Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

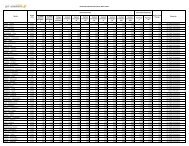

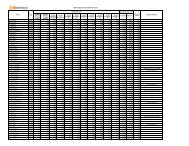

Significant Accounting Policies and Notes to Accounts (contd.)<br />

d) Engine Repairs Cost :<br />

The aircraft engines have to undergo shop visits for overhaul and maintenance at specified intervals as per the<br />

Maintenance Program Document. The same was provided for on the basis of hours flown at a pre-determined<br />

rate.<br />

Amount (Rs. in lakhs)<br />

Particulars 2009-10 2008-09<br />

Opening Balance 333 657<br />

Add/(Less) :- Adjustments during the year * (6) 164<br />

Less: - Amounts used during the year 327 372<br />

Less: - Unused Amounts reversed during the year - 116<br />

Closing Balance - 333<br />

* Adjustments during the year represents exchange fluctuation impact consequent to restatement of liabilities<br />

denominated in foreign currency.<br />

16) In the previous year, the Company adopted the option offered by the notification of the Companies (Accounting<br />

Standards) Amendment Rules, 2006 which amended Accounting Standard - 11 “The Effects of Changes in Foreign<br />

Exchange Rates”.<br />

Pursuant to the aforesaid notification, exchange differences relating to long term monetary items have been<br />

accounted for as described in Accounting policy L of Schedule S. Accordingly, cumulative foreign exchange loss (net)<br />

of Rs. 94,895 lakhs (Previous year Rs. 215,556 lakhs) has been adjusted to the cost of the fixed assets/capital<br />

work-in-progress being the exchange differences on long term monetary items relatable to the acquisition of fixed<br />

assets. As a result of this the net loss before tax for the year is higher by Rs. 120,661 lakhs and Previous Year was<br />

lower by Rs. 239,001 lakhs.<br />

17) The Company has entered into a “Power by the Hour” (PBTH) Engine Maintenance agreement with a Service<br />

provider for its Next Generation Boeing 737 Aircraft fleet. Till the previous year, with respect to all Aircraft on<br />

operating lease, the company was charging variable rent payable to various Lessors to the profit and loss account<br />

as per the agreement entered into with them.<br />

Consequent to the new arrangement entered into with the Engine Maintenance Service provider, which includes the<br />

cost of future engine shop visits, the Company has expensed out the monthly cost of PBTH at the rate specified<br />

in the contract to the profit and loss account and treated the variable rental payable to the Lessors as receivables<br />

to be set off against the future claims payable on engine shop visits. Accordingly, the variable rent of Rs. 9,712<br />

lakhs for the year ended 31st March, 2010 has been reflected as “Receivable from Lessors” and classified under<br />

“Loans and Advances”.<br />

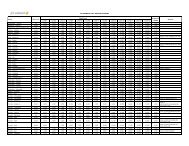

18) Disclosures relating to amounts payable as at the year end together with interest paid / payable to Micro, Small<br />

and Medium Enterprises have been made in the accounts, as required under the Micro, Small and Medium Enterprises<br />

Development Act, 2006 to the extent of information available with the Company determined on the basis of<br />

intimation received from suppliers regarding their status and the required disclosure are given below:<br />

Amount (Rs. in lakhs)<br />

Particulars 2009-10 2008-09<br />

a Principal amount remaining unpaid as on 31 st March, 2010 30 113<br />

b Interest due thereon as on 31st March, 2010 - -<br />

c Interest paid by the Company in terms of Section 16 of Micro,<br />

Small and Medium Enterprises Development Act, 2006, along<br />

with the amount of the payment made to the supplier beyond<br />

the appointed day during the year. - -<br />

79