Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BOARD OF DIRECTORS’ REVIEW<br />

The members of the Board of<br />

Directors of <strong>Kemira</strong> Oyj in<br />

<strong>1999</strong> were (from the left)<br />

Vice Chairman Timo<br />

Mattila, Juhani Kari, Tauno<br />

Pihlava, as from 1 June,<br />

Chairman Heimo Karinen,<br />

Esa Tirkkonen, Leif Ekström<br />

and Sten-Olof Hansén.<br />

<strong>1999</strong> was a spotty year for the <strong>Kemira</strong><br />

Group. The positive trend continued for<br />

both <strong>Kemira</strong> Chemicals and <strong>Kemira</strong> Pigments,<br />

both of which improved their<br />

earnings markedly. <strong>Kemira</strong> Agro suffered<br />

from the oversupply of nitrogen fertilizers<br />

and record-low prices. Tikkurila in turn<br />

fared well in the Finnish and Scandinavian<br />

market, but sales in Russia again<br />

trailed the previous year. Similarly, sales<br />

of Tikkurila’s CPS tinting machines fell<br />

clearly short of the previous year’s figure.<br />

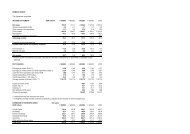

Consolidated net sales were up 5% on<br />

the previous year and were EUR 2,526<br />

million (2,413 million in 1998). Operating<br />

income was EUR 111 million (148 million<br />

in 1998), which includes EUR 28 million<br />

of non-recurring net costs. Operating income<br />

was 4% of net sales.<br />

Income before taxes and minority interests<br />

fell to EUR 59 million, from EUR<br />

97 million a year earlier. Taking into account<br />

the non-recurring costs of the<br />

structural change, the Group’s net income<br />

before extraordinary items was<br />

near the previous year’s level. Income after<br />

taxes was EUR 30 million (EUR 79<br />

million in 1998). Earnings per share were<br />

EUR 0.23 (0.61).<br />

The major factors that influenced the<br />

trend in net sales were the fast growth in<br />

the sales of <strong>Kemira</strong> Chemicals’ pulp and<br />

paper chemicals (in part thanks to the<br />

previous year’s acquisitions) as well as<br />

the marked growth in the sales volumes<br />

of <strong>Kemira</strong> Pigments’ titanium dioxide pigments.<br />

About 82% of the Group’s net<br />

sales came from outside Finland.<br />

The table on page 12 shows the<br />

breakdown of consolidated net sales<br />

among the different business areas.<br />

Return on equity was 3.2%. The cash<br />

flow return on capital invested was 9%.<br />

The Group’s gearing ratio was 95%.<br />

The Board of Directors proposes that<br />

a dividend of EUR 0.23 per share be paid<br />

for the <strong>1999</strong> financial year, or a total dividend<br />

payout of EUR 29.6 million.<br />

NEW STRATEGIC FOCUS<br />

In order to improve competitiveness and<br />

profitability, the Board of Directors decided<br />

to overhaul its business strategy in<br />

such a way that in the future the Group<br />

will concentrate on fields that have promising<br />

growth prospects and are less dependent<br />

on economic cycles than is the<br />

industry average. In accordance with the<br />

new strategy, <strong>Kemira</strong> will seek growth<br />

within paper and pulp chemicals, water<br />

treatment chemicals and paints. Other priority<br />

areas are speciality fertilizers and industrial<br />

chemicals.<br />

For the fields falling outside the new<br />

core business (titanium dioxide pigments<br />

and nitrogen fertilizers) solutions that enhance<br />

their cash flow generation potential<br />

will be sought by way of co-operation or<br />

ownership arrangements. The growth potential<br />

of the Tikkurila CPS unit, which<br />

has specialized in colour processing systems,<br />

will be promoted by separating it<br />

out from the paint business either by listing<br />

it on the stock exchange or by means<br />

of other M&A arrangements.<br />

The arrangements concerning <strong>Kemira</strong><br />

Pigments have progressed the farthest<br />

now that sale agreements have been<br />

signed for the divestment of the plants in<br />

the United States and the Netherlands.<br />

Plans concerning Tikkurila CPS are also<br />

expected to be implemented this year. It<br />

is more difficult to set a time for the arrangements<br />

concerning <strong>Kemira</strong> Agro’s nitrogen<br />

fertilizer business, but the objective<br />

is nevertheless to find a solution already<br />

during the current year.<br />

The cash flow from the arrangements<br />

will be used for the accelerated expansion<br />

of the above-mentioned growth areas,<br />

both organically and via acquisitions.<br />

<strong>Kemira</strong> considers eastern Central Europe,<br />

Russia, North America, and the Far East to<br />

be its geographical growth areas.<br />

In connection with <strong>Kemira</strong>’s strategy<br />

process, the Board of Directors confirmed<br />

the new financial targets for the Group’s<br />

profitable growth. At the same time attention<br />

will be paid to the efficient use of<br />

capital and to the Group’s balance sheet<br />

structure. The objectives are set forth in<br />

the table on page 4.<br />

KEMIRA CHEMICALS<br />

The Group’s fastest growing area was<br />

again <strong>Kemira</strong> Chemicals, whose net sales<br />

rose by 11% to EUR 697 million (630 million<br />

in 1998). All three strategic business<br />

units – Pulp & Paper Chemicals, Kemwa-<br />

7