Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

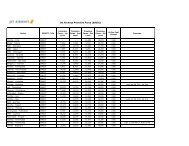

Annexure to the Auditors’ <strong>Report</strong> (contd.)<br />

7) The Company has an internal audit system comprising of its own internal management audit team and during the year it<br />

also involved a firm of chartered accountants for specific areas. The scope of internal audit needs to be extended to<br />

include certain areas viz. outsourced payroll and purchase of fixed assets so as to be commensurate with the size of the<br />

Company and nature of its business.<br />

8) Maintenance of cost records has not been prescribed by the Central Government under clause (d) of sub section (1) of<br />

section 209 of the Companies Act, 1956. Therefore, the provisions of clause 4(viii) of the Companies (Auditor’s <strong>Report</strong>)<br />

Order, 2003 are not applicable to the company.<br />

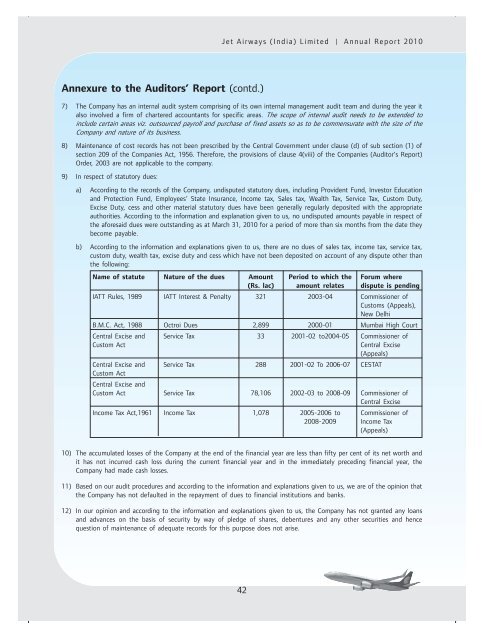

9) In respect of statutory dues:<br />

a) According to the records of the Company, undisputed statutory dues, including Provident Fund, Investor Education<br />

and Protection Fund, Employees’ State Insurance, Income tax, Sales tax, Wealth Tax, Service Tax, Custom Duty,<br />

Excise Duty, cess and other material statutory dues have been generally regularly deposited with the appropriate<br />

authorities. According to the information and explanation given to us, no undisputed amounts payable in respect of<br />

the aforesaid dues were outstanding as at March 31, 2010 for a period of more than six months from the date they<br />

become payable.<br />

b) According to the information and explanations given to us, there are no dues of sales tax, income tax, service tax,<br />

custom duty, wealth tax, excise duty and cess which have not been deposited on account of any dispute other than<br />

the following:<br />

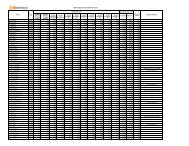

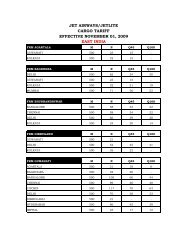

Name of statute Nature of the dues Amount Period to which the Forum where<br />

(Rs. lac) amount relates dispute is pending<br />

IATT Rules, 1989 IATT Interest & Penalty 321 2003-04 Commissioner of<br />

Customs (Appeals),<br />

New Delhi<br />

B.M.C. Act, 1988 Octroi Dues 2,899 2000-01 Mumbai High Court<br />

Central Excise and Service Tax 33 2001-02 to2004-05 Commissioner of<br />

Custom Act Central Excise<br />

(Appeals)<br />

Central Excise and<br />

Custom Act<br />

Central Excise and<br />

Service Tax 288 2001-02 To 2006-07 CESTAT<br />

Custom Act Service Tax 78,106 2002-03 to 2008-09 Commissioner of<br />

Central Excise<br />

Income Tax Act,1961 Income Tax 1,078 2005-2006 to Commissioner of<br />

2008-2009 Income Tax<br />

(Appeals)<br />

10) The accumulated losses of the Company at the end of the financial year are less than fifty per cent of its net worth and<br />

it has not incurred cash loss during the current financial year and in the immediately preceding financial year, the<br />

Company had made cash losses.<br />

11) Based on our audit procedures and according to the information and explanations given to us, we are of the opinion that<br />

the Company has not defaulted in the repayment of dues to financial institutions and banks.<br />

12) In our opinion and according to the information and explanations given to us, the Company has not granted any loans<br />

and advances on the basis of security by way of pledge of shares, debentures and any other securities and hence<br />

question of maintenance of adequate records for this purpose does not arise.<br />

42