Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

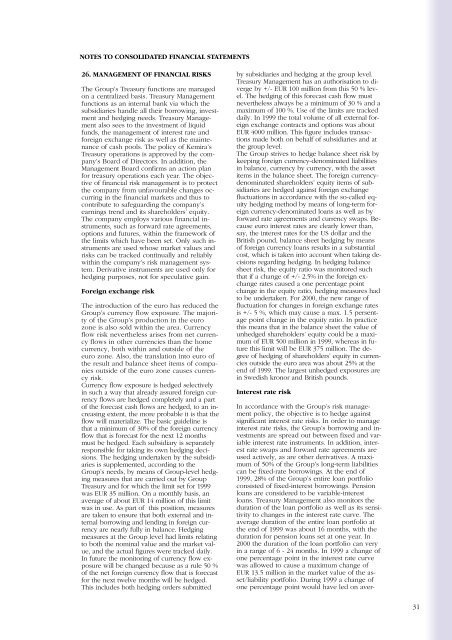

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

26. MANAGEMENT OF FINANCIAL RISKS<br />

The Group’s Treasury functions are managed<br />

on a centralized basis. Treasury Management<br />

functions as an internal bank via which the<br />

subsidiaries handle all their borrowing, investment<br />

and hedging needs. Treasury Management<br />

also sees to the investment of liquid<br />

funds, the management of interest rate and<br />

foreign exchange risk as well as the maintenance<br />

of cash pools. The policy of <strong>Kemira</strong>’s<br />

Treasury operations is approved by the company’s<br />

Board of Directors. In addition, the<br />

Management Board confirms an action plan<br />

for treasury operations each year. The objective<br />

of financial risk management is to protect<br />

the company from unfavourable changes occurring<br />

in the financial markets and thus to<br />

contribute to safeguarding the company’s<br />

earnings trend and its shareholders’ equity.<br />

The company employs various financial instruments,<br />

such as forward rate agreements,<br />

options and futures, within the framework of<br />

the limits which have been set. Only such instruments<br />

are used whose market values and<br />

risks can be tracked continually and reliably<br />

within the company’s risk management system.<br />

Derivative instruments are used only for<br />

hedging purposes, not for speculative gain.<br />

Foreign exchange risk<br />

The introduction of the euro has reduced the<br />

Group’s currency flow exposure. The majority<br />

of the Group’s production in the euro<br />

zone is also sold within the area. Currency<br />

flow risk nevertheless arises from net currency<br />

flows in other currencies than the home<br />

currency, both within and outside of the<br />

euro zone. Also, the translation into euro of<br />

the result and balance sheet items of companies<br />

outside of the euro zone causes currency<br />

risk.<br />

Currency flow exposure is hedged selectively<br />

in such a way that already assured foreign currency<br />

flows are hedged completely and a part<br />

of the forecast cash flows are hedged, to an increasing<br />

extent, the more probable it is that the<br />

flow will materialize. The basic guideline is<br />

that a minimum of 30% of the foreign currency<br />

flow that is forecast for the next 12 months<br />

must be hedged. Each subsidiary is separately<br />

responsible for taking its own hedging decisions.<br />

The hedging undertaken by the subsidiaries<br />

is supplemented, according to the<br />

Group’s needs, by means of Group-level hedging<br />

measures that are carried out by Group<br />

Treasury and for which the limit set for <strong>1999</strong><br />

was EUR 35 million. On a monthly basis, an<br />

average of about EUR 14 million of this limit<br />

was in use. As part of this position, measures<br />

are taken to ensure that both external and internal<br />

borrowing and lending in foreign currency<br />

are nearly fully in balance. Hedging<br />

measures at the Group level had limits relating<br />

to both the nominal value and the market value,<br />

and the actual figures were tracked daily.<br />

In future the monitoring of currency flow exposure<br />

will be changed because as a rule 50 %<br />

of the net foreign currency flow that is forecast<br />

for the next twelve months will be hedged.<br />

This includes both hedging orders submitted<br />

by subsidiaries and hedging at the group level.<br />

Treasury Management has an authorisation to diverge<br />

by +/- EUR 100 million from this 50 % level.<br />

The hedging of this forecast cash flow must<br />

nevertheless always be a minimum of 30 % and a<br />

maximum of 100 %. Use of the limits are tracked<br />

daily. In <strong>1999</strong> the total volume of all external foreign<br />

exchange contracts and options was about<br />

EUR 4000 million. This figure includes transactions<br />

made both on behalf of subsidiaries and at<br />

the group level.<br />

The Group strives to hedge balance sheet risk by<br />

keeping foreign currency-denominated liabilities<br />

in balance, currency by currency, with the asset<br />

items in the balance sheet. The foreign currencydenominated<br />

shareholders’ equity items of subsidiaries<br />

are hedged against foreign exchange<br />

fluctuations in accordance with the so-called equity<br />

hedging method by means of long-term foreign<br />

currency-denominated loans as well as by<br />

forward rate agreements and currency swaps. Because<br />

euro interest rates are clearly lower than,<br />

say, the interest rates for the US dollar and the<br />

British pound, balance sheet hedging by means<br />

of foreign currency loans results in a substantial<br />

cost, which is taken into account when taking decisions<br />

regarding hedging. In hedging balance<br />

sheet risk, the equity ratio was monitored such<br />

that if a change of +/- 2.5% in the foreign exchange<br />

rates caused a one percentage point<br />

change in the equity ratio, hedging measures had<br />

to be undertaken. For 2000, the new range of<br />

fluctuation for changes in foreign exchange rates<br />

is +/- 5 %, which may cause a max. 1.5 persentage<br />

point change in the equity ratio. In practice<br />

this means that in the balance sheet the value of<br />

unhedged shareholders’ equity could be a maximum<br />

of EUR 500 million in <strong>1999</strong>, whereas in future<br />

this limit will be EUR 375 million. The degree<br />

of hedging of shareholders’ equity in currencies<br />

outside the euro area was about 25% at the<br />

end of <strong>1999</strong>. The largest unhedged exposures are<br />

in Swedish kronor and British pounds.<br />

Interest rate risk<br />

In accordance with the Group’s risk management<br />

policy, the objective is to hedge against<br />

significant interest rate risks. In order to manage<br />

interest rate risks, the Group’s borrowing and investments<br />

are spread out between fixed and variable<br />

interest rate instruments. In addition, interest<br />

rate swaps and forward rate agreements are<br />

used actively, as are other derivatives. A maximum<br />

of 50% of the Group’s long-term liabilities<br />

can be fixed-rate borrowings. At the end of<br />

<strong>1999</strong>, 28% of the Group’s entire loan portfolio<br />

consisted of fixed-interest borrowings. Pension<br />

loans are considered to be variable-interest<br />

loans. Treasury Management also monitors the<br />

duration of the loan portfolio as well as its sensitivity<br />

to changes in the interest rate curve. The<br />

average duration of the entire loan portfolio at<br />

the end of <strong>1999</strong> was about 16 months, with the<br />

duration for pension loans set at one year. In<br />

2000 the duration of the loan portfolio can very<br />

in a range of 6 - 24 months. In <strong>1999</strong> a change of<br />

one percentage point in the interest rate curve<br />

was allowed to cause a maximum change of<br />

EUR 13.5 million in the market value of the asset/liability<br />

portfolio. During <strong>1999</strong> a change of<br />

one percentage point would have led on aver-<br />

31