Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

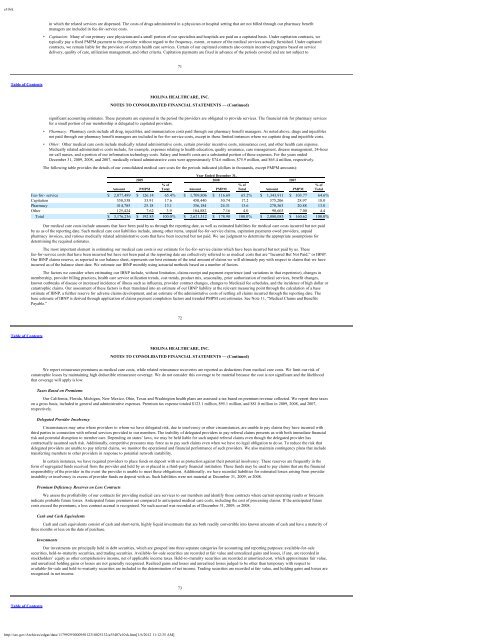

e10vkin which the related services are dispensed. The costs of drugs administered in a physician or hospital setting that are not billed through our pharmacy benefitmanagers are included in fee-for-service costs.• Capitation: Many of our primary care physicians and a small portion of our specialists and hospitals are paid on a capitated basis. Under capitation contracts, wetypically pay a fixed PMPM payment to the provider without regard to the frequency, extent, or nature of the medical services actually furnished. Under capitatedcontracts, we remain liable for the provision of certain health care services. Certain of our capitated contracts also contain incentive programs based on servicedelivery, quality of care, utilization management, and other criteria. Capitation payments are fixed in advance of the periods covered and are not subject to71Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)significant accounting estimates. These payments are expensed in the period the providers are obligated to provide services. The financial risk for pharmacy servicesfor a small portion of our membership is delegated to capitated providers.• Pharmacy: Pharmacy costs include all drug, injectibles, and immunization costs paid through our pharmacy benefit managers. As noted above, drugs and injectiblesnot paid through our pharmacy benefit managers are included in fee-for-service costs, except in those limited instances where we capitate drug and injectible costs.• Other: Other medical care costs include medically related administrative costs, certain provider incentive costs, reinsurance cost, and other health care expense.Medically related administrative costs include, for example, expenses relating to health education, quality assurance, case management, disease management, 24-houron-call nurses, and a portion of our information technology costs. Salary and benefit costs are a substantial portion of these expenses. For the years endedDecember 31, 2009, 2008, and 2007, medically related administrative costs were approximately $74.6 million, $75.9 million, and $65.4 million, respectively.The following table provides the details of our consolidated medical care costs for the periods indicated (dollars in thousands, except PMPM amounts):Year Ended December 31,2009 2008 2007% of % of % ofAmount PMPM Total Amount PMPM Total Amount PMPM TotalFee-for- service $ 2,077,489 $ 126.14 65.4% $ 1,709,806 $ 116.69 65.2% $ 1,343,911 $ 103.77 64.6%Capitation 558,538 33.91 17.6 450,440 30.74 17.2 375,206 28.97 18.0Pharmacy 414,785 25.18 13.1 356,184 24.31 13.6 270,363 20.88 13.0Other 125,424 7.62 3.9 104,882 7.16 4.0 90,603 7.00 4.4Total $ 3,176,236 $ 192.85 100.0% $ 2,621,312 $ 178.90 100.0% $ 2,080,083 $ 160.62 100.0%Our medical care costs include amounts that have been paid by us through the reporting date, as well as estimated liabilities for medical care costs incurred but not paidby us as of the reporting date. Such medical care cost liabilities include, among other items, unpaid fee-for-service claims, capitation payments owed providers, unpaidpharmacy invoices, and various medically related administrative costs that have been incurred but not paid. We use judgment to determine the appropriate assumptions fordetermining the required estimates.The most important element in estimating our medical care costs is our estimate for fee-for-service claims which have been incurred but not paid by us. Thesefee-for-service costs that have been incurred but have not been paid at the reporting date are collectively referred to as medical costs that are “Incurred But Not Paid,” or IBNP.Our IBNP claims reserve, as reported in our balance sheet, represents our best estimate of the total amount of claims we will ultimately pay with respect to claims that we haveincurred as of the balance sheet date. We estimate our IBNP monthly using actuarial methods based on a number of factors.The factors we consider when estimating our IBNP include, without limitation, claims receipt and payment experience (and variations in that experience), changes inmembership, provider billing practices, health care service utilization trends, cost trends, product mix, seasonality, prior authorization of medical services, benefit changes,known outbreaks of disease or increased incidence of illness such as influenza, provider contract changes, changes to <strong>Medicaid</strong> fee schedules, and the incidence of high dollar orcatastrophic claims. Our assessment of these factors is then translated into an