Council Agenda - Kangaroo Island Council - SA.Gov.au

Council Agenda - Kangaroo Island Council - SA.Gov.au

Council Agenda - Kangaroo Island Council - SA.Gov.au

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

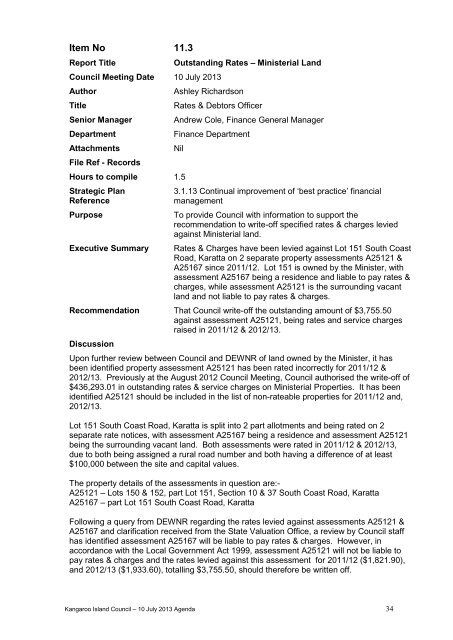

Item No 11.3<br />

Report Title<br />

<strong>Council</strong> Meeting Date 10 July 2013<br />

Author<br />

Title<br />

Senior Manager<br />

Department<br />

Attachments<br />

File Ref - Records<br />

Outstanding Rates – Ministerial Land<br />

Ashley Richardson<br />

Rates & Debtors Officer<br />

Andrew Cole, Finance General Manager<br />

Finance Department<br />

Nil<br />

Hours to compile 1.5<br />

Strategic Plan<br />

Reference<br />

Purpose<br />

Executive Summary<br />

3.1.13 Continual improvement of ‘best practice’ financial<br />

management<br />

To provide <strong>Council</strong> with information to support the<br />

recommendation to write-off specified rates & charges levied<br />

against Ministerial land.<br />

Rates & Charges have been levied against Lot 151 South Coast<br />

Road, Karatta on 2 separate property assessments A25121 &<br />

A25167 since 2011/12. Lot 151 is owned by the Minister, with<br />

assessment A25167 being a residence and liable to pay rates &<br />

charges, while assessment A25121 is the surrounding vacant<br />

land and not liable to pay rates & charges.<br />

Recommendation That <strong>Council</strong> write-off the outstanding amount of $3,755.50<br />

against assessment A25121, being rates and service charges<br />

raised in 2011/12 & 2012/13.<br />

Discussion<br />

Upon further review between <strong>Council</strong> and DEWNR of land owned by the Minister, it has<br />

been identified property assessment A25121 has been rated incorrectly for 2011/12 &<br />

2012/13. Previously at the August 2012 <strong>Council</strong> Meeting, <strong>Council</strong> <strong>au</strong>thorised the write-off of<br />

$436,293.01 in outstanding rates & service charges on Ministerial Properties. It has been<br />

identified A25121 should be included in the list of non-rateable properties for 2011/12 and,<br />

2012/13.<br />

Lot 151 South Coast Road, Karatta is split into 2 part allotments and being rated on 2<br />

separate rate notices, with assessment A25167 being a residence and assessment A25121<br />

being the surrounding vacant land. Both assessments were rated in 2011/12 & 2012/13,<br />

due to both being assigned a rural road number and both having a difference of at least<br />

$100,000 between the site and capital values.<br />

The property details of the assessments in question are:-<br />

A25121 – Lots 150 & 152, part Lot 151, Section 10 & 37 South Coast Road, Karatta<br />

A25167 – part Lot 151 South Coast Road, Karatta<br />

Following a query from DEWNR regarding the rates levied against assessments A25121 &<br />

A25167 and clarification received from the State Valuation Office, a review by <strong>Council</strong> staff<br />

has identified assessment A25167 will be liable to pay rates & charges. However, in<br />

accordance with the Local <strong>Gov</strong>ernment Act 1999, assessment A25121 will not be liable to<br />

pay rates & charges and the rates levied against this assessment for 2011/12 ($1,821.90),<br />

and 2012/13 ($1,933.60), totalling $3,755.50, should therefore be written off.<br />

<strong>Kangaroo</strong> <strong>Island</strong> <strong>Council</strong> – 10 July 2013 <strong>Agenda</strong> 34