Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SHARES AND SHAREHOLDERS<br />

SHARES AND VOTING RIGHTS<br />

The nominal value of the shares of<br />

<strong>Kemira</strong> Oyj was deleted in accordance<br />

with the resolution of the <strong>Annual</strong> General<br />

Meeting, and at the same time the share<br />

capital was redenominated in euros. The<br />

number of shares is 128,800,000 and each<br />

share confers one vote at the meetings of<br />

shareholders. According to the Articles of<br />

Association, the company’s share capital<br />

can be in the range of from EUR 217 to<br />

850 million. The share capital can be<br />

changed within these limits without<br />

amending the Articles of Association. The<br />

share capital of <strong>Kemira</strong> Oyj at present is<br />

EUR 217 million. <strong>Kemira</strong> Oyj shares are<br />

registered within the book-entry system.<br />

DIVIDEND POLICY<br />

<strong>Kemira</strong> aims to distribute a dividend which<br />

in the long term is competitive with that of<br />

major Finnish companies and with foreign<br />

chemicals groups, nevertheless taking into<br />

account the company’s result and capital requirement<br />

at any given time. The company’s<br />

Board of Directors will propose to the<br />

<strong>Annual</strong> General Meeting that a dividend of<br />

EUR 0.23 per share, or EUR 29.6 million, be<br />

paid for the <strong>1999</strong> financial year. This corresponds<br />

to a dividend payout of 100% of the<br />

net income for the year. Taking into account<br />

the Finnish tax base, this amounts to<br />

a taxable dividend of EUR 0.32. The record<br />

date for the dividend payout will be 14<br />

April 2000, and the dividend will be paid<br />

on 26 April 2000.<br />

INCREASE IN SHARE CAPITAL<br />

The Board of Directors of <strong>Kemira</strong> Oyj<br />

does not at present have authorizations to<br />

increase the company’s share capital. During<br />

the past year the share capital was increased<br />

by a transfer of EUR 0.4 million<br />

from the share premium account, whereby<br />

the share capital is now EUR 217 million.<br />

PURCHASE OF OWN SHARES<br />

On 7 April <strong>1999</strong>, the <strong>Annual</strong> General Meeting<br />

