malesia, in which<br />

<strong>Kemira</strong> Agro has a 30% holding, started<br />

up in mid-<strong>1999</strong>. Construction works on<br />

the plant in China continued ahead and<br />

the facility is expected to reach completion<br />

in the autumn of 2000. <strong>Kemira</strong> Agro<br />

has a 49% interest and Finnfund a 26%<br />

interest in the joint venture in China.<br />

In Finland, <strong>Kemira</strong> Agro purchased<br />

an 20% holding in the Suomen Rehu animal<br />

feed business, thereby strengthening<br />

the logistics co-operation that has already<br />

been started.<br />

The development programme that<br />

was launched at the beginning of 1998<br />

at <strong>Kemira</strong> Agro has progressed according<br />

to plans. Its objective is to achieve a<br />

significant improvement in earnings,<br />

which will show up to the full extent in<br />

2001.<br />

KEMIRA PIGMENTS<br />

<strong>Kemira</strong> Pigments’ net sales rose by 15%<br />

and were EUR 488 million. Average selling<br />

prices for titanium dioxide pigments<br />

during the year were at the previous<br />

year’s level. Selling prices in the September-December<br />

period were about 2%<br />

lower than prices in the May-August period<br />

and prices in the last four months<br />

of 1998.<br />

Sales volumes of titanium dioxide<br />

pigments were 13% higher than they<br />

were a year earlier. The sales volume in<br />

the last four months of the year was 25%<br />

higher than it was in the last four<br />

months of the previous year, a situation<br />

that may be partly attributable to the<br />

precautions taken by customers on the<br />

eve of the new millennium.<br />

Demand was in decline in Europe<br />

and Asia in the previous year, but it<br />

swung to strong growth during <strong>1999</strong>,<br />

particularly after the January-April period.<br />

In North America demand remained<br />

good, though in Latin America it was<br />

weak throughout the year.<br />

Changes in the titanium dioxide industry<br />

continued when the American<br />

company Huntsman Chemicals acquired<br />

Tioxide from ICI. <strong>Kemira</strong> is also peeling<br />

off its plants in the United States and the<br />

Netherlands.<br />

<strong>Kemira</strong> Pigments’ operating income<br />

was EUR 35 million (22 million in 1998),<br />

or 7% of net sales. Operating income in<br />

the September-December period was<br />

EUR 18 million, as against EUR 10 million<br />

in the previous four month period<br />

and EUR 7 million in the last four month<br />

period of the previous year. A change in<br />

the actuarial assumptions for calculating<br />

the liability of Finnish pension funds resulted<br />

in a non-recurring reversal of<br />

about EUR 3 million in contributions to<br />

the supplementary pension foundation<br />

in the September-December period,<br />

whereas in the previous year the change<br />

resulted in having to book a one-off expense<br />

of the same size.<br />

The debottlenecking project at the<br />

Pori plant was completed according to<br />

plans towards the end of the <strong>1999</strong>.<br />

Thereafter the Pori unit’s production capacity<br />

will be 120,000 tonnes a year.<br />

OTHER UNITS<br />

<strong>Kemira</strong> Metalkat, which manufactures<br />

catalytic converters, reported net sales<br />

growth of 19%, to EUR 36 million. Operating<br />

income was EUR 3.1 million, as<br />

against EUR 1.7 million a year earlier.<br />

Net sales by <strong>Kemira</strong> Safety, which manufactures<br />

personal protection equipment,<br />

were down 1%, to EUR 14 million. Operating<br />

income was EUR 0.9 million (1.3<br />

million in 1998).<br />

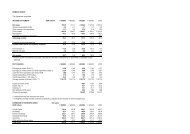

GROUP FINANCIAL PERFORMANCE<br />

The Group’s operating income was EUR<br />

111 million (148 million in 1998), or 4%<br />

of net sales. This figure includes a total<br />

of EUR 28 million of non-recurring net<br />

costs. Income before taxes and minority<br />

interests was 59 million (97 million in<br />

1998). Net financial expenses were EUR<br />

52 million (51 million in 1998). Income<br />

after taxes was EUR 30 million (79 million<br />

in 1998). The effective tax rate rose<br />

from 20% to 47%. The increase in the effective<br />

tax rate was mainly due to the<br />

non-recurring costs booked. As was reported<br />

in the previous year’s financial<br />

statements, taxes in the 1998 income<br />

statement were reduced by an EUR 14<br />

million deferred taxes item which resulted<br />

from a review of the accounting policy<br />

in line with changed IAS rules. The<br />

return on capital invested was 5.9%<br />

(8.3%).<br />

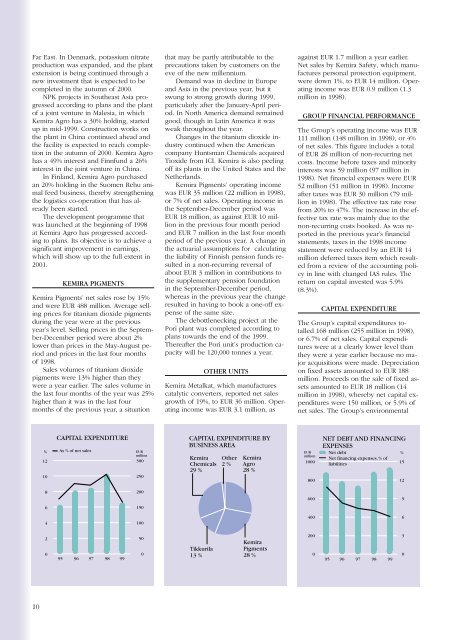

CAPITAL EXPENDITURE<br />

The Group’s capital expenditures totalled<br />

168 million (255 million in 1998),<br />

or 6.7% of net sales. Capital expenditures<br />

were at a clearly lower level than<br />

they were a year earlier because no major<br />

acquisitions were made. Depreciation<br />

on fixed assets amounted to EUR 188<br />

million. Proceeds on the sale of fixed assets<br />

amounted to EUR 18 million (14<br />

million in 1998), whereby net capital expenditures<br />

were 150 million, or 5.9% of<br />

net sales. The Group’s environmental<br />

INVESTOINNIT<br />

CAPITAL EXPENDITURE<br />

% As % of net sales<br />

12<br />

10<br />

euroa EUR<br />

million<br />

300<br />

250<br />

CAPITAL EXPENDITURE BY<br />

BUSINESS AREA<br />

<strong>Kemira</strong><br />

Chemicals<br />

29 %<br />

Other<br />

2 %<br />

<strong>Kemira</strong><br />

Agro<br />

28 %<br />

EUR<br />

million<br />

1000<br />

800<br />

NET DEBT AND FINANCING<br />

EXPENSES<br />

Net debt<br />

Net financing expenses, % of<br />

liabilities<br />

%<br />

15<br />

12<br />

8<br />

200<br />

600<br />

9<br />

6<br />

150<br />

4<br />

100<br />

400<br />

6<br />

2<br />

0<br />

95 96 97 98 99<br />

50<br />

0<br />

Tikkurila<br />

13 %<br />

<strong>Kemira</strong><br />

Pigments<br />

28 %<br />

200<br />

0<br />

95 96 97 98 99<br />

3<br />

0<br />

10