Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Significant Accounting Policies and Notes forming part of Consolidated Accounts (contd.)<br />

O. AIRCRAFT MAINTENANCE AND REPAIRS COST:<br />

Aircraft Maintenance, Auxiliary Power Unit (APU) and Engine maintenance and repair costs are expensed on<br />

incurrence as incurred except with respect to Engines / APU which are covered by third party maintenance agreement<br />

and these are accounted in accordance with the relevant terms.<br />

P. TAXES:<br />

Provision for current tax is made after taking into consideration benefits admissible under the provisions of the<br />

Income Tax Act, 1961.<br />

Deferred tax resulting from “timing differences” between book and taxable profit is accounted for using the tax rates<br />

and laws that have been enacted or substantively enacted as on the balance sheet date. The deferred tax asset is<br />

recognised and carried forward only to the extent that there is a reasonable / virtual certainty, as the case may be,<br />

that the asset will be realised in future.<br />

Fringe Benefit Tax is recognized in accordance with the relevant provisions of the Income Tax Act, 1961 and the<br />

Guidance note on Fringe Benefit Tax issued by the Institute of Chartered Accountants of India (ICAI).<br />

Q. SHARE ISSUE EXPENSES:<br />

Issue Expenses are adjusted against the Share Premium Account.<br />

R. SALE AND LEASE BACK TRANSACTION:<br />

Profit or loss on sale and lease back arrangements resulting in operating leases are recognized, in case the<br />

transaction is established at fair value, else the excess over the fair value is deferred and amortized over the period<br />

for which the asset is expected to be used.<br />

S. ACCOUNTING FOR DERIVATIVE INSTRUMENTS:<br />

Interest Rate Swaps, Currency Option, Currency Swaps and other products, entered into by the Company for hedging<br />

the risks of foreign currency exposure (including interest rate risk) are marked to market and losses, if any is<br />

accounted based on the principles of prudence as enunciated in Accounting Standard 1 (AS-1) “Disclosure of<br />

Accounting Policies”.<br />

T. PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS:<br />

Provisions involving a substantial degree of estimation in measurement are recognised when there is a present<br />

obligation as a result of past events and it is probable that there will be an outflow of resources. Contingent<br />

Liabilities are not recognised but are disclosed in the notes. Contingent Assets are neither recognised nor disclosed<br />

in the financial statements.<br />

II. NOTES TO ACCOUNTS:<br />

1. The consolidated financial statements present the consolidated accounts of <strong>Jet</strong> <strong>Airways</strong> (India) Limited with the<br />

following subsidiary:<br />

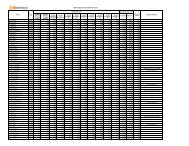

Name of the Subsidiary Company Country of Incorporation Extent of Holding as on<br />

31st March, 2010<br />

<strong>Jet</strong> Lite (India) Limited India 100%<br />

2. Estimated amount of Contracts remaining to be executed on capital account net of advances, not provided for:<br />

Tangible Assets Rs. 1,390,286 lakhs (Previous Year Rs. 1,618,788 lakhs)<br />

103