Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

KEMIRA AGRO<br />

EUR<br />

million<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

MANAGEMENT<br />

President: Risto Keränen<br />

Vice President:<br />

Rauno Valkonen<br />

Agriculture: Timo Lainto<br />

Horticulture: Hannu Virolainen<br />

Process Chemicals: R.A. Chorlton<br />

Risto<br />

Keränen<br />

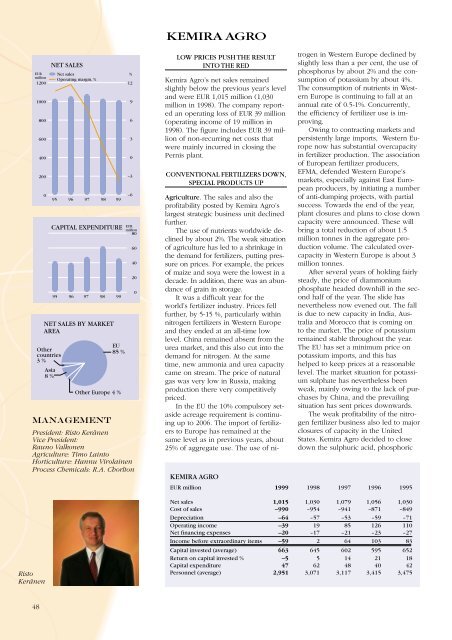

NET SALES<br />

Net sales<br />

Operating margin, %<br />

95 96 97 98 99<br />

CAPITAL EXPENDITURE<br />

95 96 97 98 99<br />

NET SALES BY MARKET<br />

AREA<br />

Other<br />

countries<br />

3 %<br />

Asia<br />

8 %<br />

EU<br />

85 %<br />

Other Europe 4 %<br />

%<br />

12<br />

9<br />

6<br />

3<br />

0<br />

–3<br />

–6<br />

EUR<br />

million<br />

80<br />

60<br />

40<br />

20<br />

0<br />

LOW PRICES PUSH THE RESULT<br />

INTO THE RED<br />

<strong>Kemira</strong> Agro’s net sales remained<br />

slightly below the previous year’s level<br />

and were EUR 1,015 million (1,030<br />

million in 1998). The company reported<br />

an operating loss of EUR 39 million<br />

(operating income of 19 million in<br />

1998). The figure includes EUR 39 million<br />

of non-recurring net costs that<br />

were mainly incurred in closing the<br />

Pernis plant.<br />

CONVENTIONAL FERTILIZERS DOWN,<br />

SPECIAL PRODUCTS UP<br />

Agriculture. The sales and also the<br />

profitability posted by <strong>Kemira</strong> Agro’s<br />

largest strategic business unit declined<br />

further.<br />

The use of nutrients worldwide declined<br />

by about 2%. The weak situation<br />

of agriculture has led to a shrinkage in<br />

the demand for fertilizers, putting pressure<br />

on prices. For example, the prices<br />

of maize and soya were the lowest in a<br />

decade. In addition, there was an abundance<br />

of grain in storage.<br />

It was a difficult year for the<br />

world’s fertilizer industry. Prices fell<br />

further, by 5-15 %, particularly within<br />

nitrogen fertilizers in Western Europe<br />

and they ended at an all-time low<br />

level. China remained absent from the<br />

urea market, and this also cut into the<br />

demand for nitrogen. At the same<br />

time, new ammonia and urea capacity<br />

came on stream. The price of natural<br />

gas was very low in Russia, making<br />

production there very competitively<br />

priced.<br />

In the EU the 10% compulsory setaside<br />

acreage requirement is continuing<br />

up to 2006. The import of fertilizers<br />

to Europe has remained at the<br />

same level as in previous years, about<br />

25% of aggregate use. The use of nitrogen<br />

in Western Europe declined by<br />

slightly less than a per cent, the use of<br />

phosphorus by about 2% and the consumption<br />

of potassium by about 4%.<br />

The consumption of nutrients in Western<br />

Europe is continuing to fall at an<br />

annual rate of 0.5-1%. Concurrently,<br />

the efficiency of fertilizer use is improving.<br />

Owing to contracting markets and<br />

persistently large imports, Western Europe<br />

now has substantial overcapacity<br />

in fertilizer production. The association<br />

of European fertilizer producers,<br />

EFMA, defended Western Europe’s<br />

markets, especially against East European<br />

producers, by initiating a number<br />

of anti-dumping projects, with partial<br />

success. Towards the end of the year,<br />

plant closures and plans to close down<br />

capacity were announced. These will<br />

bring a total reduction of about 1.5<br />

million tonnes in the aggregate production<br />

volume. The calculated overcapacity<br />

in Western Europe is about 3<br />

million tonnes.<br />

After several years of holding fairly<br />

steady, the price of diammonium<br />

phosphate headed downhill in the second<br />

half of the year. The slide has<br />

nevertheless now evened out. The fall<br />

is due to new capacity in India, Australia<br />

and Morocco that is coming on<br />

to the market. The price of potassium<br />

remained stable throughout the year.<br />

The EU has set a minimum price on<br />

potassium imports, and this has<br />

helped to keep prices at a reasonable<br />

level. The market situation for potassium<br />

sulphate has nevertheless been<br />

weak, mainly owing to the lack of purchases<br />

by China, and the prevailing<br />

situation has sent prices downwards.<br />

The weak profitability of the nitrogen<br />

fertilizer business also led to major<br />

closures of capacity in the United<br />

States. <strong>Kemira</strong> Agro decided to close<br />

down the sulphuric acid, phosphoric<br />

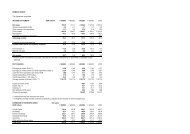

KEMIRA AGRO<br />

EUR million <strong>1999</strong> 1998 1997 1996 1995<br />

Net sales 1,015 1,030 1,079 1,056 1,030<br />

Cost of sales –990 –954 –941 –871 –849<br />

Depreciation –64 –57 –53 –59 –71<br />

Operating income –39 19 85 126 110<br />

Net financing expenses –20 –17 –21 –23 –27<br />

Income before extraordinary items –59 2 64 103 83<br />

Capital invested (average) 663 645 602 595 652<br />

Return on capital invested % –5 5 14 21 18<br />

Capital expenditure 47 62 48 40 42<br />

Personnel (average) 2,951 3,071 3,117 3,415 3,475<br />

48