Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

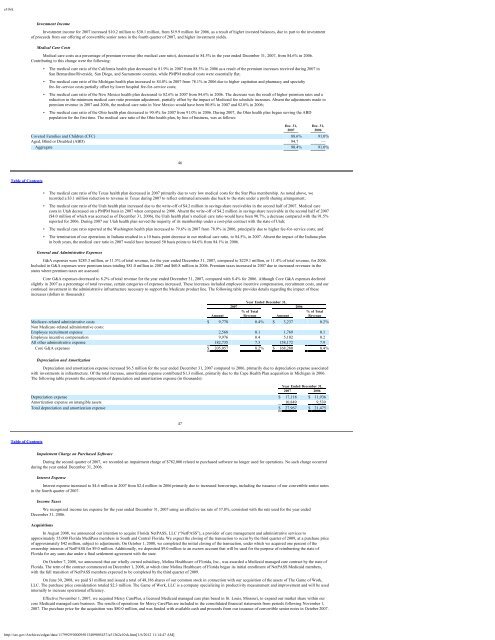

e10vkInvestment IncomeInvestment income for 2007 increased $10.2 million to $30.1 million, from $19.9 million for 2006, as a result of higher invested balances, due in part to the investmentof proceeds from our offering of convertible senior notes in the fourth quarter of 2007, and higher investment yields.Medical Care CostsMedical care costs as a percentage of premium revenue (the medical care ratio), decreased to 84.5% in the year ended December 31, 2007, from 84.6% in 2006.Contributing to this change were the following:• The medical care ratio of the California health plan decreased to 81.9% in 2007 from 88.3% in 2006 as a result of the premium increases received during 2007 inSan Bernardino/Riverside, San Diego, and Sacramento counties, while PMPM medical costs were essentially flat;• The medical care ratio of the Michigan health plan increased to 84.0% in 2007 from 78.1% in 2006 due to higher capitation and pharmacy and specialtyfee-for-service costs partially offset by lower hospital fee-for-service costs;• The medical care ratio of the New Mexico health plan decreased to 82.6% in 2007 from 84.6% in 2006. The decrease was the result of higher premium rates and areduction in the minimum medical care ratio premium adjustment, partially offset by the impact of <strong>Medicaid</strong> fee schedule increases. Absent the adjustments made topremium revenue in 2007 and 2006, the medical care ratio in New Mexico would have been 80.8% in 2007 and 82.0% in 2006;• The medical care ratio of the Ohio health plan decreased to 90.4% for 2007 from 91.0% in 2006. During 2007, the Ohio health plan began serving the ABDpopulation for the first time. The medical care ratio of the Ohio health plan, by line of business, was as follows:Dec. 31, Dec. 31,2007 2006Covered Families and Children (CFC) 88.6% 91.0%Aged, Blind or Disabled (ABD) 94.7 —Aggregate 90.4% 91.0%46Table of Contents• The medical care ratio of the Texas health plan decreased in 2007 primarily due to very low medical costs for the Star Plus membership. As noted above, werecorded a $3.1 million reduction to revenue in Texas during 2007 to reflect estimated amounts due back to the state under a profit sharing arrangement;• The medical care ratio of the Utah health plan increased due to the write-off of $4.2 million in savings share receivables in the second half of 2007. Medical carecosts in Utah decreased on a PMPM basis in 2007 when compared to 2006. Absent the write-off of $4.2 million in savings share receivable in the second half of 2007($4.0 million of which was accrued as of December 31, 2006), the Utah health plan’s medical care ratio would have been 90.7%, a decrease compared with the 91.5%reported for 2006. During 2007 our Utah health plan served the majority of its membership under a cost-plus contract with the state of Utah;• The medical care ratio reported at the Washington health plan increased to 79.6% in 2007 from 78.9% in 2006, principally due to higher fee-for-service costs; and• The termination of our operations in Indiana resulted in a 10 basis-point decrease in our medical care ratio, to 84.5%, in 2007. Absent the impact of the Indiana planin both years, the medical care ratio in 2007 would have increased 50 basis points to 84.6% from 84.1% in 2006.General and Administrative ExpensesG&A expenses were $285.3 million, or 11.5% of total revenue, for the year ended December 31, 2007, compared to $229.1 million, or 11.4% of total revenue, for 2006.Included in G&A expenses were premium taxes totaling $81.0 million in 2007 and $60.8 million in 2006. Premium taxes increased in 2007 due to increased revenues in thestates where premium taxes are assessed.Core G&A expenses decreased to 8.2% of total revenue for the year ended December 31, 2007, compared with 8.4% for 2006. Although Core G&A expenses declinedslightly in 2007 as a percentage of total revenue, certain categories of expenses increased. These increases included employee incentive compensation, recruitment costs, and ourcontinued investment in the