Annual Report 2011 - T-Hrvatski Telekom

Annual Report 2011 - T-Hrvatski Telekom

Annual Report 2011 - T-Hrvatski Telekom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

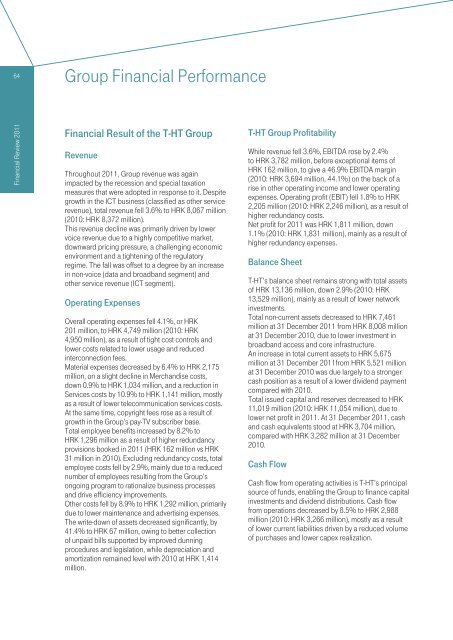

64<br />

Group Financial Performance<br />

Financial Review <strong>2011</strong><br />

Financial Result of the T-HT Group<br />

Revenue<br />

Throughout <strong>2011</strong>, Group revenue was again<br />

impacted by the recession and special taxation<br />

measures that were adopted in response to it. Despite<br />

growth in the ICT business (classified as other service<br />

revenue), total revenue fell 3.6% to HRK 8,067 million<br />

(2010: HRK 8,372 million).<br />

This revenue decline was primarily driven by lower<br />

voice revenue due to a highly competitive market,<br />

downward pricing pressure, a challenging economic<br />

environment and a tightening of the regulatory<br />

regime. The fall was offset to a degree by an increase<br />

in non-voice (data and broadband segment) and<br />

other service revenue (ICT segment).<br />

Operating Expenses<br />

Overall operating expenses fell 4.1%, or HRK<br />

201 million, to HRK 4,749 million (2010: HRK<br />

4,950 million), as a result of tight cost controls and<br />

lower costs related to lower usage and reduced<br />

interconnection fees.<br />

Material expenses decreased by 6.4% to HRK 2,175<br />

million, on a slight decline in Merchandise costs,<br />

down 0.9% to HRK 1,034 million, and a reduction in<br />

Services costs by 10.9% to HRK 1,141 million, mostly<br />

as a result of lower telecommunication services costs.<br />

At the same time, copyright fees rose as a result of<br />

growth in the Group’s pay-TV subscriber base.<br />

Total employee benefits increased by 8.2% to<br />

HRK 1,296 million as a result of higher redundancy<br />

provisions booked in <strong>2011</strong> (HRK 162 million vs HRK<br />

31 million in 2010). Excluding redundancy costs, total<br />

employee costs fell by 2.9%, mainly due to a reduced<br />

number of employees resulting from the Group’s<br />

ongoing program to rationalize business processes<br />

and drive efficiency improvements.<br />

Other costs fell by 8.9% to HRK 1,292 million, primarily<br />

due to lower maintenance and advertising expenses.<br />

The write-down of assets decreased significantly, by<br />

41.4% to HRK 67 million, owing to better collection<br />

of unpaid bills supported by improved dunning<br />

procedures and legislation, while depreciation and<br />

amortization remained level with 2010 at HRK 1,414<br />

million.<br />

T-HT Group Profitability<br />

While revenue fell 3.6%, EBITDA rose by 2.4%<br />

to HRK 3,782 million, before exceptional items of<br />

HRK 162 million, to give a 46.9% EBITDA margin<br />

(2010: HRK 3,694 million, 44.1%) on the back of a<br />

rise in other operating income and lower operating<br />

expenses. Operating profit (EBIT) fell 1.8% to HRK<br />

2,205 million (2010: HRK 2,246 million), as a result of<br />

higher redundancy costs.<br />

Net profit for <strong>2011</strong> was HRK 1,811 million, down<br />

1.1% (2010: HRK 1,831 million), mainly as a result of<br />

higher redundancy expenses.<br />

Balance Sheet<br />

T-HT’s balance sheet remains strong with total assets<br />

of HRK 13,136 million, down 2.9% (2010: HRK<br />

13,529 million), mainly as a result of lower network<br />

investments.<br />

Total non-current assets decreased to HRK 7,461<br />

million at 31 December <strong>2011</strong> from HRK 8,008 million<br />

at 31 December 2010, due to lower investment in<br />

broadband access and core infrastructure.<br />

An increase in total current assets to HRK 5,675<br />

million at 31 December <strong>2011</strong>from HRK 5,521 million<br />

at 31 December 2010 was due largely to a stronger<br />

cash position as a result of a lower dividend payment<br />

compared with 2010.<br />

Total issued capital and reserves decreased to HRK<br />

11,019 million (2010: HRK 11,054 million), due to<br />

lower net profit in <strong>2011</strong>. At 31 December <strong>2011</strong>, cash<br />

and cash equivalents stood at HRK 3,704 million,<br />

compared with HRK 3,282 million at 31 December<br />

2010.<br />

Cash Flow<br />

Cash flow from operating activities is T-HT’s principal<br />

source of funds, enabling the Group to finance capital<br />

investments and dividend distributions. Cash flow<br />

from operations decreased by 8.5% to HRK 2,988<br />

million (2010: HRK 3,266 million), mostly as a result<br />

of lower current liabilities driven by a reduced volume<br />

of purchases and lower capex realization.