passed a resolution to authorize the<br />

company’s Board of Directors to purchase<br />

a maximum of 2,576,000 of the company’s<br />

own shares on the market in order to create<br />

a share-tied incentive system for the<br />

company’s personnel. The authorization is<br />

valid for one year from the date of the <strong>Annual</strong><br />

General Meeting. During June 15 to<br />

August 13 <strong>Kemira</strong> Oyj purchased 1,000,000<br />

of its own shares at an average price of<br />

EUR 5.82. The shares are at present in the<br />

company’s ownership but they will be sold<br />

on to the personnel funds operating within<br />

the company.<br />

INSIDER RULES<br />

In accordance with the decision of the<br />

Board of Directors of <strong>Kemira</strong> Oyj, the<br />

<strong>Kemira</strong> Group has placed in use insider<br />

rules pursuant to the Guidelines for Insiders<br />

issued by Helsinki Exchanges on<br />

28 October <strong>1999</strong>. A list of insiders including<br />

their shareholdings is given on page<br />

66 of the <strong>Annual</strong> <strong>Report</strong>.<br />

LISTING AND SHARE TRADING<br />

<strong>Kemira</strong> Oyj’s shares have been listed on<br />

Helsinki Exchanges since 10 November<br />

1994. In addition to Helsinki, trading in<br />

the shares is done through the SEAQ International<br />

trading system operated by<br />

the London Stock Exchange. <strong>Kemira</strong> is<br />

also part of the PORTAL system in the<br />

United States. In the United States,<br />

<strong>Kemira</strong>’s shares were issued under Regulation<br />

144A, whereby only qualified institutional<br />

buyers permitted under this legislation<br />

are allowed to buy and sell the<br />

shares. <strong>Kemira</strong>’s shares can also be traded<br />

in the United States in the form of<br />

ADS shares. One ADS share corresponds<br />

to two <strong>Kemira</strong> shares.<br />

PRICE AND TRADING VOLUME<br />

The price of <strong>Kemira</strong>’s share on Helsinki<br />

Exchanges weakened by 2.1% on Helsinki<br />

Exchanges during <strong>1999</strong>, whereas the<br />

HEX index rose by 162%. The highest<br />

price of the share was EUR 6.90 and the<br />

lowest price was EUR 5.20. The price of<br />

the share at the end of the year was EUR<br />

6.11. The taxation value of the share in<br />

<strong>1999</strong> was EUR 4.309. Turnover of the<br />

share on Helsinki Exchanges totalled<br />

20,702,853 shares, and in euro terms the<br />

turnover was EUR 121 million. The market<br />

capitalization at the end of <strong>1999</strong> was<br />

EUR 781 million.<br />

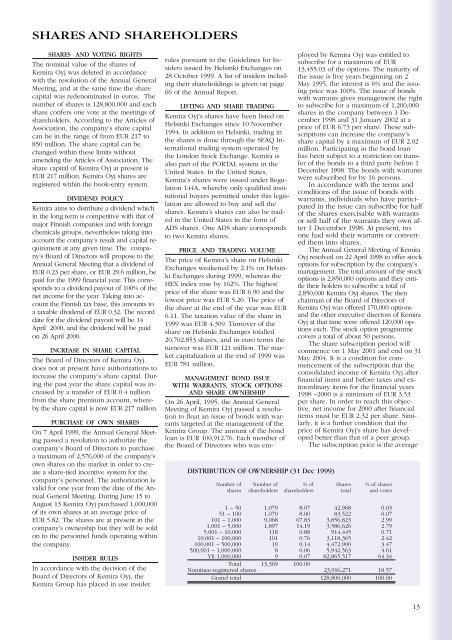

DISTRIBUTION OF OWNERSHIP (31 Dec <strong>1999</strong>)<br />

MANAGEMENT BOND ISSUE<br />

WITH WARRANTS, STOCK OPTIONS<br />

AND SHARE OWNERSHIP<br />

On 26 April, 1995, the <strong>Annual</strong> General<br />

Meeting of <strong>Kemira</strong> Oyj passed a resolution<br />

to float an issue of bonds with warrants<br />

targeted at the management of the<br />

<strong>Kemira</strong> Group. The amount of the bond<br />

loan is EUR 100,912.76. Each member of<br />

the Board of Directors who was employed<br />

by <strong>Kemira</strong> Oyj was entitled to<br />

subscribe for a maximum of EUR<br />

13,455.03 of the options. The maturity of<br />

the issue is five years beginning on 2<br />

May 1995, the interest is 6% and the issuing<br />

price was 100%. The issue of bonds<br />

with warrants gives management the right<br />

to subscribe for a maximum of 1,200,000<br />

shares in the company between 1 December<br />

1998 and 31 January 2002 at a<br />

price of EUR 6.73 per share. These subscriptions<br />

can increase the company’s<br />

share capital by a maximum of EUR 2.02<br />

million. Participating in the bond loan<br />

has been subject to a restriction on transfer<br />

of the bonds to a third party before 1<br />

December 1998. The bonds with warrants<br />

were subscribed for by 16 persons.<br />

In accordance with the terms and<br />

conditions of the issue of bonds with<br />

warrants, individuals who have participated<br />

in the issue can subscribe for half<br />

of the shares exercisable with warrants<br />

or sell half of the warrants they own after<br />

1 December 1998. At present, no<br />

one had sold their warrants or converted<br />

them into shares.<br />

The <strong>Annual</strong> General Meeting of <strong>Kemira</strong><br />

Oyj resolved on 22 April 1998 to offer stock<br />

options for subscription by the company’s<br />

management. The total amount of the stock<br />

options is 2,850,000 options and they entitle<br />

their holders to subscribe a total of<br />

2,850,000 <strong>Kemira</strong> Oyj shares. The then<br />

chairman of the Board of Directors of<br />

<strong>Kemira</strong> Oyj was offered 170,000 options<br />

and the other executive directors of <strong>Kemira</strong><br />

Oyj at that time were offered 120,000 options<br />

each. The stock option programme<br />

covers a total of about 50 persons.<br />

The share subscription period will<br />

commence on 1 May 2001 and end on 31<br />

May 2004. It is a condition for commencement<br />

of the subscription that the<br />

consolidated income of <strong>Kemira</strong> Oyj after<br />

financial items and before taxes and extraordinary<br />

items for the financial years<br />

1998 –2000 is a minimum of EUR 3.53<br />

per share. In order to reach this objective,<br />

net income for 2000 after financial<br />

items must be EUR 2.32 per share. Similarly,<br />

it is a further condition that the<br />

price of <strong>Kemira</strong> Oyj’s share has developed<br />

better than that of a peer group.<br />

The subscription price is the average<br />

Number of Number of % of Shares % of shares<br />

shares shareholders shareholders total and votes<br />

1 – 50 1,079 8.07 42,968 0.03<br />

51 – 100 1,070 8.00 83,522 0.07<br />

101 – 1,000 9,068 67.83 3,856,823 2.99<br />

1,001 – 5,000 1,897 14.19 3,586,626 2.79<br />

5,001 – 10,000 118 0.88 914,445 0.71<br />

10,001 – 100,000 101 0.76 3,118,365 2.42<br />

100,001 – 500,000 19 0.14 4,472,900 3.47<br />

500,001 – 1,000,000 8 0.06 5,942,563 4.61<br />

Yli 1,000,000 9 0.07 82,865,517 64.34<br />

Total 13,369 100.00<br />

Nominee-registered shares 23,916,271 18.57<br />

Grand total 128,800,000 100.00<br />

13