administrative infrastructure necessary to support the Medicare product line. The following table provides details regarding the impact of theseincreases (dollars in thousands):Year Ended December 31,2007 2006% of Total % of TotalAmount Revenue Amount RevenueMedicare-related administrative costs $ 9,778 0.4% $ 3,237 0.2%Non Medicare-related administrative costs:Employee recruitment expense 2,568 0.1 1,769 0.1Employee incentive compensation 9,976 0.4 5,102 0.2All other administrative expense 182,735 7.3 158,172 7.9Core G&A expenses $ 205,057 8.2% $ 168,280 8.4%Depreciation and AmortizationDepreciation and amortization expense increased $6.5 million for the year ended December 31, 2007 compared to 2006, primarily due to depreciation expense associatedwith investments in infrastructure. Of the total increase, amortization expense contributed $1.3 million, primarily due to the Cape Health Plan acquisition in Michigan in 2006.The following table presents the components of depreciation and amortization expense (in thousands):Year Ended December 31,2007 2006Depreciation expense $ 17,118 $ 11,936Amortization expense on intangible assets 10,849 9,539Total depreciation and amortization expense $ 27,967 $ 21,47547Table of ContentsImpairment Charge on Purchased SoftwareDuring the second quarter of 2007, we recorded an impairment charge of $782,000 related to purchased software no longer used for operations. No such charge occurredduring the year ended December 31, 2006.Interest ExpenseInterest expense increased to $4.6 million in 2007 from $2.4 million in 2006 primarily due to increased borrowings, including the issuance of our convertible senior notesin the fourth quarter of 2007.Income TaxesWe recognized income tax expense for the year ended December 31, 2007 using an effective tax rate of 37.8%, consistent with the rate used for the year endedDecember 31, 2006.AcquisitionsIn August 2008, we announced our intention to acquire Florida NetPASS, LLC (“NetPASS”), a provider of care management and administrative services toapproximately 55,000 Florida MediPass members in South and Central Florida. We expect the closing of the transaction to occur by the third quarter of 2009, at a purchase priceof approximately $42 million, subject to adjustments. On October 1, 2008, we completed the initial closing of the transaction, under which we acquired one percent of theownership interests of NetPASS for $9.0 million. Additionally, we deposited $9.0 million to an escrow account that will be used for the purpose of reimbursing the state ofFlorida for any sums due under a final settlement agreement with the state.On October 7, 2008, we announced that our wholly owned subsidiary, <strong>Molina</strong> Healthcare of Florida, Inc., was awarded a <strong>Medicaid</strong> managed care contract by the state ofFlorida. The term of the contract commenced on December 1, 2008, at which time <strong>Molina</strong> Healthcare of Florida began its initial enrollment of NetPASS <strong>Medicaid</strong> members,with the full transition of NetPASS members expected to be completed by the third quarter of 2009.On June 30, 2008, we paid $1 million and issued a total of 48,186 shares of our common stock in connection with our acquisition of the assets of The Game of Work,LLC. The purchase price consideration totaled $2.3 million. The Game of Work, LLC is a company specializing in productivity measurement and improvement and will be usedinternally to increase operational efficiency.Effective November 1, 2007, we acquired Mercy CarePlus, a licensed <strong>Medicaid</strong> managed care plan based in St. Louis, Missouri, to expand our market share within ourcore <strong>Medicaid</strong> managed care business. The results of operations for Mercy CarePlus are included in the consolidated financial statements from periods following November 1,2007. The purchase price for the acquisition was $80.0 million, and was funded with available cash and proceeds from our issuance of convertible senior notes in October 2007.http://sec.gov/Archives/edgar/data/1179929/000095013409005437/a51362e10vk.htm[1/6/2012 11:14:47 AM]