Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

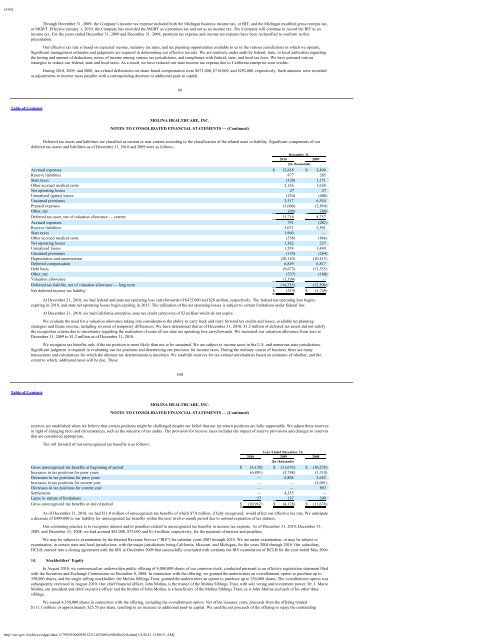

e10vkThrough December 31, 2009, the Company’s income tax expense included both the Michigan business income tax, or BIT, and the Michigan modified gross receipts tax,or MGRT. Effective January 1, 2010, the Company has recorded the MGRT as a premium tax and not as an income tax. The Company will continue to record the BIT as anincome tax. For the years ended December 31, 2009 and December 31, 2008, premium tax expense and income tax expense have been reclassified to conform to thispresentation.Our effective tax rate is based on expected income, statutory tax rates, and tax planning opportunities available to us in the various jurisdictions in which we operate.Significant management estimates and judgments are required in determining our effective tax rate. We are routinely under audit by federal, state, or local authorities regardingthe timing and amount of deductions, nexus of income among various tax jurisdictions, and compliance with federal, state, and local tax laws. We have pursued variousstrategies to reduce our federal, state and local taxes. As a result, we have reduced our state income tax expense due to California enterprise zone credits.During 2010, 2009, and 2008, tax-related deficiencies on share-based compensation were $673,000, $718,000, and $292,000, respectively. Such amounts were recordedas adjustments to income taxes payable with a corresponding decrease to additional paid-in capital.99Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)Deferred tax assets and liabilities are classified as current or non-current according to the classification of the related asset or liability. Significant components of ourdeferred tax assets and liabilities as of December 31, 2010 and 2009 were as follows:December 31,2010 2009(In thousands)Accrued expenses $ 12,618 $ 2,494Reserve liabilities 877 285State taxes (120) 1,151Other accrued medical costs 2,126 1,628Net operating losses 27 27Unrealized (gains) losses (254) (408)Unearned premiums 3,517 6,554Prepaid expenses (3,006) (2,894)Other, net (69) (80)Deferred tax asset, net of valuation allowance — current 15,716 8,757Accrued expenses 791 (281)Reserve liabilities 3,071 2,501State taxes 1,960 —Other accrued medical costs (358) (866)Net operating losses 1,362 237Unrealized losses 1,559 1,480Unearned premiums (135) (264)Depreciation and amortization (20,110) (10,415)Deferred compensation 6,829 6,817Debt basis (9,673) (11,555)Other, net (337) (160)Valuation allowance (1,194) —Deferred tax liability, net of valuation allowance — long term (16,235) (12,506)Net deferred income tax liability $ (519) $ (3,749)At December 31, 2010, we had federal and state net operating loss carryforwards of $475,000 and $28 million, respectively. The federal net operating loss beginsexpiring in 2018, and state net operating losses begin expiring in 2015. The utilization of the net operating losses is subject to certain limitations under federal law.At December 31, 2010, we had California enterprise zone tax credit carryovers of $3 million which do not expire.We evaluate the need for a valuation allowance taking into consideration the ability to carry back and carry forward tax credits and losses, available tax planningstrategies and future income, including reversal of temporary differences. We have determined that as of December 31, 2010, $1.2 million of deferred tax assets did not satisfythe recognition criteria due to uncertainty regarding the realization of some of our state tax operating loss carryforwards. We increased our valuation allowance from zero atDecember 31, 2009 to $1.2 million as of December 31, 2010.We recognize tax benefits only if the tax position is more likely than not to be sustained. We are subject to income taxes in the U.S. and numerous state jurisdictions.Significant judgment is required in evaluating