Annual Report 2011 - T-Hrvatski Telekom

Annual Report 2011 - T-Hrvatski Telekom

Annual Report 2011 - T-Hrvatski Telekom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

34<br />

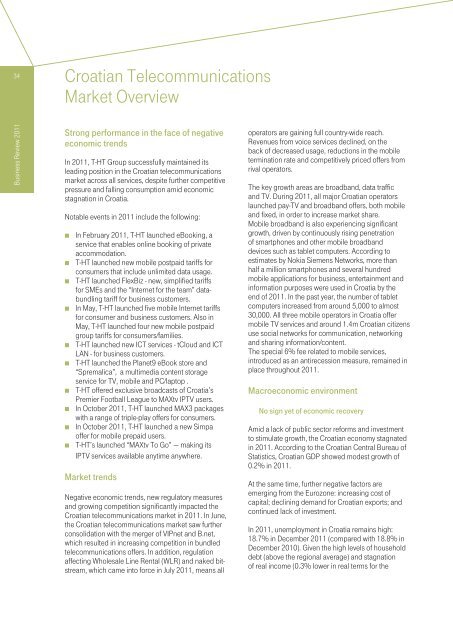

Croatian Telecommunications<br />

Market Overview<br />

Business Review <strong>2011</strong><br />

Strong performance in the face of negative<br />

economic trends<br />

In <strong>2011</strong>, T-HT Group successfully maintained its<br />

leading position in the Croatian telecommunications<br />

market across all services, despite further competitive<br />

pressure and falling consumption amid economic<br />

stagnation in Croatia.<br />

Notable events in <strong>2011</strong> include the following:<br />

• In February <strong>2011</strong>, T-HT launched eBooking, a<br />

service that enables online booking of private<br />

accommodation.<br />

• T-HT launched new mobile postpaid tariffs for<br />

consumers that include unlimited data usage.<br />

• T-HT launched FlexBiz - new, simplified tariffs<br />

for SMEs and the “Internet for the team” databundling<br />

tariff for business customers.<br />

• In May, T-HT launched five mobile Internet tariffs<br />

for consumer and business customers. Also in<br />

May, T-HT launched four new mobile postpaid<br />

group tariffs for consumers/families.<br />

• T-HT launched new ICT services - tCloud and ICT<br />

LAN - for business customers.<br />

• T-HT launched the Planet9 eBook store and<br />

“Spremalica”, a multimedia content storage<br />

service for TV, mobile and PC/laptop .<br />

• T-HT offered exclusive broadcasts of Croatia’s<br />

Premier Football League to MAXtv IPTV users.<br />

• In October <strong>2011</strong>, T-HT launched MAX3 packages<br />

with a range of triple-play offers for consumers.<br />

• In October <strong>2011</strong>, T-HT launched a new Simpa<br />

offer for mobile prepaid users.<br />

• T-HT’s launched “MAXtv To Go” — making its<br />

IPTV services available anytime anywhere.<br />

Market trends<br />

Negative economic trends, new regulatory measures<br />

and growing competition significantly impacted the<br />

Croatian telecommunications market in <strong>2011</strong>. In June,<br />

the Croatian telecommunications market saw further<br />

consolidation with the merger of VIPnet and B.net,<br />

which resulted in increasing competition in bundled<br />

telecommunications offers. In addition, regulation<br />

affecting Wholesale Line Rental (WLR) and naked bitstream,<br />

which came into force in July <strong>2011</strong>, means all<br />

operators are gaining full country-wide reach.<br />

Revenues from voice services declined, on the<br />

back of decreased usage, reductions in the mobile<br />

termination rate and competitively priced offers from<br />

rival operators.<br />

The key growth areas are broadband, data traffic<br />

and TV. During <strong>2011</strong>, all major Croatian operators<br />

launched pay-TV and broadband offers, both mobile<br />

and fixed, in order to increase market share.<br />

Mobile broadband is also experiencing significant<br />

growth, driven by continuously rising penetration<br />

of smartphones and other mobile broadband<br />

devices such as tablet computers. According to<br />

estimates by Nokia Siemens Networks, more than<br />

half a million smartphones and several hundred<br />

mobile applications for business, entertainment and<br />

information purposes were used in Croatia by the<br />

end of <strong>2011</strong>. In the past year, the number of tablet<br />

computers increased from around 5,000 to almost<br />

30,000. All three mobile operators in Croatia offer<br />

mobile TV services and around 1.4m Croatian citizens<br />

use social networks for communication, networking<br />

and sharing information/content.<br />

The special 6% fee related to mobile services,<br />

introduced as an antirecession measure, remained in<br />

place throughout <strong>2011</strong>.<br />

Macroeconomic environment<br />

No sign yet of economic recovery<br />

Amid a lack of public sector reforms and investment<br />

to stimulate growth, the Croatian economy stagnated<br />

in <strong>2011</strong>. According to the Croatian Central Bureau of<br />

Statistics, Croatian GDP showed modest growth of<br />

0.2% in <strong>2011</strong>.<br />

At the same time, further negative factors are<br />

emerging from the Eurozone: increasing cost of<br />

capital; declining demand for Croatian exports; and<br />

continued lack of investment.<br />

In <strong>2011</strong>, unemployment in Croatia remains high:<br />

18.7% in December <strong>2011</strong> (compared with 18.8% in<br />

December 2010). Given the high levels of household<br />

debt (above the regional average) and stagnation<br />

of real income (0.3% lower in real terms for the