Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management’s Discussion and Analysis (contd.)<br />

6.8 The Company, as part of its risk management strategy, reviews on a continuous basis, its strategies, processes,<br />

procedures and guidelines to effectively identify and mitigate risks. Key risks in all areas of the Company’s<br />

operations and management have been identified and are monitored.<br />

7. Opportunities, Risks, Concerns and Threats<br />

7.1 We believe that the strong performance of the Indian economy will be the most important factor in the recovery of<br />

Indian aviation and to improve the Company’s performance. This has already been demonstrated in the latter part<br />

of the financial year 2009-10 and in both passengers and cargo loads and revenues compared to the same period<br />

in the previous financial year.<br />

7.2 The introduction of “<strong>Jet</strong> <strong>Airways</strong> Konnect” and the improvement in the service and reliability of our subsidiary<br />

<strong>Jet</strong> Lite (India) Limited have ensured that we are a strong player in the “no frills” sector.<br />

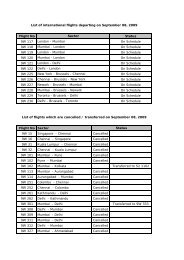

7.3 The convenient flights in our large domestic network and our convenient flights to and from SAARC and ASEAN,<br />

help feed our long and medium – haul international flights to and from India.<br />

7.4 We will continue to expand alliances with other international carriers in order to improve our global connectivity<br />

and network.<br />

7.5 While global oil prices have been relatively less volatile during the year under review, any major increase in oil<br />

prices will adversely impact the aviation industry. The Company will also be impacted by any major deterioration of<br />

the Rupee against the US Dollar and Euro, as the Company’s outflow in foreign currency is higher than the inflow.<br />

7.6 The possibility of terrorist attacks in India (such as those that took place in Mumbai on 26th November, 2008),<br />

internal terrorism as well as terrorist activities in neighbouring countries, such incidents could adversely affect<br />

travel into India and out of India.<br />

Certain statements in this Management Discussion and Analysis describing the Company may be ‘forward-looking statements’<br />

within the meaning of applicable securities laws and regulations. Actual results could differ materially from those expressed or<br />

implied. Important factors that could make a difference to the Company’s future operations include economic conditions<br />

affecting air travel in India and overseas, change in Government Regulations, changes in Central and State taxation, fuel prices<br />

and other factors.<br />

25