Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management’s Discussion and Analysis (contd.)<br />

Employee Remuneration and Benefits<br />

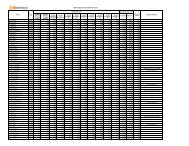

2.10 Expenses with regard to employee remuneration and benefits decreased by 13% to Rs.122,655 lakhs in<br />

Fiscal 2010 from Rs.141,050 lakhs in Fiscal 2009 due to reduction in the average number of personnel employed<br />

from 13,843 to 12,060. This is the result of the Company’s cost cutting measures including freezing recruitment,<br />

freezing salaries and in certain cases salary reductions and other steps taken to rationalize and optimize manpower.<br />

As on 31 st March, 2010, our headcount had reduced to 11,788 v/s 13,843 on 31 st March, 2009.<br />

Selling and Distribution Costs<br />

2.11 Selling and Distribution costs decreased by 10.3% to Rs.98491 lakhs for Fiscal 2010 from Rs.109,817 lakhs for<br />

Fiscal 2009 . This decrease in costs was due to:<br />

● Commission costs decreased by 22% because of reduced passenger and cargo revenues.<br />

● However, Central Reservation System (CRS) expenses and Global Distribution System (GDS) expenses increased<br />

by 22% to Rs.33,161 lakhs for Fiscal 2010 from Rs.27,185 lakhs for Fiscal 2009 mainly due to the increase in<br />

the number of passengers carried particularly on international routes.<br />

Aircraft Rentals<br />

2.12 Aircraft Rentals increased by 16.7% to Rs.83,173 lakhs in Fiscal 2010 from Rs.71,283 lakhs in Fiscal 2009 mainly<br />

on account of:<br />

● The number of leased ATR aircraft increased from 11 to 14<br />

● The induction of 5 leased Boeing 737-800 aircraft during the Financial Year<br />

● The full yearly impact of aircraft sold and leased back during Fiscal 2009<br />

Depreciation<br />

2.13 Depreciation increased by 6.9% to Rs.96,196 lakhs in Fiscal 2010 from Rs.89,981 lakhs in Fiscal 2009 mainly on<br />

account of:<br />

● The full year’s impact of wide-bodied aircraft inducted into the fleet in Fiscal 2010<br />

● The induction of one owned Boeing 737-800 aircraft during Fiscal 2010<br />

Interest Expense<br />

2.14 Interest Expense increased by 34.5% to Rs.99,301 lakhs in Fiscal 2010 from Rs.73,803 lakhs in Fiscal 2009, largely<br />

due to the increase in working capital requirements.<br />

Exceptional Items<br />

2.15 These include gains of Rs.7,045 lakhs due to Mark-to-Market valuation of outstanding derivative contracts<br />

compared to a loss of Rs.10,073 lakhs in Fiscal 2010. Exceptional items in Fiscal 2009 included CENVAT credit of<br />

Rs.34,993 lakhs and a credit of Rs.91,587 lakhs due to the change in the method of depreciation, and there were<br />

no corresponding items in Fiscal 2010.<br />

Profit / (Loss) before Taxation<br />

2.16 Loss before taxation is Rs.46,755 lakhs in Fiscal 2010 compared to Rs.46,962 lakhs in Fiscal 2009.<br />

Profit / (Loss) after Taxation<br />

2.17 Loss after taxation was Rs.46,764 lakhs in Fiscal 2010 compared to Rs.40,234 lakhs in Fiscal 2009.<br />

3. Initiatives<br />

3.1 The Company has continued major initiatives to respond to the market situation and the challenging environment.<br />

The Company continues to control and monitor costs in all areas of its operations.<br />

3.2 The Company introduced a new all–economy product “<strong>Jet</strong> <strong>Airways</strong> Konnect”, with a product offering that effectively<br />

competes with other “no frills” domestic airlines. The Company maintains the same level of care of its guests in<br />

<strong>Jet</strong> <strong>Airways</strong> Konnect flights as it does in its full service operations.<br />

23