Annual Report 2011 - T-Hrvatski Telekom

Annual Report 2011 - T-Hrvatski Telekom

Annual Report 2011 - T-Hrvatski Telekom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

90<br />

Consolidated financial statements<br />

Where the effect of the time value of money is<br />

material, the amount of a provision is the present<br />

value of the expenditures expected to be required to<br />

settle the obligation. When discounting is used, the<br />

increase in provision reflecting the passage of time is<br />

recognized as interest expense.<br />

Provisions for termination benefits are recognized when<br />

the Group is demonstrably committed to a termination<br />

of employment contracts, that is when the Group has<br />

a detailed formal plan for the termination which is<br />

without realistic possibility of withdrawal. Provisions for<br />

termination benefits are computed based on amounts<br />

paid or expected to be paid in redundancy programs.<br />

s) Contingencies<br />

Contingent liabilities are not recognized in the<br />

financial statements. They are disclosed unless the<br />

possibility of an outflow of resources embodying<br />

economic benefits is remote.<br />

A contingent asset is not recognized in the financial<br />

statements but is disclosed when an inflow of<br />

economic benefits is probable.<br />

t) Share-based payments<br />

The cost of cash-settled transactions is measured<br />

initially at fair value at the grant date using a binomial<br />

model, further details of which are given in Note 32.<br />

This fair value is expensed over the period until the<br />

vesting date with recognition of a corresponding<br />

liability. The liability is remeasured to fair value at<br />

each statement of financial position date up to and<br />

including the settlement date with changes in fair<br />

value recognized in the statement of comprehensive<br />

income.<br />

u) Events after reporting period<br />

Post-year-end events that provide additional<br />

information about the Group’s position at the<br />

statement of financial position date (adjusting events)<br />

are reflected in the financial statements. Post-yearend<br />

events that are not adjusting events are disclosed<br />

in the notes when material.<br />

v) Trade payables<br />

Trade payables are obligations to pay for goods or<br />

services that have been acquired in the ordinary<br />

course of business from suppliers. Accounts payable<br />

are classified as current liabilities if payment is due<br />

within one year or less. If not, they are presented as<br />

non-current liabilities.<br />

w) Dividend distribution<br />

Dividend distribution to the Group’s shareholders<br />

is recognized as a liability in the Group’s financial<br />

statements in the period in which the dividends are<br />

approved by the Group’s shareholders.<br />

x) Earnings per share<br />

Earnings per share are calculated by dividing the<br />

profit attributable to equity holders of the Group by<br />

the weighted average number of ordinary shares<br />

in issue during the year excluding ordinary shares<br />

purchased by the Group and held as treasury shares.<br />

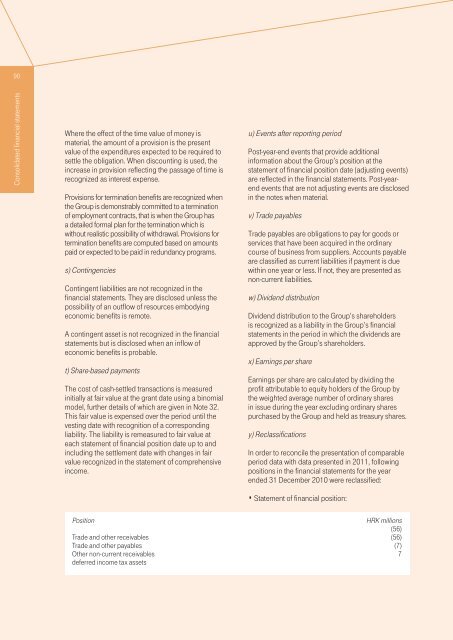

y) Reclassifications<br />

In order to reconcile the presentation of comparable<br />

period data with data presented in <strong>2011</strong>, following<br />

positions in the financial statements for the year<br />

ended 31 December 2010 were reclassified:<br />

· Statement of financial position:<br />

Position<br />

Trade and other receivables<br />

Trade and other payables<br />

Other non-current receivables<br />

deferred income tax assets<br />

HRK millions<br />

(56)<br />

(56)<br />

(7)<br />

7