Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

age to a change of about EUR 8 million in the<br />

asset/liability porfolio. For 2000, the new limit is<br />

EUR 15 million. By a decision of the Management<br />

Board, the limits can be changed in accordance<br />

with the market situation. As a consequence<br />

of this policy, the Group’s average interest<br />

rate level has in general been higher than<br />

the market level of short-term interest rates<br />

when low rates prevail and, on the other hand,<br />

lower than the market level when high rates<br />

prevail.<br />

Counterparty risk<br />

Counterparty risk is due to the fact that a contractual<br />

party to a financing transaction is not necessarily<br />

able to fulfil its obligations under the agreement.<br />

Counterparty risks in treasury operations<br />

are mainly connected with investing funds and<br />

with the counterparty risks of derivative contracts.<br />

The Group accepts as its counterparty only financial<br />

institutions that have a good credit rating. At<br />

present there are more than 20 approved counterparties.<br />

A counterparty that has received a<br />

credit rating under the A level or that is unrated<br />

must have a separate approval. At present this<br />

condition applies only to a few counterparties.<br />

Before being accepted as a counterparty, the financial<br />

institution must go through a special approval<br />

process. In addition, Treasury Management<br />

approves the new banking relationships of<br />

subsidiaries. Counterparty risk is monitored on a<br />

monthly basis by defining from the market values<br />

of receivables the maximum risk associated with<br />

each counterparty. For each financial institution,<br />

there is an approved limit. Of these limits, the<br />

maximum amount in use at the turn of the year<br />

was 33 %. Short-term investments are made in<br />

liquid instruments that have a low risk. Credit<br />

risks in treasury operations did not result in credit<br />

losses during the financial year.<br />

Funding risk<br />

The Group diversifies its funding risk by obtaining<br />

financing from different sources in different<br />

markets. The Group has bank loans,<br />

pension loans, insurance company loans, a Medium<br />

Term Note Programme as well as shortterm<br />

domestic and foreign commercial paper<br />

programmes. The objective is to balance the<br />

maturity schedule of the bond and loan portfolio<br />

and to maintain a sufficiently long maturity<br />

for long-term loans. The Group’s solvency and<br />

funding arrangements are safeguarded by maintaining<br />

good liquidity and by means of revolving<br />

credit facilities. The Group has a commercial<br />

paper programme, providing for the raising<br />

of a maximum of EUR 150 million as well as a<br />

Euro Commercial Paper (ECP) programme,<br />

within which a maximum of USD 200 million<br />

can be raised. The ECP programme was used<br />

to a very minor extent in <strong>1999</strong>. The Group’s average<br />

liquidity in <strong>1999</strong> was EUR 91 million. At<br />

the end of <strong>1999</strong> the liquidity was EUR 88 million<br />

as well as an unutilized revolving credit facility<br />

of about EUR 260 million, or a total of<br />

EUR 348 million. The management of liquidity<br />

is being developed continually through more<br />

effective use of the Group’s cash pool arrangements.<br />

The introduction of the euro from the<br />

beginning of <strong>1999</strong> and the euro cash pool that<br />

is to be developed as a consequence of it will<br />

facilitate the management of liquid funds considerably.<br />

As plans now stand, a euro cash pool<br />

will be started up stage by stage during 2000.<br />

Documentation risk<br />

The Group’s documentation risk of financing<br />

agreement is managed by concentrating the<br />

approval of financing agreements within<br />

Group Treasury as well as by using standardized<br />

agreement models.<br />

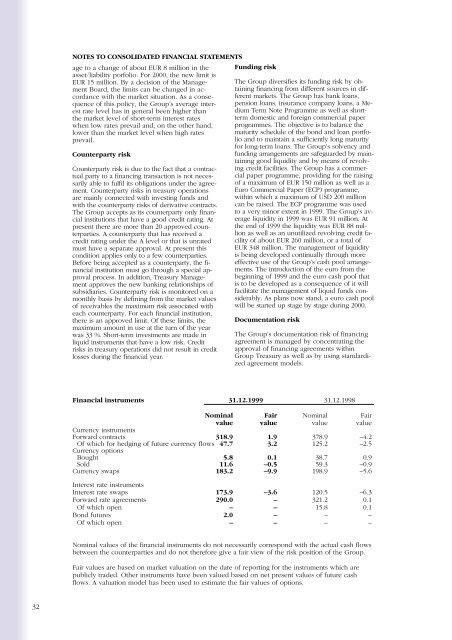

Financial instruments 31.12.<strong>1999</strong> 31.12.1998<br />

Nominal Fair Nominal Fair<br />

value value value value<br />

Currency instruments<br />

Forward contracts 318.9 1.9 378.9 –4.2<br />

Of which for hedging of future currency flows 47.7 3.2 125.2 –2.5<br />

Currency options<br />

Bought 5.8 0.1 38.7 0.9<br />

Sold 11.6 –0.5 59.3 –0.9<br />

Currency swaps 183.2 –9.9 198.9 –5.6<br />

Interest rate instruments<br />

Interest rate swaps 173.9 –3.6 120.5 –6.3<br />

Forward rate agreements 290.0 – 321.2 0.1<br />

Of which open – – 15.8 0.1<br />

Bond futures 2.0 – – –<br />

Of which open – – – –<br />

Nominal values of the financial instruments do not necessarily correspond with the actual cash flows<br />

between the counterparties and do not therefore give a fair view of the risk position of the Group.<br />

Fair values are based on market valuation on the date of reporting for the instruments which are<br />

publicly traded. Other instruments have been valued based on net present values of future cash<br />

flows. A valuation model has been used to estimate the fair values of options.<br />

32