Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

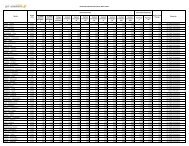

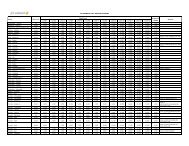

Significant Accounting Policies and Notes forming part of Consolidated Accounts (contd.)<br />

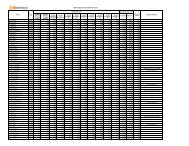

b) The foreign currency exposures that have not been hedged by any derivative instrument or otherwise as on<br />

31st March, 2010 are as follows:<br />

Particulars INR Equivalent USD Equivalent<br />

(Rs. in lakhs) (USD in lakhs)<br />

Current Assets 57,798 1,288<br />

(98,334) (1,979)<br />

Current Liabilities 115,829 2,580<br />

(111,299) (2,225)<br />

Interest accrued but not due on Loans 2,752 61<br />

(3,745) (74)<br />

Long Term Loans for purchase of Aircraft* 734,339 16,355<br />

(904,823) (17,840)<br />

Other Loans payable 68,307 1,521<br />

(79,697) (1,670)<br />

(Figures in brackets indicate 31st March, 2009 figures)<br />

*Includes Loans payable after 5 years – Rs. 430,591 lakhs (Previous year Rs. 585,847 lakhs)<br />

5. a) The Company has equity and preference investments aggregating to Rs. 164,500 lakhs in <strong>Jet</strong> Lite (India)<br />

Limited, a wholly owned subsidiary, and an amount of Rs. 68,207 lakhs advanced as interest free loan as on<br />

31st March, 2010. The said subsidiary has improved its financial position by earning a profit for the year ending<br />

31st March 2010, however, the Company continues to show a negative net-worth. A reputed valuer has recently<br />

valued the equity interest in the subsidiary based on its business plans, which supports the carrying value of<br />

such investment and loan outstanding. The Company continues to provide financial support to subsidiary’s<br />

operations to further such business plans and expects improved performance in the future. Accordingly, the<br />

financial statements of the subsidiary company have been prepared on “Going Concern” basis and no provision<br />

is considered necessary at this stage in respect of its investments and loans outstanding from the said<br />

subsidiary company at the year end.<br />

b) (i) In the year 2007-08, the Company acquired 100% shares of Sahara Airlines Limited (SAL) (Now known<br />

as <strong>Jet</strong> Lite (India) Limited) as per Share Purchase agreement with erstwhile shareholders of SAL (“Selling<br />

Shareholders”) and ‘Consent Terms and Consent Award’ for a lump-sum price of Rs. 146,500 lakhs, out<br />

of which, Rs. 91,500 lakhs was paid on or before the acquisition date. The balance Rs. 55,000 lakhs was<br />

payable in four interest free annual equal installments commencing on or before 30th March, 2008. Out<br />

of Rs. 55,000 lakhs, two annual installments aggregating Rs. 18,792 lakhs have been paid after deducting<br />

Rs. 8,708 lakhs, which the Company had paid to income tax department in respect of demands on SAL<br />

for periods prior to the execution of the Share Purchase Agreement. The installment due on or before<br />

30th March, 2010 for Rs. 13,750 lakhs has been deposited with the registry of Bombay High Court as per<br />

the order passed by the Honorable Bombay High Court.<br />

Balance installment payable of Rs. 13,750 lakhs as on 31 st March, 2010 has been disclosed under the<br />

separate head “Deferred payment liability towards Investment in wholly owned subsidiary company”.<br />

Aggrieved by such deduction from 1 st and 2 nd installments due under the Consent Terms and Consent<br />

Award dated 12 th April, 2007, the Selling Shareholders on 30 th March, 2009 filed an Execution Application<br />

for recovery of an amount of Rs. 99,958 lakhs. The claim by Selling Shareholders of Rs. 99,958 lakhs<br />

includes acceleration of three installments each of Rs. 13,750 lakhs plus deduction of Rs. 3,708 lakhs<br />

made from 1st installment paid in March, 2008 and demanding further Rs. 55,000 lakhs towards increase<br />

in lump-sum purchase consideration for the breach of the Consent Terms in payment of installments by<br />

the Company after deducting tax dues of earlier years of SAL.<br />

105