Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

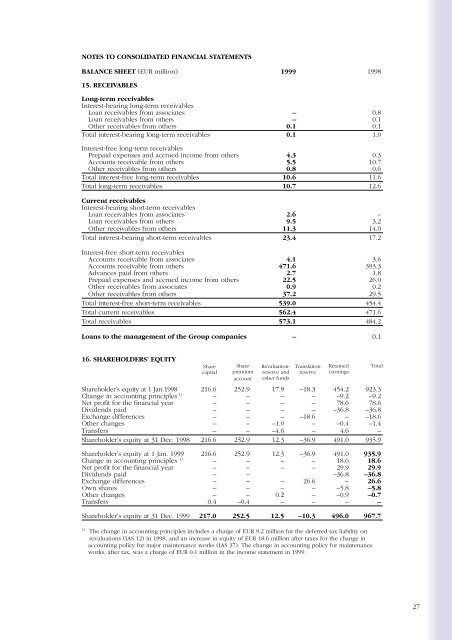

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

BALANCE SHEET (EUR million) <strong>1999</strong> 1998<br />

15. RECEIVABLES<br />

Long-term receivables<br />

Interest-bearing long-term receivables<br />

Loan receivables from associates – 0.8<br />

Loan receivables from others – 0.1<br />

Other receivables from others 0.1 0.1<br />

Total interest-bearing long-term receivables 0.1 1.0<br />

Interest-free long-term receivables<br />

Prepaid expenses and accrued income from others 4.3 0.3<br />

Accounts receivable from others 5.5 10.7<br />

Other receivables from others 0.8 0.6<br />

Total interest-free long-term receivables 10.6 11.6<br />

Total long-term receivables 10.7 12.6<br />

Current receivables<br />

Interest-bearing short-term receivables<br />

Loan receivables from associates 2.6 –<br />

Loan receivables from others 9.5 3.2<br />

Other receivables from others 11.3 14.0<br />

Total interest-bearing short-term receivables 23.4 17.2<br />

Interest-free short-term receivables<br />

Accounts receivable from associates 4.1 3.6<br />

Accounts receivable from others 471.6 393.3<br />

Advances paid from others 2.7 1.8<br />

Prepaid expenses and accrued income from others 22.5 26.0<br />

Other receivables from associates 0.9 0.2<br />

Other receivables from others 37.2 29.5<br />

Total interest-free short-term receivables 539.0 454.4<br />

Total current receivables 562.4 471.6<br />

Total receivables 573.1 484.2<br />

Loans to the management of the Group companies – 0.1<br />

16. SHAREHOLDERS’ EQUITY<br />

Share<br />

capital<br />

Share<br />

premium<br />

account<br />

Revaluationreserve<br />

and<br />

other funds<br />

Translation<br />

reserve<br />

Retained<br />

earnings<br />

Shareholder’s equity at 1 Jan.1998 216.6 252.9 17.9 –18.3 454.2 923.3<br />

Change in accounting principles 1) – – – – –9.2 –9.2<br />

Net profit for the financial year – – – – 78.6 78.6<br />

Dividends paid – – – – –36.8 –36.8<br />

Exchange differences – – – –18.6 – –18.6<br />

Other changes – – –1.0 – –0.4 –1.4<br />

Transfers – – –4.6 – 4.6 –<br />

Shareholder’s equity at 31 Dec. 1998 216.6 252.9 12.3 –36.9 491.0 935.9<br />

Shareholder’s equity at 1 Jan. <strong>1999</strong> 216.6 252.9 12.3 –36.9 491.0 935.9<br />

Change in accounting principles 1) – – – – 18.6 18.6<br />

Net profit for the financial year – – – – 29.9 29.9<br />

Dividends paid – – –36.8 –36.8<br />

Exchange differences – – – 26.6 – 26.6<br />

Own shares – – – – –5.8 –5.8<br />

Other changes – – 0.2 – –0.9 –0.7<br />

Transfers 0.4 –0.4 – – – –<br />

Shareholder’s equity at 31 Dec. <strong>1999</strong> 217.0 252.5 12.5 –10.3 496.0 967.7<br />

1)<br />

The change in accounting principles includes a charge of EUR 9.2 million for the deferred tax liability on<br />

revaluations (IAS 12) in 1998, and an increase in equity of EUR 18.6 million after taxes for the change in<br />

accounting policy for major maintenance works (IAS 37). The change in accounting policy for maintenance<br />

works, after tax, was a charge of EUR 0.1 million in the income statement in <strong>1999</strong>.<br />

Total<br />

27