Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

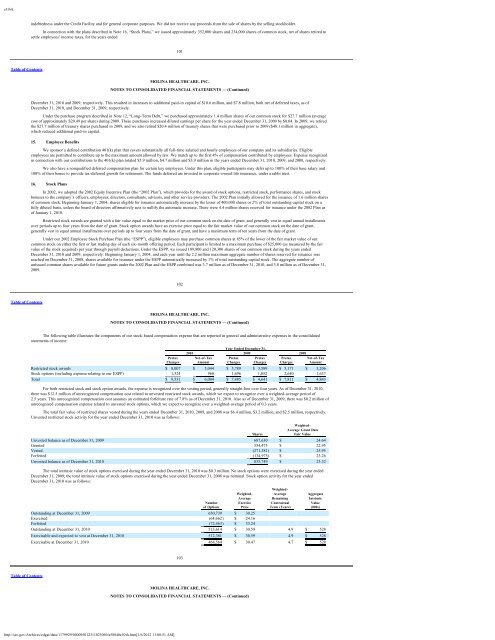

e10vkindebtedness under the Credit Facility and for general corporate purposes. We did not receive any proceeds from the sale of shares by the selling stockholder.In connection with the plans described in Note 16, “Stock Plans,” we issued approximately 352,000 shares and 234,000 shares of common stock, net of shares retired tosettle employees’ income taxes, for the years ended101Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)December 31, 2010 and 2009, respectively. This resulted in increases to additional paid-in capital of $10.6 million, and $7.8 million, both net of deferred taxes, as ofDecember 31, 2010, and December 31, 2009, respectively.Under the purchase program described in Note 12, “Long-Term Debt,” we purchased approximately 1.4 million shares of our common stock for $27.7 million (averagecost of approximately $20.49 per share) during 2009. These purchases increased diluted earnings per share for the year ended December 31, 2009 by $0.04. In 2009, we retiredthe $27.7 million of treasury shares purchased in 2009, and we also retired $20.4 million of treasury shares that were purchased prior to 2009 ($48.1 million in aggregate),which reduced additional paid-in capital.15. Employee BenefitsWe sponsor a defined contribution 401(k) plan that covers substantially all full-time salaried and hourly employees of our company and its subsidiaries. Eligibleemployees are permitted to contribute up to the maximum amount allowed by law. We match up to the first 4% of compensation contributed by employees. Expense recognizedin connection with our contributions to the 401(k) plan totaled $5.9 million, $4.7 million and $3.9 million in the years ended December 31, 2010, 2009, and 2008, respectively.We also have a nonqualified deferred compensation plan for certain key employees. Under this plan, eligible participants may defer up to 100% of their base salary and100% of their bonus to provide tax-deferred growth for retirement. The funds deferred are invested in corporate-owned life insurance, under a rabbi trust.16. Stock PlansIn 2002, we adopted the 2002 Equity Incentive Plan (the “2002 Plan”), which provides for the award of stock options, restricted stock, performance shares, and stockbonuses to the company’s officers, employees, directors, consultants, advisors, and other service providers. The 2002 Plan initially allowed for the issuance of 1.6 million sharesof common stock. Beginning January 1, 2004, shares eligible for issuance automatically increase by the lesser of 400,000 shares or 2% of total outstanding capital stock on afully diluted basis, unless the board of directors affirmatively acts to nullify the automatic increase. There were 4.4 million shares reserved for issuance under the 2002 Plan asof January 1, 2010.Restricted stock awards are granted with a fair value equal to the market price of our common stock on the date of grant, and generally vest in equal annual installmentsover periods up to four years from the date of grant. Stock option awards have an exercise price equal to the fair market value of our common stock on the date of grant,generally vest in equal annual installments over periods up to four years from the date of grant, and have a maximum term of ten years from the date of grant.Under our 2002 Employee Stock Purchase Plan (the “ESPP”), eligible employees may purchase common shares at 85% of the lower of the fair market value of ourcommon stock on either the first or last trading day of each six-month offering period. Each participant is limited to a maximum purchase of $25,000 (as measured by the fairvalue of the stock acquired) per year through payroll deductions. Under the ESPP, we issued 109,800 and 120,300 shares of our common stock during the years endedDecember 31, 2010 and 2009, respectively. Beginning January 1, 2004, and each year until the 2.2 million maximum aggregate number of shares reserved for issuance wasreached on December 31, 2008, shares available for issuance under the ESPP automatically increased by 1% of total outstanding capital stock. The aggregate number ofunissued common shares available for future grants under the 2002 Plan and the ESPP combined was 3.7 million as of December 31, 2010, and 3.8 million as of December 31,2009.102Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)The following table illustrates the components of our stock-based compensation expense that are reported in general and administrative expenses in the consolidatedstatements of income:Year Ended December 31,2010 2009 2008Pretax Net-of-Tax Pretax Pretax Pretax Net-of-TaxCharges Amount Charges Charges Charges AmountRestricted stock awards $ 8,007 $ 5,044 $ 5,789 $ 3,589 $ 5,171 $ 3,206Stock options (including expense relating to our ESPP) 1,524 960 1,696 1,052 2,640 1,637Total $ 9,531 $ 6,004 $ 7,485 $ 4,641 $ 7,811 $ 4,843For both restricted stock and stock option awards, the expense is recognized over the vesting period, generally straight-line over four years. As of December 31, 2010,there was $12.5 million of unrecognized compensation cost related to unvested restricted stock awards, which we expect to recognize over a weighted-average period of2.5 years. This unrecognized compensation cost assumes an estimated forfeiture rate of 7.8% as of December 31, 2010. Also as of December 31, 2009, there was $0.2 million ofunrecognized compensation expense related to unvested stock options, which we expect to recognize over a weighted-average period of 0.3 years.The total fair value of restricted shares vested during the years ended December 31, 2010, 2009, and 2008 was $6.4 million, $3.2 million, and $2.5 million, respectively.Unvested restricted stock activity for the year ended December 31, 2010 was as follows:Weighted-Average Grant DateShares Fair ValueUnvested balance as of December 31, 2009 687,630 $ 24.64Granted 554,475 $ 22.95Vested (271,381) $ 25.95Forfeited (134,975) $ 23.26Unvested balance as of December 31, 2010 835,749 $ 23.32The total intrinsic value of stock options exercised during the year ended December 31, 2010 was $0.3 million. No stock options were exercised during the year endedDecember 31, 2009; the total intrinsic value of stock options exercised during the year ended December 31, 2008 was nominal. Stock option activity for the year endedDecember 31, 2010 was as follows:Weighted-Weighted- Average AggregateAverage Remaining IntrinsicNumber Exercise Contractual Valueof Options Price Term (Years) (000s)Outstanding at December 31, 2009 650,739 $ 30.25Exercised (64,662) $ 24.16Forfeited (72,463) $ 33.24Outstanding at December 31, 2010 513,614 $ 30.59 4.9 $ 528Exercisable and expected to vest at December 31, 2010 512,381 $ 30.59 4.9 $ 528Exercisable at December 31, 2010 468,564 $ 30.47 4.7 $ 528103Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)http://sec.gov/Archives/edgar/data/1179929/000095012311023069/a58840e10vk.htm[1/6/2012 11:08:51 AM]