Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

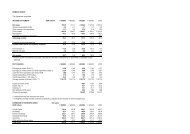

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

Basis of presentation<br />

The <strong>Kemira</strong> Group’s financial statements have been prepared<br />

in compliance with the relevant acts and regulations in force<br />

in Finland and in accordance with the Group’s uniform accounting<br />

principles. The Group’s accounting principles are<br />

based on International Accounting Standards (IAS). Accordingly,<br />

the financial statements also correspond to IAS, with<br />

the exception of accounting for pension expenses, IAS 19,<br />

which entered into force on 1 January <strong>1999</strong>. Its effects on the<br />

consolidated income statement and shareholders’ equity are<br />

discussed and presented in Notes 23 and 24 to the consolidated<br />

financial statements.<br />

Principles of consolidation<br />

The consolidated financial statements include the accounts of<br />

the parent company, <strong>Kemira</strong> Oyj, and companies in which it<br />

owns, directly or indirectly through subsidiaries, over 50 percent<br />

of the voting rights. Certain real estate and housing companies,<br />

and captive insurance companies, as well as companies<br />

that had no operations during the financial year, have not<br />

been consolidated. However, the effect of these companies<br />

on the Group’s results and distributable reserves, in cases of<br />

any significance, has been consolidated using the equity<br />

method of accounting. Companies acquired during the accounting<br />

period are consolidated from the date the responsibility<br />

for their operations was transferred to the Group. Similarly,<br />

units or companies sold during the fiscal year are included<br />

in the income statement up to the date of disposition.<br />

All intra-Group transactions have been eliminated as part of<br />

the consolidation process. Acquisitions of companies are accounted<br />

for under the purchase (past-equity) method of accounting.<br />

The excess of the acquisition cost over fair value of<br />

the net assets acquired is recorded as goodwill. Goodwill is<br />

amortized over the useful life of the assets acquired, which<br />

since 1998 has as a rule been a maximum of 5 years. Should a<br />

longer amortization period be justified, it is a maximum of 10<br />

years. The interests of minority shareholders in the net assets<br />

and profit and loss of consolidated subsidiaries is reflected as<br />

a separate item in the Group’s consolidated balance sheet and<br />

income statement.<br />

Companies in which the Group has a participating interest are<br />

associated companies, in which the interest is 20-50%. Holdings<br />

in associated companies are presented in the consolidated financial<br />

statements using the equity method of accounting. Under<br />

the equity method the Group’s proportionate share of the<br />

associated companies’ net income for the financial year is included<br />

in income and expenses from operations. Joint ventures<br />

that are owned on a fifty-fifty basis with another shareholder<br />

and in which the voting rights and management responsibility<br />

are divided evenly between the shareholders have been consolidated<br />

according to the proportionate method of accounting.<br />

Other companies (voting rights owned less than 20 percent)<br />

are stated at cost in the balance sheet and dividends received<br />

are included in the income statement.<br />

Items denominated in foreign currency, and foreign<br />

currency and interest rate derivatives<br />

In day-to-day accounting of each Group company, transactions<br />

in foreign currencies are translated at the rates of exchange<br />

prevailing on the dates of the transactions. At the end<br />

of the accounting period the unsettled balances of foreign<br />

currency transactions are valued at the rates of exchange prevailing<br />

on the balance sheet date. Foreign exchange gains and<br />

losses related to normal business operations are treated as adjustments<br />

to sales and purchases, while those gains and losses<br />

associated with financing and hedging of the total foreign exchange<br />

position are recorded as financing income and expenses.<br />

Derivative financial instruments to hedge currency and interest<br />

rate risks have been recorded in the income statement simultaneously<br />

with the commitment hedged. Derivative financial<br />

instruments which are not considered as hedging instruments<br />

are valued in the financial statements at the market<br />

price in accordance with conservative accounting practice.<br />

The interest portion of currency forwards is recorded as interest<br />

income and expense over the terms of the contract, and<br />

the differences in the foreign exchange rates are booked as a<br />

credit or charged to income when the underlying hedged<br />

transaction has been credited or charged to income in the financial<br />

statements.<br />

In the consolidated financial statements, the income statements<br />

of foreign subsidiaries have been translated into euro<br />

amounts using the average exchange rates and the balance<br />

sheets have been translated using the year-end exchange<br />

rates. The translation difference, which arises in translating<br />

the income statement and balance sheet using the different<br />

exchange rates, is entered in non-restricted equity.<br />

The Group seeks to hedge the translation risk of its investment<br />

in the net assets of foreign subsidiaries, which includes<br />

the original cost of ownership plus any undistributed post-acquisition<br />

profits and losses of those subsidiaries. Accordingly,<br />

the foreign currency-denominated shareholders’ equity in the<br />

Group’s non-Finnish subsidiaries are hedged against exchange<br />

rate changes using long-term foreign currency-denominated<br />

loans as well as forward and currency swap contracts.<br />

In the consolidated financial statements, the exchange rate<br />

gains and losses of such loans and forward and currency<br />

swap contracts are credited or charged against the translation<br />

differences arising from the translation of the shareholders’<br />

equity amounts of the last confirmed balance sheets of the<br />

subsidiaries. Other translation differences affecting shareholders’<br />

equity are stated as an increase or decrease in the non-restricted<br />

shareholders’ equity.<br />

The foreign exchange rates on the balance sheet date are given<br />

on page 17.<br />

Pension arrangements<br />

The Group has various pension schemes in accordance with<br />

the local conditions and practices in the countries in which it<br />

operates. The schemes are generally funded through payments<br />

to separate funds or to insurance companies. Contributions<br />

are based on periodic actuarial calculations and are<br />

charged against profits.<br />

The parent company’s pension arrangements have been<br />

handled within the separate pension funds. The uncovered<br />

liabilities of pension funds are presented in the parent<br />

company’s financial statements in short-term interest-free<br />

receivables and in short-term interest-free liabilities.<br />

In <strong>1999</strong>, IAS 19 was not applied, but the effect of applying the<br />

standard on the Group’s net income and retained earnings<br />

has been calculated and stated in Notes 23-24. The liability resulting<br />

from the changeover to applying IAS 19, which came<br />

into force in <strong>1999</strong>, has been calculated at the Group level so<br />

that the accumulated entitlement has been periodized over<br />

the time of the employment according to the accrual rules for<br />

21