College's catalog - Trinity Christian College

College's catalog - Trinity Christian College

College's catalog - Trinity Christian College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

98<br />

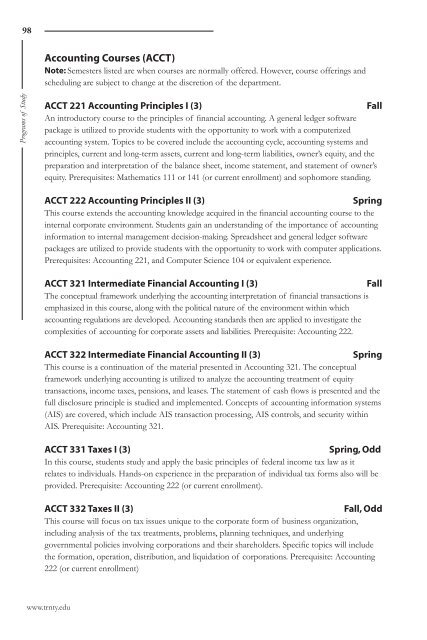

Accounting Courses (ACCT)<br />

Note: Semesters listed are when courses are normally offered. However, course offerings and<br />

scheduling are subject to change at the discretion of the department.<br />

Programs of Study<br />

ACCT 221 Accounting Principles I (3)<br />

Fall<br />

An introductory course to the principles of financial accounting. A general ledger software<br />

package is utilized to provide students with the opportunity to work with a computerized<br />

accounting system. Topics to be covered include the accounting cycle, accounting systems and<br />

principles, current and long-term assets, current and long-term liabilities, owner’s equity, and the<br />

preparation and interpretation of the balance sheet, income statement, and statement of owner’s<br />

equity. Prerequisites: Mathematics 111 or 141 (or current enrollment) and sophomore standing.<br />

ACCT 222 Accounting Principles II (3)<br />

Spring<br />

This course extends the accounting knowledge acquired in the financial accounting course to the<br />

internal corporate environment. Students gain an understanding of the importance of accounting<br />

information to internal management decision-making. Spreadsheet and general ledger software<br />

packages are utilized to provide students with the opportunity to work with computer applications.<br />

Prerequisites: Accounting 221, and Computer Science 104 or equivalent experience.<br />

ACCT 321 Intermediate Financial Accounting I (3)<br />

Fall<br />

The conceptual framework underlying the accounting interpretation of financial transactions is<br />

emphasized in this course, along with the political nature of the environment within which<br />

accounting regulations are developed. Accounting standards then are applied to investigate the<br />

complexities of accounting for corporate assets and liabilities. Prerequisite: Accounting 222.<br />

ACCT 322 Intermediate Financial Accounting II (3)<br />

Spring<br />

This course is a continuation of the material presented in Accounting 321. The conceptual<br />

framework underlying accounting is utilized to analyze the accounting treatment of equity<br />

transactions, income taxes, pensions, and leases. The statement of cash flows is presented and the<br />

full disclosure principle is studied and implemented. Concepts of accounting information systems<br />

(AIS) are covered, which include AIS transaction processing, AIS controls, and security within<br />

AIS. Prerequisite: Accounting 321.<br />

ACCT 331 Taxes I (3)<br />

spring, Odd<br />

In this course, students study and apply the basic principles of federal income tax law as it<br />

relates to individuals. Hands-on experience in the preparation of individual tax forms also will be<br />

provided. Prerequisite: Accounting 222 (or current enrollment).<br />

ACCT 332 Taxes II (3)<br />

Fall, Odd<br />

This course will focus on tax issues unique to the corporate form of business organization,<br />

including analysis of the tax treatments, problems, planning techniques, and underlying<br />

governmental policies involving corporations and their shareholders. Specific topics will include<br />

the formation, operation, distribution, and liquidation of corporations. Prerequisite: Accounting<br />

222 (or current enrollment)<br />

www.trnty.edu