Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Significant Accounting Policies and Notes to Accounts (contd.)<br />

Q. SALE AND LEASE BACK TRANSACTION:<br />

Profit or loss on sale and lease back arrangements resulting in operating leases are recognized, in case the<br />

transaction is established at fair value, else the excess over the fair value is deferred and amortized over the period<br />

for which the asset is expected to be used.<br />

R. ACCOUNTING FOR DERIVATIVE INSTRUMENTS:<br />

Interest Rate Swaps, Currency Option, Currency Swaps and other products, entered into by the Company for hedging<br />

the risks of foreign currency exposure (including interest rate risk) are marked to market and losses, if any is<br />

accounted based on the principles of prudence as enunciated in Accounting Standard 1(AS - 1) “Disclosure of<br />

Accounting Policies”.<br />

S. PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS:<br />

Provisions involving a substantial degree of estimation in measurement are recognised when there is a present<br />

obligation as a result of past events and it is probable that there will be an outflow of resources. Contingent<br />

Liabilities are not recognised but are disclosed in the notes. Contingent Assets are neither recognised nor disclosed<br />

in the financial statements.<br />

II. NOTES TO ACCOUNTS<br />

1) Estimated amount of Contracts remaining to be executed on capital account (net of advances), not provided for:<br />

Tangible Assets Rs. 1,238,107 lakhs (Previous Year - Rs. 1,430,940 lakhs)<br />

2) CONTINGENT LIABILITIES :<br />

a) Service Tax demands which are under appeals are Rs. 78,427 lakhs (Previous Year Rs. 55,237 lakhs).<br />

b) Sales Tax demands which are under appeals are Rs. 6 lakhs (Previous Year Rs. 6 lakhs) and the same has been<br />

deposited with the authorities.<br />

c) Claims against the Company, pending Civil and Consumer suits of Rs. 4,291 lakhs (Previous Year Rs. 2,780<br />

lakhs).<br />

d) Inland Air Travel Tax demands which are under appeal Rs.426 lakhs (Previous Year Rs. 473 lakhs) against which<br />

the amount of Rs. 105 lakhs (Previous Year Rs. 117 lakhs) is deposited with the Authorities.<br />

e) Claims for Octroi amounts to Rs. 2,899 lakhs (Previous Year Rs. 2,899 lakhs).<br />

f) Disputed claims against the company towards Ground Handling charges amount to Rs. 5,738 lakhs (Previous<br />

Year Rs. 5,477 lakhs).<br />

g) Letters of Credit outstanding are Rs. 89,307 lakhs (Previous Year Rs. 79,133 lakhs) and Bank Guarantees<br />

outstanding are Rs. 89,891 lakhs (Previous Year Rs. 85,144 lakhs).<br />

h) Corporate Guarantee given to Banks and Financial Institution against credit facilities, and to Lessor against<br />

financial obligations extended to Subsidiary Company as under:<br />

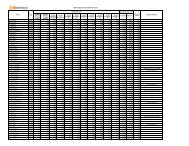

(Amount in Rs. lakhs)<br />

Amount of guarantee Outstanding Amounts against the guarantee<br />

73,318 70,736<br />

(86,720) (71,187)<br />

(Figures in brackets indicate 31 st March, 2009 figures)<br />

i) Claims against the Company not acknowledged as debt – Rs. 63,708 lakhs (Previous Year Rs. 63,708 lakhs)<br />

claim filed by erstwhile selling shareholders of Sahara Airlines Limited – Refer note no. 5 (a) for details.<br />

61