Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Significant Accounting Policies and Notes forming part of Consolidated Accounts (contd.)<br />

3. CONTINGENT LIABILITIES:<br />

a) Income Tax demands which are under appeals and Others Rs. 85,705 lakhs (Previous Year Rs. 103,570 lakhs)<br />

b) Service Tax demands which are under appeals and Others Rs. 113,563 lakhs (Previous Year Rs. 78,674 lakhs).<br />

c) Sales Tax demands which are under appeals Rs. 6 lakhs (Previous Year Rs.6 lakhs) and the same has been<br />

deposited with the authorities.<br />

d) Claims against the Company, pending Civil and Consumer suits of Rs. 6,536 lakhs (Previous Year Rs. 5,149<br />

lakhs).<br />

e) Inland Air Travel Tax demands which are under appeal Rs.426 lakhs (Previous Year Rs. 473 lakhs) against which<br />

the amount of Rs. 105 lakhs (Previous Year Rs. 117 lakhs) is deposited with the Authorities.<br />

f) Claims for Octroi amounts to Rs. 2,899 lakhs (Previous Year Rs. 2,899 lakhs).<br />

g) Disputed claims against the company towards Ground Handling charges amount to Rs. 5,738 lakhs (Previous<br />

Year Rs. 5,477 lakhs).<br />

h) Letters of Credit outstanding are Rs. 96,735 lakhs (Previous Year Rs. 86,780 lakhs) and Bank Guarantees<br />

outstanding are Rs. 99,570 lakhs (Previous Year Rs. 95,134 lakhs).<br />

i) Claims against the Company not acknowledged as debt Rs. 63,708 lakhs (Previous Year Rs. 63,708 lakhs) claim<br />

filed by erstwhile selling shareholders of Sahara Airlines Limited - Refer note no. 5 (a) for details.<br />

4.<br />

The Company is a party to various legal proceedings in the normal course of business and does not expect the<br />

outcome of these proceedings to have any adverse effect on its financial conditions, results of operations or cash<br />

flows.<br />

DISCLOSURE ON DERIVATIVES<br />

a) The Holding Company has entered into certain derivative contracts viz. interest rate swaps (IRS), currency<br />

options, IRS cum currency swaps, etc in order to hedge and manage its foreign currency exposures towards<br />

future export receivables and foreign currency borrowings. Such derivative contracts which are in the nature<br />

of firm commitments and highly probable forecast transactions are entered into by the Company for hedging<br />

purposes only and does not use the same for trading or speculation purposes.<br />

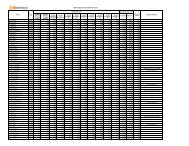

Nominal amounts of derivatives contracts entered into by the Company and outstanding as on 31st March, 2010<br />

amount of Rs.126,036 lakhs (Previous Year Rs.165,638 lakhs). The category-wise break-up thereof is as under:<br />

Amount (Rs. in lakhs)<br />

Particulars 2009-10 2008-09<br />

No. of Amount No. of Amount<br />

Contracts Contracts<br />

Interest Rate Swaps 3 106,413 3 120,206<br />

Currency Options 1 12,123 1 18,259<br />

Currency Swaps - - 1 12,173<br />

IRS cum Currency Swaps 1 7,500 2 15,000<br />

The Holding Company, based on the Announcement of The Institute of Chartered Accountants of India<br />

“Accounting for Derivatives” along with the principles of prudence as enunciated in Accounting Standard<br />

(AS-1) “Disclosure of Accounting Polices” the Company has accounted for outstanding derivative contracts at<br />

fair values as at the balance sheet date.<br />

On that basis, the fair value of the derivative instruments as at 31st March, 2010 aggregating to Rs. 7,045 lakhs<br />

has been credited (Previous Year Rs. 10,073 lakhs has been debited) to the Profit and Loss Account and<br />

disclosed as exceptional item in the current year. The charge on account of derivative losses has been computed<br />

on the basis of MTM values based on the confirmations from the counter parties.<br />

104