Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

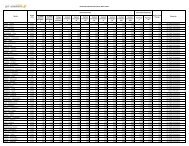

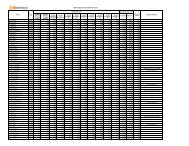

Significant Accounting Policies and Notes to Accounts (contd.)<br />

c) Statement of Material Transactions during the year and balances with related parties:<br />

i) Subsidiary Company<br />

Amount (Rs. in lakhs)<br />

<strong>Jet</strong> Lite (India) Limited<br />

Transactions During the Year :<br />

- Other Hire Charges received (-) 429<br />

((-)363)<br />

- Reimbursement Received Nil<br />

((-)92)<br />

- Corporate Guarantee given by the Company on behalf of the Subsidiary Company 4,194<br />

(16,067)<br />

- Investments in Equity and Preference Shares -<br />

(18,000)<br />

- Interline Billing (-) 24,116<br />

((-)7,330)<br />

Assignment of Fixed Asset Right (-) 4,015<br />

(-)<br />

Closing Balance as on 31 st March, 2010:<br />

- Interest free Loan 68,207<br />

(62,314)<br />

- Deposit Nil<br />

((-)8)<br />

- Investments in Equity and Preference Shares 164,500<br />

(164,500)<br />

- Corporate Guarantee by Company on behalf of Subsidiary Company* 70,736<br />

(71,187)<br />

- Corporate Guarantee given by Subsidiary Company on behalf of the Company (-)319,863<br />

((-)361,324)<br />

(Figures in brackets indicate 31st March, 2009 figures)<br />

*Closing Balance of Corporate Guarantee given by <strong>Jet</strong> <strong>Airways</strong> (India) Limited represents utilized amount<br />

against total guarantee amount of Rs. 73,318 lakhs (Rs. 86,720 lakhs)<br />

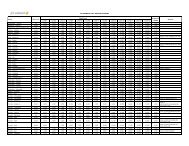

ii) Remuneration includes remuneration to Mrs. Anita Goyal, relative of controlling shareholder of Holding<br />

Company Rs.128 lakhs (Previous Year Rs.156 lakhs) and to Mr. Saroj K. Datta, Key Managerial Personnel<br />

Rs. 127 lakhs (Refer Note 8 of schedule S) (Previous Year Rs. 94 lakhs).<br />

iii) Enterprises over which controlling shareholder of Holding Company and his relatives are able to exercise<br />

significant influence:<br />

71