Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

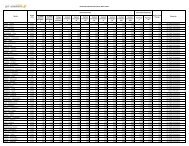

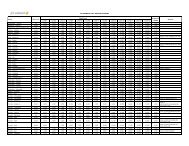

Significant Accounting Policies and Notes to Accounts<br />

SCHEDULE ‘S’<br />

SIGNIFICANT ACCOUNTING POLICIES AND NOTES TO ACCOUNTS<br />

I. SIGNIFICANT ACCOUNTING POLICIES<br />

A. BASIS OF PREPARATION OF FINANCIAL STATEMENTS:<br />

The financial statements are prepared under the historical cost convention, except certain Fixed Assets which are<br />

revalued, in accordance with the generally accepted accounting principles in India, the provisions of the Companies<br />

Act, 1956 and the applicable accounting standards.<br />

B. USE OF ESTIMATES :<br />

The preparation of financial statements in conformity with generally accepted accounting principles requires estimates<br />

and assumptions to be made that affect the reported amount of assets and liabilities on the date of the financial<br />

statements and the reported amount of revenue and expenses during the reporting period. Differences between the<br />

actual results and estimates are recognised in the period in which the results are known / materialised.<br />

C. REVENUE RECOGNITION :<br />

a) Passenger and Cargo income is recognised on flown basis, i.e. when the service is rendered.<br />

b) The sale of tickets / airway bills (sales net of refunds) are initially credited to the “Forward Sales Account”.<br />

Income recognised as indicated above is reduced from the Forward Sales Account and the balance net of<br />

commission and discount thereon is shown under Current Liabilities.<br />

c) The unutilized balances in Forward Sales Account are recognized as income based on historical statistics, data<br />

and management estimates and considering Company’s refund policy.<br />

d) Lease income including Variable rentals on the Aircraft given on operating lease is recognized in the Profit and<br />

Loss account on an accrual basis over the period of lease.<br />

D. EXPORT INCENTIVE<br />

Export incentive available under prevalent scheme is accrued in the year when the right to receive credit as per the<br />

terms of the scheme is established in respect of exports made and are accounted to the extent there is no significant<br />

uncertainty about the measurability and ultimate utilization of such duty credit.<br />

E. COMMISSION :<br />

As in the case of revenue, the commission paid / payable on sales including any over-riding commission is<br />

recognised only on flown basis.<br />

F. EMPLOYEE BENEFITS :<br />

a) Defined Contribution plan: Company’s contribution paid / payable for the year to defined contribution<br />

schemes are charged to Profit and Loss Account.<br />

b) Defined Benefit and Other Long Term Benefit plan: Company’s liabilities towards defined benefit plans<br />

and other long term benefit plans are determined using the Projected Unit Credit Method. Actuarial valuations<br />

under the Projected Unit Credit Method are carried out at the balance sheet date. Actuarial gains and losses<br />

are recognised in the Profit and Loss account in the period of occurrence of such gains and losses. Past service<br />

cost is recognised immediately to the extent of benefits are vested, otherwise it is amortised on straight-line<br />

basis over the remaining average period until the benefits become vested.<br />

The employee benefit obligation recognised in the balance sheet represents the present value of the defined<br />

benefit obligation as adjusted for unrecognised past service cost.<br />

c) Short Term Employee Benefits:<br />

Short-term employee benefits expected to be paid in exchange for the services rendered by employees are<br />

recognised undiscounted during the period employee renders services.<br />

58