Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

KEMIRA CHEMICALS<br />

EUR<br />

million<br />

800<br />

600<br />

400<br />

200<br />

0<br />

MANAGEMENT<br />

President: Yrjö Sipilä<br />

Pulp & Paper Chemicals:<br />

Juhani Lindholm<br />

Kemwater: Lennart Johansson<br />

Industrial Chemicals:<br />

Harri Kerminen<br />

Yrjö<br />

Sipilä<br />

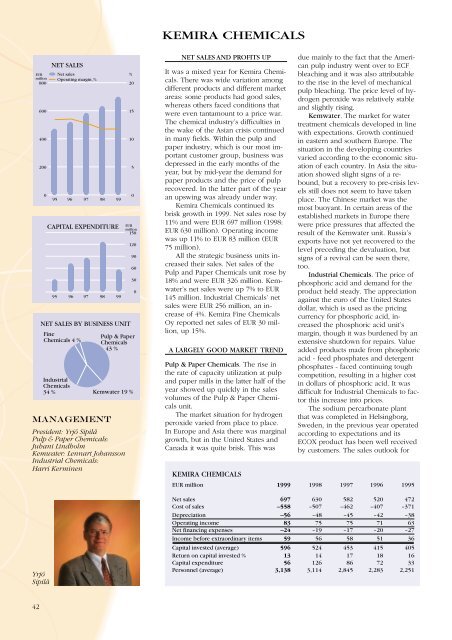

NET SALES<br />

Net sales<br />

Operating margin, %<br />

95 96 97 98 99<br />

CAPITAL EXPENDITURE<br />

95 96 97 98 99<br />

NET SALES BY BUSINESS UNIT<br />

Fine<br />

Chemicals 4 %<br />

Industrial<br />

Chemicals<br />

34 %<br />

%<br />

20<br />

15<br />

10<br />

5<br />

0<br />

EUR<br />

million<br />

150<br />

120<br />

90<br />

60<br />

30<br />

Pulp & Paper<br />

Chemicals<br />

43 %<br />

Kemwater 19 %<br />

0<br />

NET SALES AND PROFITS UP<br />

It was a mixed year for <strong>Kemira</strong> Chemicals.<br />

There was wide variation among<br />

different products and different market<br />

areas: some products had good sales,<br />

whereas others faced conditions that<br />

were even tantamount to a price war.<br />

The chemical industry’s difficulties in<br />

the wake of the Asian crisis continued<br />

in many fields. Within the pulp and<br />

paper industry, which is our most important<br />

customer group, business was<br />

depressed in the early months of the<br />

year, but by mid-year the demand for<br />

paper products and the price of pulp<br />

recovered. In the latter part of the year<br />

an upswing was already under way.<br />

<strong>Kemira</strong> Chemicals continued its<br />

brisk growth in <strong>1999</strong>. Net sales rose by<br />

11% and were EUR 697 million (1998:<br />

EUR 630 million). Operating income<br />

was up 11% to EUR 83 million (EUR<br />

75 million).<br />

All the strategic business units increased<br />

their sales. Net sales of the<br />

Pulp and Paper Chemicals unit rose by<br />

18% and were EUR 326 million. Kemwater’s<br />

net sales were up 7% to EUR<br />

145 million. Industrial Chemicals’ net<br />

sales were EUR 256 million, an increase<br />

of 4%. <strong>Kemira</strong> Fine Chemicals<br />

Oy reported net sales of EUR 30 million,<br />

up 15%.<br />

A LARGELY GOOD MARKET TREND<br />

Pulp & Paper Chemicals. The rise in<br />

the rate of capacity utilization at pulp<br />

and paper mills in the latter half of the<br />

year showed up quickly in the sales<br />

volumes of the Pulp & Paper Chemicals<br />

unit.<br />

The market situation for hydrogen<br />

peroxide varied from place to place.<br />

In Europe and Asia there was marginal<br />

growth, but in the United States and<br />

Canada it was quite brisk. This was<br />

due mainly to the fact that the American<br />

pulp industry went over to ECF<br />

bleaching and it was also attributable<br />

to the rise in the level of mechanical<br />

pulp bleaching. The price level of hydrogen<br />

peroxide was relatively stable<br />

and slightly rising.<br />

Kemwater. The market for water<br />

treatment chemicals developed in line<br />

with expectations. Growth continued<br />

in eastern and southern Europe. The<br />

situation in the developing countries<br />

varied according to the economic situation<br />

of each country. In Asia the situation<br />

showed slight signs of a rebound,<br />

but a recovery to pre-crisis levels<br />

still does not seem to have taken<br />

place. The Chinese market was the<br />

most buoyant. In certain areas of the<br />

established markets in Europe there<br />

were price pressures that affected the<br />

result of the Kemwater unit. Russia’s<br />

exports have not yet recovered to the<br />

level preceding the devaluation, but<br />

signs of a revival can be seen there,<br />

too.<br />

Industrial Chemicals. The price of<br />

phosphoric acid and demand for the<br />

product held steady. The appreciation<br />

against the euro of the United States<br />

dollar, which is used as the pricing<br />

currency for phosphoric acid, increased<br />

the phosphoric acid unit’s<br />

margin, though it was burdened by an<br />

extensive shutdown for repairs. Value<br />

added products made from phosphoric<br />

acid - feed phosphates and detergent<br />

phosphates - faced continuing tough<br />

competition, resulting in a higher cost<br />

in dollars of phosphoric acid. It was<br />

difficult for Industrial Chemicals to factor<br />

this increase into prices.<br />

The sodium percarbonate plant<br />

that was completed in Helsingborg,<br />

Sweden, in the previous year operated<br />

according to expectations and its<br />

ECOX product has been well received<br />

by customers. The sales outlook for<br />

KEMIRA CHEMICALS<br />

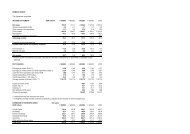

EUR million <strong>1999</strong> 1998 1997 1996 1995<br />

Net sales 697 630 582 520 472<br />

Cost of sales –558 –507 –462 –407 –371<br />

Depreciation –56 –48 –45 –42 –38<br />

Operating income 83 75 75 71 63<br />

Net financing expenses –24 –19 –17 –20 –27<br />

Income before extraordinary items 59 56 58 51 36<br />

Capital invested (average) 596 524 453 415 405<br />

Return on capital invested % 13 14 17 18 16<br />

Capital expenditure 56 126 86 72 33<br />

Personnel (average) 3,138 3,114 2,845 2,283 2,251<br />

42