estimate of our IBNP liability at the relevant measuring point through the calculation of a baseestimate of IBNP, a further reserve for adverse claims development, and an estimate of the administrative costs of settling all claims incurred through the reporting date. Thebase estimate of IBNP is derived through application of claims payment completion factors and trended PMPM cost estimates. See Note 11, “Medical Claims and BenefitsPayable.”72Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)We report reinsurance premiums as medical care costs, while related reinsurance recoveries are reported as deductions from medical care costs. We limit our risk ofcatastrophic losses by maintaining high deductible reinsurance coverage. We do not consider this coverage to be material because the cost is not significant and the likelihoodthat coverage will apply is low.Taxes Based on PremiumsOur California, Florida, Michigan, New Mexico, Ohio, Texas and Washington health plans are assessed a tax based on premium revenue collected. We report these taxeson a gross basis, included in general and administrative expenses. Premium tax expense totaled $123.1 million, $95.1 million, and $81.0 million in 2009, 2008, and 2007,respectively.Delegated Provider InsolvencyCircumstances may arise where providers to whom we have delegated risk, due to insolvency or other circumstances, are unable to pay claims they have incurred withthird parties in connection with referral services provided to our members. The inability of delegated providers to pay referral claims presents us with both immediate financialrisk and potential disruption to member care. Depending on states’ laws, we may be held liable for such unpaid referral claims even though the delegated provider hascontractually assumed such risk. Additionally, competitive pressures may force us to pay such claims even when we have no legal obligation to do so. To reduce the risk thatdelegated providers are unable to pay referral claims, we monitor the operational and financial performance of such providers. We also maintain contingency plans that includetransferring members to other providers in response to potential network instability.In certain instances, we have required providers to place funds on deposit with us as protection against their potential insolvency. These reserves are frequently in theform of segregated funds received from the provider and held by us or placed in a third-party financial institution. These funds may be used to pay claims that are the financialresponsibility of the provider in the event the provider is unable to meet these obligations. Additionally, we have recorded liabilities for estimated losses arising from providerinstability or insolvency in excess of provider funds on deposit with us. Such liabilities were not material at December 31, 2009, or 2008.Premium Deficiency Reserves on Loss ContractsWe assess the profitability of our contracts for providing medical care services to our members and identify those contracts where current operating results or forecastsindicate probable future losses. Anticipated future premiums are compared to anticipated medical care costs, including the cost of processing claims. If the anticipated futurecosts exceed the premiums, a loss contract accrual is recognized. No such accrual was recorded as of December 31, 2009, or 2008.Cash and Cash EquivalentsCash and cash equivalents consist of cash and short-term, highly liquid investments that are both readily convertible into known amounts of cash and have a maturity ofthree months or less on the date of purchase.InvestmentsOur investments are principally held in debt securities, which are grouped into three separate categories for accounting and reporting purposes: available-for-salesecurities, held-to-maturity securities, and trading securities. Available-for-sale securities are recorded at fair value and unrealized gains and losses, if any, are recorded instockholders’ equity as other comprehensive income, net of applicable income taxes. Held-to-maturity securities are recorded at amortized cost, which approximates fair value,and unrealized holding gains or losses are not generally recognized. Realized gains and losses and unrealized losses judged to be other than temporary with respect toavailable-for-sale and held-to-maturity securities are included in the determination of net income. Trading securities are recorded at fair value, and holding gains and losses arerecognized in net income.73Table of Contentshttp://sec.gov/Archives/edgar/data/1179929/000095012310025132/a55407e10vk.htm[1/6/2012 11:12:35 AM]