Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

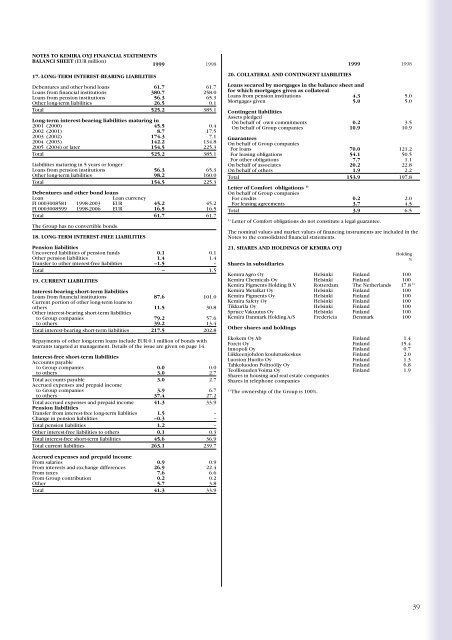

NOTES TO KEMIRA OYJ FINANCIAL STATEMENTS<br />

BALANCI SHEET (EUR million)<br />

<strong>1999</strong> 1998<br />

17. LONG-TERM INTEREST-BEARING LIABILITIES<br />

Debentures and other bond loans 61.7 61.7<br />

Loans from financial institutions 380.7 258.0<br />

Loans from pension institutions 56.3 65.3<br />

Other long-term liabilities 26.5 0.1<br />

Total 525.2 385.1<br />

Long-term interest-bearing liabilities maturing in<br />

2001 (2000) 45.5 0.4<br />

2002 (2001) 8.7 17.5<br />

2003 (2002) 174.3 7.1<br />

2004 (2003) 142.2 134.8<br />

2005 (2004) or later 154.5 225.3<br />

Total 525.2 385.1<br />

Liabilities maturing in 5 years or longer<br />

Loans from pension institutions 56.3 65.3<br />

Other long-term liabilities 98.2 160.0<br />

Total 154.5 225.3<br />

Debentures and other bond loans<br />

Loan<br />

Loan currency<br />

FI 0003008581 1998-2003 EUR 45.2 45.2<br />

FI 0003008599 1998-2006 EUR 16.5 16.5<br />

Total 61.7 61.7<br />

The Group has no convertible bonds.<br />

18. LONG-TERM INTEREST-FREE LIABILITIES<br />

Pension liabilities<br />

Uncovered liabilities of pension funds 0.1 0.1<br />

Other pension liabilities 1.4 1.4<br />

Transfer to other interest-free liabilities –1.5 –<br />

Total – 1.5<br />

19. CURRENT LIABILITIES<br />

Interest-bearing short-term liabilities<br />

Loans from financial institutions 87.6 101.0<br />

Current portion of other long-term loans to<br />

others 11.5 30.8<br />

Other interest-bearing short-term liabilities<br />

to Group companies 79.2 57.6<br />

to others 39.2 13.4<br />

Total interest-bearing short-term liabilities 217.5 202.8<br />

Repayments of other long-term loans include EUR 0.1 million of bonds with<br />

warrants targeted at management. Details of the issue are given on page 14.<br />

Interest-free short-term liabilities<br />

Accounts payable<br />

to Group companies 0.0 0.0<br />

to others 3.0 2.7<br />

Total accounts payable 3.0 2.7<br />

Accrued expenses and prepaid income<br />

to Group companies 3.9 6.7<br />

to others 37.4 27.2<br />

Total accrued expenses and prepaid income 41.3 33.9<br />

Pension liabilities<br />

Transfer from interest-free long-term liablities 1.5 –<br />

Change in pension liabilities –0.3 –<br />

Total pension liabilities 1.2 –<br />

Other interest-free liabilities to others 0.1 0.3<br />

Total interest-free short-term liabilities 45.6 36.9<br />

Total current liabilities 263.1 239.7<br />

<strong>1999</strong> 1998<br />

20. COLLATERAL AND CONTINGENT LIABILITIES<br />

Loans secured by mortgages in the balance sheet and<br />

for which mortgages given as collateral<br />

Loans from pension institutions 4.3 5.0<br />

Mortgages given 5.0 5.0<br />

Contingent liabilities<br />

Assets pledged<br />

On behalf of own commitments 0.2 3.5<br />

On behalf of Group companies 10.9 10.9<br />

Guarantees<br />

On behalf of Group companies<br />

For loans 70.0 121.2<br />

For leasing obligations 54.1 50.5<br />

For other obligations 7.7 1.1<br />

On behalf of associates 20.2 22.8<br />

On behalf of others 1.9 2.2<br />

Total 153.9 197.8<br />

Letter of Comfort obligations 1)<br />

On behalf of Group companies<br />

For credits 0.2 2.0<br />

For leasing agreements 3.7 4.5<br />

Total 3.9 6.5<br />

1)<br />

Letter of Comfort obligations do not constitute a legal guarantee.<br />

The nominal values and market values of financing instruments are included in the<br />

Notes to the consolidated financial statements.<br />

21. SHARES AND HOLDINGS OF KEMIRA OYJ<br />

Holding<br />

%<br />

Shares in subsidiaries<br />

<strong>Kemira</strong> Agro Oy Helsinki Finland 100<br />

<strong>Kemira</strong> Chemicals Oy Helsinki Finland 100<br />

<strong>Kemira</strong> Pigments Holding B.V. Rotterdam The Netherlands<br />

1)<br />

17.8<br />

<strong>Kemira</strong> Metalkat Oy Helsinki Finland 100<br />

<strong>Kemira</strong> Pigments Oy Helsinki Finland 100<br />

<strong>Kemira</strong> Safety Oy Helsinki Finland 100<br />

Tikkurila Oy Helsinki Finland 100<br />

Spruce Vakuutus Oy Helsinki Finland 100<br />

<strong>Kemira</strong> Danmark Holding A/S Fredericia Denmark 100<br />

Other shares and holdings<br />

Ekokem Oy Ab Finland 1.4<br />

Forcit Oy Finland 15.4<br />

Innopoli Oy Finland 0.7<br />

Liikkeenjohdon koulutuskeskus Finland 2.0<br />

Luoston Huolto Oy Finland 1.3<br />

Tahkoluodon Polttoöljy Oy Finland 6.8<br />

Teollisuuden Voima Oy Finland 1.9<br />

Shares in housing and real estate companies<br />

Shares in telephone companies<br />

1)<br />

The ownership of the Group is 100%.<br />

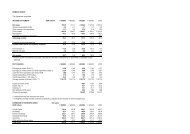

Accrued expenses and prepaid income<br />

From salaries 0.9 0.9<br />

From interests and exchange differences 26.9 22.4<br />

From taxes 7.6 6.6<br />

From Group contribution 0.2 0.2<br />

Other 5.7 3.8<br />

Total 41.3 33.9<br />

39