our tax positions and determining our provision for income taxes. During the ordinary course of business, there are manytransactions and calculations for which the ultimate tax determination is uncertain. We establish reserves for tax-related uncertainties based on estimates of whether, and theextent to which, additional taxes will be due. These100Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)reserves are established when we believe that certain positions might be challenged despite our belief that our tax return positions are fully supportable. We adjust these reservesin light of changing facts and circumstances, such as the outcome of tax audits. The provision for income taxes includes the impact of reserve provisions and changes to reservesthat are considered appropriate.The roll forward of our unrecognized tax benefits is as follows:Year Ended December 31,2010 2009 2008(In thousands)Gross unrecognized tax benefits at beginning of period $ (4,128) $ (11,676) $ (10,278)Increases in tax positions for prior years (6,891) (3,748) (3,310)Decreases in tax positions for prior years — 6,804 2,682Increases in tax positions for current year — — (2,061)Decreases in tax positions for current year — — 892Settlements — 4,355 —Lapse in statute of limitations 57 137 399Gross unrecognized tax benefits at end of period $ (10,962) $ (4,128) $ (11,676)As of December 31, 2010, we had $11.0 million of unrecognized tax benefits of which $7.8 million, if fully recognized, would affect our effective tax rate. We anticipatea decrease of $499,000 to our liability for unrecognized tax benefits within the next twelve-month period due to normal expiration of tax statutes.Our continuing practice is to recognize interest and/or penalties related to unrecognized tax benefits in income tax expense. As of December 31, 2010, December 31,2009, and December 31, 2008, we had accrued $82,000, $75,000 and $1.4 million, respectively, for the payment of interest and penalties.We may be subject to examination by the Internal Revenue Service (“IRS”) for calendar years 2007 through 2010. We are under examination, or may be subject toexamination, in certain state and local jurisdictions, with the major jurisdictions being California, Missouri, and Michigan, for the years 2004 through 2010. Our subsidiary,HCLB, entered into a closing agreement with the IRS in December 2009 that successfully concluded with certainty the IRS examination of HCLB for the year ended May 2006.14. Stockholders’ EquityIn August 2010, we commenced an underwritten public offering of 4,000,000 shares of our common stock, conducted pursuant to an effective registration statement filedwith the Securities and Exchange Commission on December 8, 2008. In connection with the offering, we granted the underwriters an overallotment option to purchase up to350,000 shares, and the single selling stockholder, the <strong>Molina</strong> Siblings Trust, granted the underwriters an option to purchase up to 250,000 shares. The overallotment option wassubsequently exercised in August 2010. Our chief financial officer, John <strong>Molina</strong>, is the trustee of the <strong>Molina</strong> Siblings Trust, with sole voting and investment power. Dr. J. Mario<strong>Molina</strong>, our president and chief executive officer and the brother of John <strong>Molina</strong>, is a beneficiary of the <strong>Molina</strong> Siblings Trust, as is John <strong>Molina</strong> and each of his other threesiblings.We issued 4,350,000 shares in connection with the offering, including the overallotment option. Net of the issuance costs, proceeds from the offering totaled$111.1 million, or approximately $25.55 per share, resulting in an increase to additional paid-in capital. We used the net proceeds of the offering to repay the outstandinghttp://sec.gov/Archives/edgar/data/1179929/000095012311023069/a58840e10vk.htm[1/6/2012 11:08:51 AM]