Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

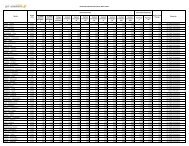

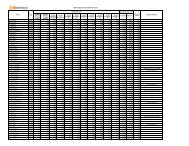

Significant Accounting Policies and Notes to Accounts (contd.)<br />

Amount (Rs. in Lakhs)<br />

Sr.<br />

No. Particulars Gratuity (Non-Funded)<br />

As on As on<br />

31.03.2010 31.03.2009<br />

II) Net cost for the year ended 31 st March, 2010 :<br />

Current Service cost 710 904<br />

Interest cost 338 378<br />

Actuarial (gain) / losses (574) (1,461)<br />

Net cost 474 (179)<br />

III) Fair Value of Planned Assets Nil Nil<br />

IV) Experience Adjustment on actuarial (Gain) / Loss:<br />

Plan Liabilities (gain) / loss (412) *<br />

Plan Assets (gain) / loss Nil *<br />

V) Assumption used in accounting for the gratuity plan:<br />

Discount rate (%) 8% 7.75%<br />

Salary escalation rate (%) 5% 5%<br />

The present value of defined benefit obligation was Rs. 4,723 lakhs as on 31 st March, 2008 and Rs. 3,603<br />

lakhs as on 31 st March, 2007.<br />

The fair value of planned assets was Nil as on 31 st March, 2008 and Nil as on 31 st March, 2007.<br />

* The details of the Experience adjustments arising on account of plan assets and liabilities as required<br />

by paragraph 120(n)(ii) of AS 15 (Revised) on “Employee Benefits” of previous financial years are not<br />

available in the valuation report for the financial year 2006-07, 2007-08, 2008-09 and hence, are not<br />

furnished.<br />

The estimates of rate of escalation in salary considered in actuarial valuation, takes into account inflation,<br />

seniority, promotion and other relevant factors including supply and demand in the employment market.<br />

c) Other Long Term Employee Benefit<br />

The Leave Encashment reversal for the year ended 31st March, 2010, based on actuarial valuation carried out<br />

using the Projected Accrued Benefit Method, amounting to Rs. 621 lakhs (Previous Year Rs. 168 lakhs) has<br />

been recognized in the Profit and Loss Account.<br />

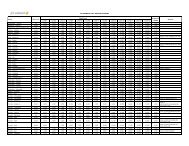

7) AUDITORS REMUNERATION (Net of Service Tax Input Credit) :<br />

Amount (Rs. in lakhs)<br />

Particulars 2009-10 2008-09<br />

(a) As Audit Fees<br />

- Statutory Audit 117 118<br />

- Tax Audit 5 8<br />

(b) As Advisor or in any other capacity in respect of:<br />

Tax Matters 55 72<br />

(c) In any other manner<br />

For other services such as quarterly limited<br />

reviews, certificates, etc 62 57<br />

(d) For reimbursement of expenses<br />

[*Rs. 7,065 (Previous Year Rs. 43,927)] -* -*<br />

Total 239 255<br />

65