Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

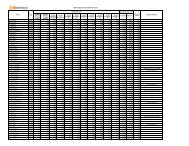

Significant Accounting Policies and Notes forming part of Consolidated Accounts (contd.)<br />

iii) During the year the Holding Company has given four (4) owned Aircraft on Dry sub lease. In the previous<br />

Holding Company has given six (6) aircraft on wet lease [Four (4) owned and Two (2) leased] and One<br />

(1) aircraft on dry sub-lease. The future minimum lease income in respect of non-cancelable period which,<br />

as at 31st March, 2010 is as follows:<br />

Amount (Rs. in lakhs)<br />

Total Lease<br />

Aircraft Income<br />

Less than 1 year (-) 25,054<br />

((-)17,377)<br />

Between 1 and 5 years (-) 10,545<br />

(Nil)<br />

More than 5 years -<br />

(Nil)<br />

Grand Total (-) 35,599<br />

((-)17,377)<br />

(Figures in brackets indicates 31 st March, 2009 figures)<br />

The Salient features of Wet Lease agreement are:<br />

· Operational control and maintenance of aircraft remains the responsibility of the Company. The aircraft<br />

remains on Indian registry and is operated with the Company’s crew.<br />

· Monthly rentals are received in form of fixed and variable rental. Variable Lease Rentals are receivable on<br />

a pre determined rate on the basis of additional flying hours.<br />

· The wet leases are non-cancelable.<br />

The Salient features of Dry Lease agreement are:<br />

· In this leasing arrangement aircraft is leased without insurance and crew.<br />

· Monthly rentals paid in form of fixed and variable rental. Variable Lease Rentals are payable on a pre<br />

determined rate payable on the basis of actual flying hours. Additionally, the predetermined rates of<br />

Variable Rentals are subject to the annual escalation as stipulated in the respective leases.<br />

· The Lessee neither has an option to buyback nor does it generally have an option to renew the leases.<br />

· The dry leases are non-cancelable.<br />

Details of the owned aircraft given on non-cancelable Dry lease / Wet lease is as under:<br />

Amount (Rs. in lakhs)<br />

Details of Leased Assets (Aircraft): 2009-10 2008-09<br />

Cost of acquisition 273,783 309,014<br />

Accumulated Depreciation 41,584 23,748<br />

iv)<br />

Depreciation of Rs.16,690 lakhs (Previous Year Rs.15,807 lakhs) has been debited to Profit and Loss<br />

Account on the above leased assets.<br />

The variable lease rental income recognized Rs. 5,863 lakhs (Previous Year Nil).<br />

v) The lease rental expense recognised Rs. 117,025 lakhs (Previous Year Rs. 114,652 lakhs). It includes Nil<br />

(Previous Year Rs. 5,977 lakhs) recognized as lease rental expenses on account of sale and lease back of<br />

aircraft.<br />

114