Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

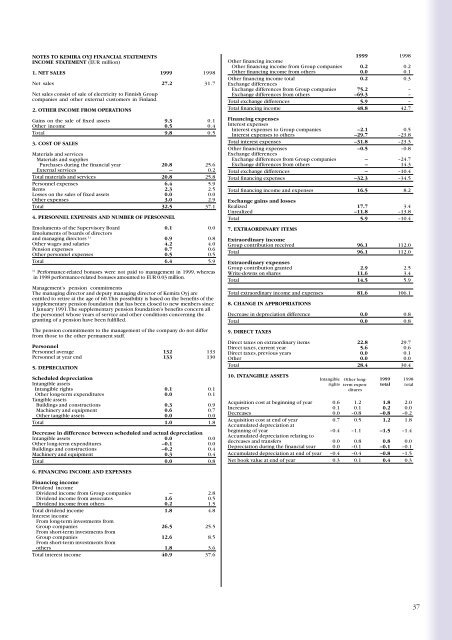

NOTES TO KEMIRA OYJ FINANCIAL STATEMENTS<br />

INCOME STATEMENT (EUR million)<br />

1. NET SALES <strong>1999</strong> 1998<br />

Net sales 27.2 31.7<br />

Net sales consist of sale of electricity to Finnish Group<br />

companies and other external customers in Finland.<br />

2. OTHER INCOME FROM OPERATIONS<br />

Gains on the sale of fixed assets 9.3 0.1<br />

Other income 0.5 0.4<br />

Total 9.8 0.5<br />

3. COST OF SALES<br />

Materials and services<br />

Materials and supplies<br />

Purchases during the financial year 20.8 25.6<br />

External services – 0.2<br />

Total materials and services 20.8 25.8<br />

Personnel expenses 6.4 5.9<br />

Rents 2.3 2.5<br />

Losses on the sales of fixed assets 0.0 0.0<br />

Other expenses 3.0 2.9<br />

Total 32.5 37.1<br />

4. PERSONNEL EXPENSES AND NUMBER OF PERSONNEL<br />

Emoluments of the Supervisory Board 0.1 0.0<br />

Emoluments of boards of directors<br />

and managing directors 1) 0.9 0.8<br />

Other wages and salaries 4.2 4.0<br />

Pension expenses 0.7 0.6<br />

Other personnel expenses 0.5 0.5<br />

Total 6.4 5.9<br />

1)<br />

Performance-related bonuses were not paid to management in <strong>1999</strong>, whereas<br />

in 1998 performance-related bonuses amounted to EUR 0.03 million.<br />

Management’s pension commitments<br />

The managing director and deputy managing director of <strong>Kemira</strong> Oyj are<br />

entitled to retire at the age of 60. This possibility is based on the benefits of the<br />

supplementary pension foundation that has been closed to new menbers since<br />

1 January 1991. The supplementary pension foundation’s benefits concern all<br />

the personnel whose years of service and other conditions concerning the<br />

granting of a pension have been fulfilled.<br />

The pension commitments to the management of the company do not differ<br />

from those to the other permanent staff.<br />

Personnel<br />

Personnel average 132 133<br />

Personnel at year end 133 130<br />

5. DEPRECIATION<br />

Scheduled depreciation<br />

Intangible assets<br />

Intangible rights 0.1 0.1<br />

Other long-term expenditures 0.0 0.1<br />

Tangible assets<br />

Buildings and constructions 0.3 0.9<br />

Machinery and equipment 0.6 0.7<br />

Other tangible assets 0.0 0.0<br />

Total 1.0 1.8<br />

Decrease in difference between scheduled and actual depreciation<br />

Intangible assets 0.0 0.0<br />

Other long-term expenditures –0.1 0.0<br />

Buildings and constructions –0.2 0.4<br />

Machinery and equipment 0.3 0.4<br />

Total 0.0 0.8<br />

6. FINANCING INCOME AND EXPENSES<br />

Financing income<br />

Dividend income<br />

Dividend income from Group companies – 2.8<br />

Dividend income from associates 1.6 0.5<br />

Dividend income from others 0.2 1.5<br />

Total dividend income 1.8 4.8<br />

Interest income<br />

From long-term investments from<br />

Group companies 26.5 25.5<br />

From short-term investments from<br />

Group companies 12.6 8.5<br />

From short-term investments from<br />

others 1.8 3.6<br />

Total interest income 40.9 37.6<br />

<strong>1999</strong> 1998<br />

Other financing income<br />

Other financing income from Group companies 0.2 0.2<br />

Other financing income from others 0.0 0.1<br />

Other financing income total 0.2 0.3<br />

Exchange differences<br />

Exchange differences from Group companies 75.2 –<br />

Exchange differences from others –69.3 –<br />

Total exchange differences 5.9 –<br />

Total financing income 48.8 42.7<br />

Financing expenses<br />

Interest expenses<br />

Interest expenses to Group companies –2.1 0.5<br />

Interest expenses to others –29.7 –23.8<br />

Total interest expenses –31.8 –23.3<br />

Other financing expenses –0.5 –0.8<br />

Exchange differences<br />

Exchange differences from Group companies – –24.7<br />

Exchange differences from others – 14.3<br />

Total exchange differences – –10.4<br />

Total financing expenses –32.3 –34.5<br />

Total financing income and expenses 16.5 8.2<br />

Exchange gains and losses<br />

Realized 17.7 3.4<br />

Unrealized –11.8 –13.8<br />

Total 5.9 –10.4<br />

7. EXTRAORDINARY ITEMS<br />

Extraordinary income<br />

Group contribution received 96.1 112.0<br />

Total 96.1 112.0<br />

Extraordinary expenses<br />

Group contribution granted 2.9 2.5<br />

Write-downs on shares 11.6 3.4<br />

Total 14.5 5.9<br />

Total extraordinary income and expenses 81.6 106.1<br />

8. CHANGE IN APPROPRIATIONS<br />

Decrease in depreciation difference 0.0 0.8<br />

Total 0.0 0.8<br />

9. DIRECT TAXES<br />

Direct taxes on extraordinary items 22.8 29.7<br />

Direct taxes, current year 5.6 0.6<br />

Direct taxes, previous years 0.0 0.1<br />

Other 0.0 0.0<br />

Total 28.4 30.4<br />

10. INTANGIBLE ASSETS<br />

Intangible Other longterm<br />

<strong>1999</strong> 1998<br />

rights<br />

expen-<br />

total total<br />

ditures<br />

Acquisition cost at beginning of year 0.6 1.2 1.8 2.0<br />

Increases 0.1 0.1 0.2 0.0<br />

Decreases 0.0 –0.8 –0.8 –0.2<br />

Acquisition cost at end of year 0.7 0.5 1.2 1.8<br />

Accumulated depreciation at<br />

beginning of year –0.4 –1.1 –1.5 –1.4<br />

Accumulated depreciation relating to<br />

decreases and transfers 0.0 0.8 0.8 0.0<br />

Depreciation during the financial year 0.0 –0.1 –0.1 –0.1<br />

Accumulated depreciation at end of year –0.4 –0.4 –0.8 –1.5<br />

Net book value at end of year 0.3 0.1 0.4 0.3<br />

37