Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

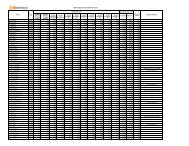

Significant Accounting Policies and Notes to Accounts (contd.)<br />

iii) During the year the Company has given four (4) owned Aircraft on Dry sub lease. In the previous Company<br />

has given six (6) aircraft on wet lease [Four (4) owned and Two (2) leased] and One (1) aircraft on dry<br />

sub-lease. The future minimum lease income in respect of non-cancelable period which, as at 31st March,<br />

2010 is as follows:<br />

Amount (Rs. in lakhs)<br />

Total Lease<br />

Aircraft Income<br />

Less than 1 year (-) 25,054<br />

((-)17,377)<br />

Between 1 and 5 years (-) 10,545<br />

(Nil)<br />

More than 5 years -<br />

(Nil)<br />

Grand Total<br />

(Figures in brackets indicates 31<br />

(-) 35,599<br />

((-)17,377)<br />

st March, 2009 figures)<br />

The Salient features of Wet Lease agreement are:<br />

• Operational control and maintenance of aircraft remains the responsibility of the Lessor. The aircraft<br />

remains on Indian registry and is operated with the Lessor’s crew.<br />

• Monthly rentals are received in the form of fixed and variable rental. Variable Lease Rentals are<br />

receivable on a pre determined rate on the basis of additional flying hours.<br />

• The wet leases are non-cancelable.<br />

The Salient features of Dry Lease agreement are:<br />

• In this leasing arrangement aircraft is leased without insurance and crew.<br />

• Monthly rentals paid in form of fixed and variable rental. Variable Lease Rentals are payable on a pre<br />

determined rate payable on the basis of actual flying hours. Additionally, the predetermined rates of<br />

Variable Rentals are subject to the annual escalation as stipulated in the respective leases.<br />

• The Lessee neither has an option to buyback nor does it generally have an option to renew the<br />

leases.<br />

• The dry leases are non-cancelable.<br />

Details of the owned aircraft given on non-cancelable Dry lease / Wet lease is as under:<br />

Amount (Rs. in lakhs)<br />

Details of Leased Assets (Aircraft): 2009-10 2008-09<br />

Cost of acquisition 273,783 309,014<br />

Accumulated Depreciation 41,584 23,748<br />

iv)<br />

Depreciation of Rs. 16,690 lakhs (Previous Year Rs. 15,807 lakhs) has been debited to Profit and Loss<br />

Account on the above leased assets.<br />

The variable lease rental income recognized Rs. 5,863 lakhs (Previous Year Nil).<br />

v) The lease rental expense recognized Rs. 117,025 (Previous Year Rs. 1,14,652 lakhs). It includes Nil<br />

(Previous Year Rs. 5,977 lakhs) recognized as lease rental expenses on account of sale and lease back of<br />

aircraft.<br />

76