Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Annual Report 1999 - Kemira

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TIKKURILA<br />

Tikkurila’s net sales fell 1% short of the<br />

previous year’s figure and were EUR 357<br />

million (361 million in 1998). Sales of<br />

decorative paints in Finland were brisker<br />

than last year, whereas the economic crisis<br />

in Russia still kept sales volumes<br />

small. Worldwide sales of colorants grew<br />

further, but this was offset by the sales<br />

of tinting machines, which were markedly<br />

smaller than they were a year earlier.<br />

Operating income was EUR 23 million<br />

(33 million in 1998), or 6% of net<br />

sales. Operating income in the September-December<br />

period was EUR 1.6 million,<br />

compared with an operating loss of<br />

0.8 million in the same period a year<br />

earlier. Credit loss provisions primarily<br />

for receivables from Russia were booked<br />

in a total amount of EUR 3.1 million, of<br />

which about a quarter came in the last<br />

three-month period.<br />

The control system of Tikkurila’s<br />

Monicolor plant in Vantaa was renewed<br />

and at the same time production capacity<br />

was raised significantly. In the vicinity<br />

of Moscow, construction work got started<br />

on a second paint plant that Tikkurila<br />

will operate in Russia. The target is to<br />

start production in the first half of this<br />

year. Deliveries by the company’s plants<br />

in St Petersburg picked up towards the<br />

end of the year. In Western Europe testing<br />

of a new marketing concept was<br />

started during the year in co-operation<br />

with the Italian company Benetton.<br />

A colorant plant was completed in<br />

Singapore towards the end of the year.<br />

In China too a unit that will manufacture<br />

components for colour processing systems<br />

will be built.<br />

In line with the new strategic focus,<br />

the Group’s objective is to promote the<br />

growth potential of the paint business by<br />

divesting Tikkurila CPS either entirely or<br />

in part.<br />

KEMIRA AGRO<br />

<strong>Kemira</strong> Agro’s net sales declined by 2%<br />

and were EUR 1,015 million. The volume<br />

of sales in Western Europe was at<br />

the previous year’s level. Overseas exports<br />

outside Europe grew significantly,<br />

up 35% on the previous year. On the<br />

other hand, the plant nutrient markets in<br />

Finland’s nearby areas in the Baltic<br />

countries and Poland were in decline.<br />

Prices of plant nutrients fell further,<br />

by 5-15%, particularly within nitrogen<br />

fertilizers in Western Europe and they<br />

ended at an all-time low level. New capacity,<br />

the cost advantage which Russian<br />

nitrogen products enjoy owing to cheap<br />

natural gas, and China’s absence as a<br />

purchaser of nitrogen products have all<br />

been factors keeping prices of these<br />

products low. At present it nevertheless<br />

appears that prices bottomed out towards<br />

the end of the year. Owing to the<br />

risks posed by the East European countries<br />

and the Baltic area, credit loss provisions<br />

were increased by total of EUR 6<br />

million.<br />

The fall in the prices and sales volume<br />

of plant nutrients was reflected in<br />

the company’s operating income, which<br />

fell significantly and was a loss of EUR<br />

39 million. In the September-December<br />

period operating income was EUR 37<br />

million negative, whereas a year earlier<br />

it was EUR 19 million negative. Operating<br />

income in the last four months of the<br />

year includes a total of EUR 23 million<br />

of non-recurring costs that are mainly<br />

connected with the company’s structural<br />

change.<br />

In line with the Group’s strategic<br />

policy, <strong>Kemira</strong> Agro will focus on speciality<br />

fertilizers and withdraw from the nitrogen<br />

fertilizer business either in part or<br />

totally. In anticipation of this change, the<br />

company’s organization was divided into<br />

two parts in January 2000: the speciality<br />

fertilizer business and the nitrogen fertilizer<br />

business.<br />

NPK fertilizer production was wound<br />

up at Pernis in the Netherlands and<br />

plans call for also closing the phosphoric<br />

acid, sulphuric acid and MAP/DAP phosphorus<br />

fertilizer plants in the summer of<br />

this year. <strong>Kemira</strong> Agro booked a total of<br />

EUR 39 million of non-recurring costs for<br />

the past financial year, the bulk of which<br />

was related to the arrangements at<br />

Pernis.<br />

In accordance with the memorandum<br />

of intent that was signed in the previous<br />

year, <strong>Kemira</strong> Agro established a<br />

joint venture that will manufacture potassium<br />

nitrate, which is a speciality fertilizer,<br />

and dicalcium phosphate, a raw<br />

material used in feeds, in Jordan. The<br />

capital project, which is to be completed<br />

in 2002, is based on local raw materials<br />

and <strong>Kemira</strong>-developed cost-effective<br />

technology.<br />

In Italy, <strong>Kemira</strong> Agro acquired a 50%<br />

interest in Biolchim S.p.A, which markets<br />

horticultural fertilizers. A joint venture<br />

that will manufacture urea phosphate<br />

was established in the United Arab<br />

Emirates. The new company will build a<br />

new plant in Dubai with the objective of<br />

starting production by the end of 2000.<br />

The joint ventures in Dubai, Jordan<br />

and Italy will enable <strong>Kemira</strong> Agro to expand<br />

its operations, according to its specialization<br />

strategy, in the irrigation fertilizer<br />

markets in the Mediterranean countries<br />

as well as in the Middle East and<br />

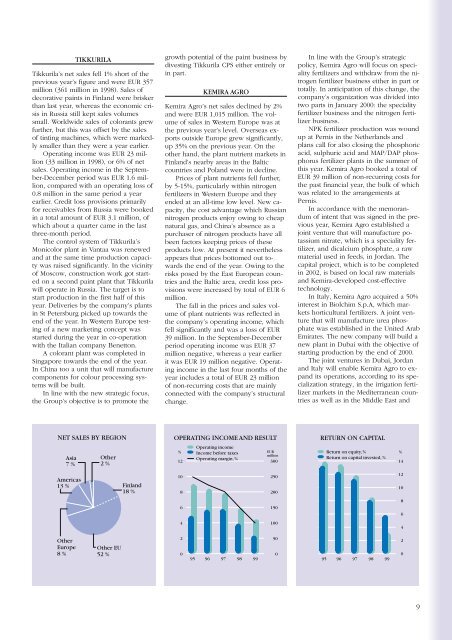

NET SALES BY REGION<br />

OPERATING INCOME AND RESULT<br />

RETURN ON CAPITAL<br />

Asia<br />

7 %<br />

Other<br />

2 %<br />

%<br />

12<br />

Operating income<br />

Income before taxes<br />

Operating margin, %<br />

EUR<br />

million<br />

300<br />

Return on equity, %<br />

Return on capital invested, %<br />

%<br />

14<br />

Americas<br />

13 % Finland<br />

18 %<br />

10<br />

8<br />

250<br />

200<br />

12<br />

10<br />

6<br />

150<br />

8<br />

6<br />

4<br />

100<br />

4<br />

Other<br />

Europe<br />

8 %<br />

Other EU<br />

52 %<br />

2<br />

0<br />

95 96 97 98 99<br />

50<br />

0<br />

95 96 97 98 99<br />

2<br />

0<br />

9